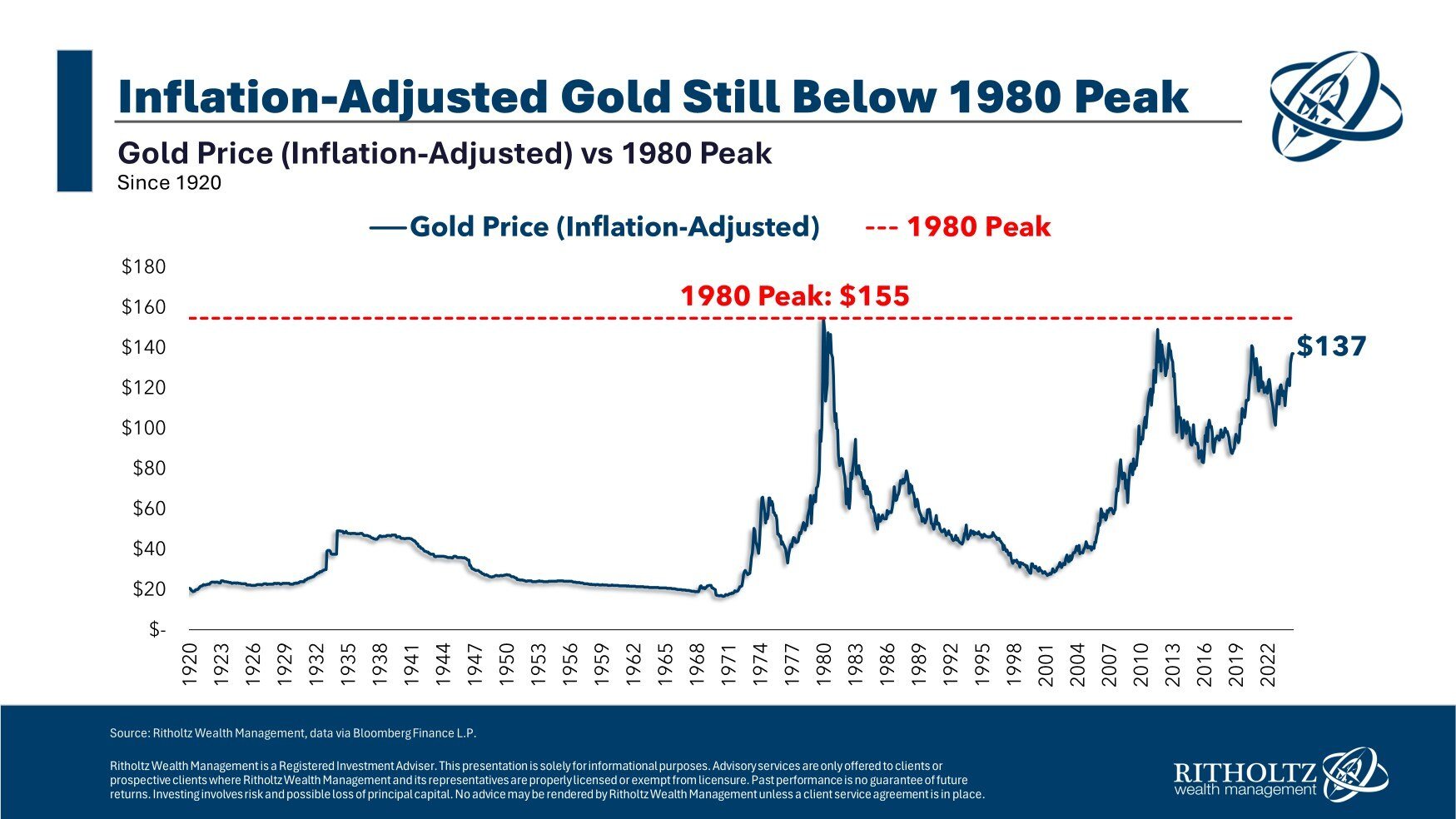

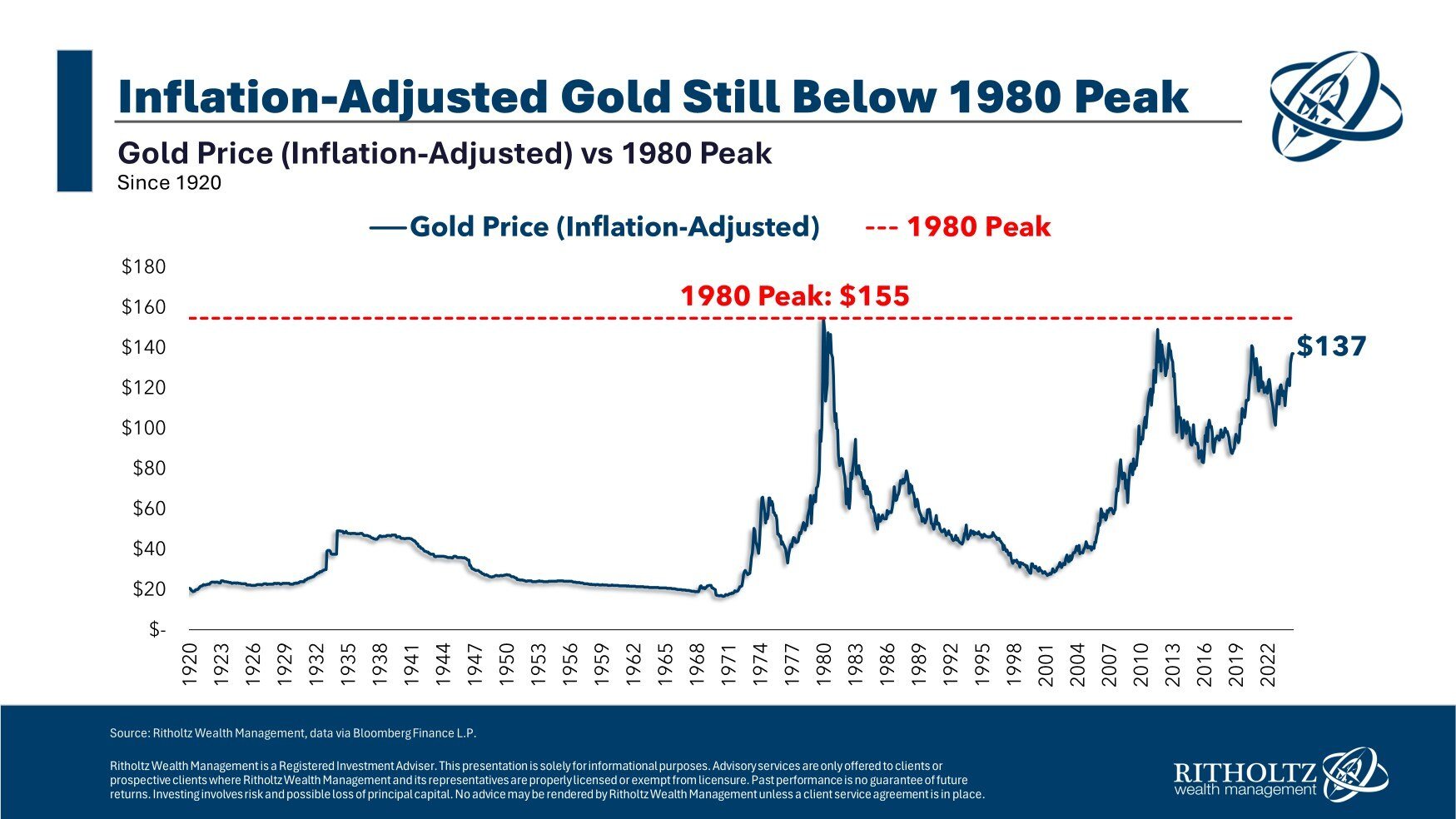

Chart of the Day: Gold vs. Inflation

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Today's Chart of the Day from Ben Carlson's book "A Wealth of Common Sense" provides an insightful look at gold prices adjusted for inflation dating back to 1920. The chart reveals that gold reached its peak inflation-adjusted price of $155 in 1980 and has struggled to return to those heights ever since.

Gold is often promoted by financial advisors as a reliable hedge against inflation. However, the data tells a different story. When adjusted for inflation, gold's price appreciation has remained stagnant since the late 1970s, challenging the notion of it being an inflation shield.

Equities tend to be a better hedge against inflation than gold because companies can adjust their prices to keep up with rising costs, potentially boosting their earnings and stock prices. Unlike equities, gold doesn’t generate income or profits and may not rise in value as much during inflation. Therefore, stocks often provide better long-term growth and benefits during inflationary times.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.