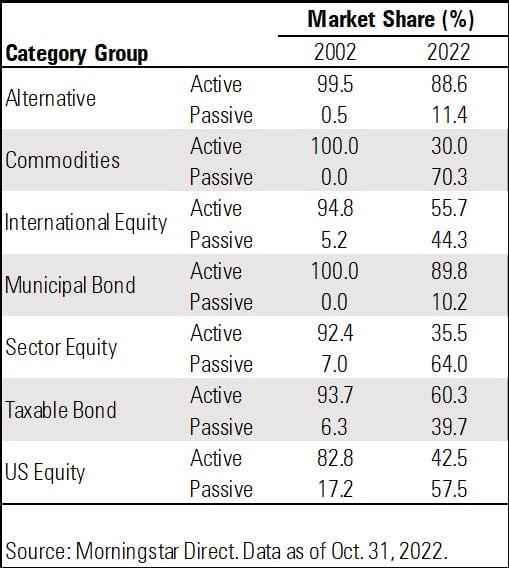

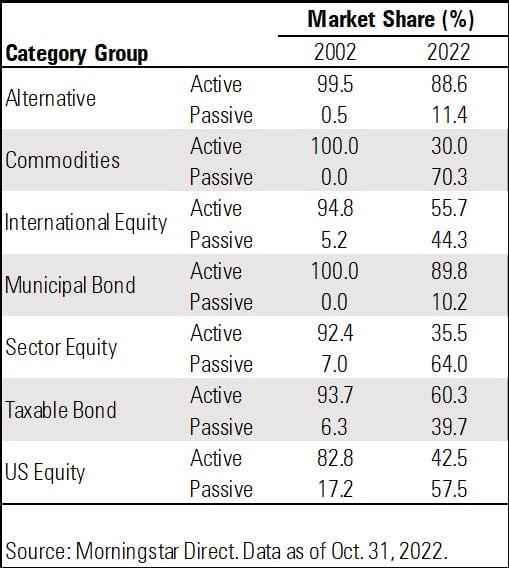

Change of Market Shares

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Today’s Chart of the Day comes from @MorningstarInc and @MstarBenJohnson on Twitter. It shows the change from actively to passively managed investments over the last 10 years.

We often talk about this shift from active to passive, but it's interesting to see that it is not uniform throughout the different types of investments. For instance, in “alternative” investments such as private equity, hedge funds, and long-short funds, the industry’s use of passive investments only went from 1% to 11%.

In commodities, however, passive investments went from 0% to 70%. I suspect passive works better in commodities since the alpha, the opportunity to outperform, is low and low costs are a primary driver of returns.

We primarily use Taxable Bonds and US Equity, and they went from 6% to 40% and 17% to 57%, respectively. Again, primarily from the low alpha and low costs.

It will be interesting to see what the percentages are in 2032.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.