Charts of the Day: 2022 Index vs. Active Update

Contents

The semi-annual SPIVA (S&P Index Vs. Active) report was recently released.

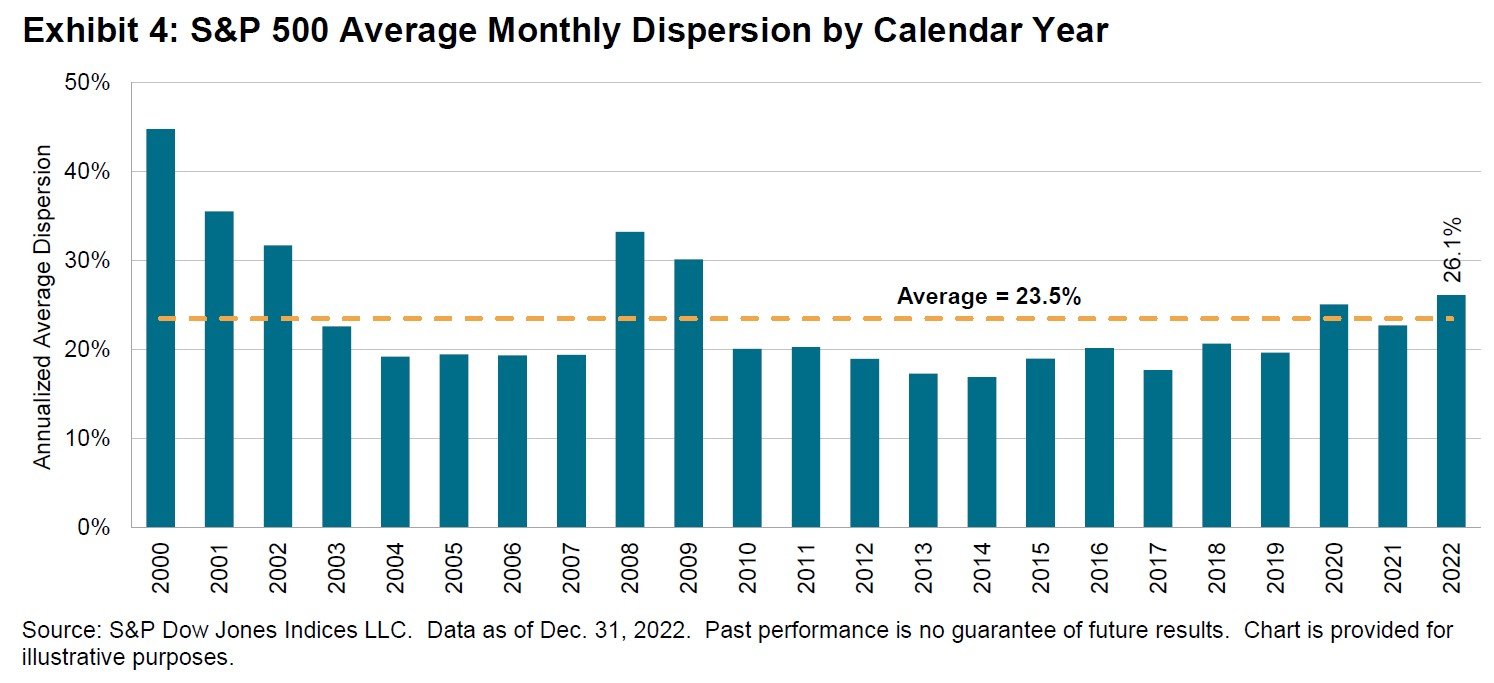

Last year was a wild ride. As seen in the chart above, there was a lot of dispersion. This resulted in better opportunities for active managers to outperform. If all stocks moved together, no “stock picks” would have the opportunity to outperform. For example, if Person A picked a stock that went up 7%, and Person B picked a different stock that went up 7%, neither would have outperformed the other. However, if Person A picked a stock that went up 14%, and Person B picked a stock that went up 0%, Person A could say they outperformed. In summary, more dispersion equals more opportunity.

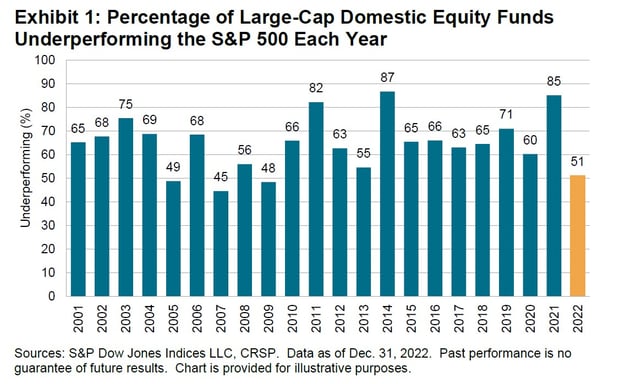

This dispersion allowed for a relatively impressive, compared to previous years, 51% of active managers beating the index.

However, it is still only 51%, so picking an outperforming stock is still only roughly a 50/50 chance.

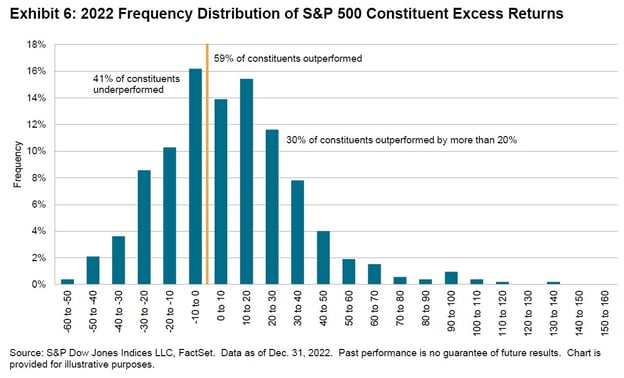

This improved performance was fueled by the fact that 59% of stocks outperformed the average, which means that the proverbial saying, “Close your eyes, and throw darts at a list of stocks” had the same chance as all others to outperform.

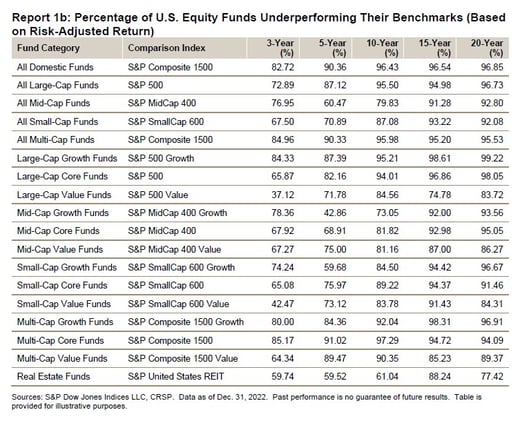

Finally, the one-year anomaly does not significantly alter the 3-, 5-, 10-, 15-, and 20-year trends. For instance, 96.43% of active managers underperformed the index over the last 10 years. Even when you add this year’s figures from the last report, the number only went down to the 96.43% from 96.79%. There will need to be a lot of repeating losses, over many years for this trend to change significantly.

As a quick reminder, this all is from the three structural reasons why indexing works.

- Traders and investors are increasingly more efficient and smarter, making it harder to beat each other. This is especially true since every excess dollar made by trader has to be lost by another.

- The distribution of returns is still wide, where only a few stocks do well and many more don’t. So, if you don’t own the few winners, you can’t outperform.

- Higher fees from active managers are a tall hurdle to cross.

About the Author

Samuel A. Kiburz, Senior Vice President, Chief Investment Officer

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.