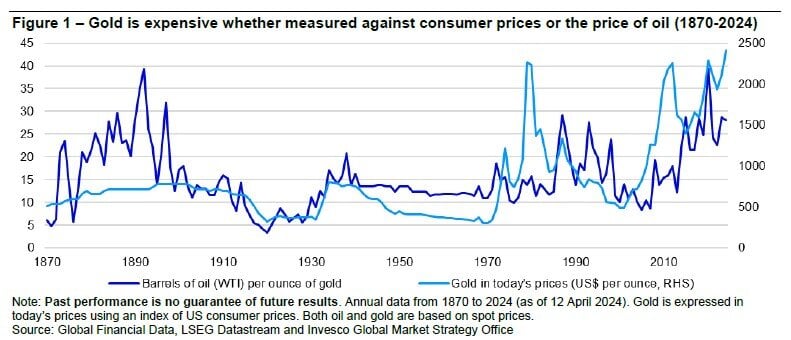

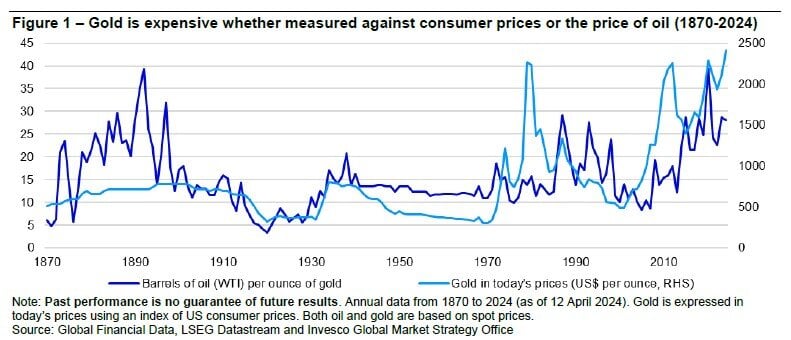

Chart of the Day: Gold vs. Oil

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Hurricane season is unpredictable. Your finances shouldn’t be. A Home Equity Line of Credit (HELOC) gives you access to funds when you need them most.

Today’s Chart of the Day is for my gold bugs. It is provided by Invesco and shows one way that investors use to value gold is to compare it to the price of oil, which is another commodity where the price is affected by geopolitical risk, inflation, and economic instability.

The chart goes back to 1870 and the past appears to be a good predictor. As of today, gold’s recent 14% year-to-date return may make it overpriced. However, as with all things, the opposite argument can be made that oil is the one that is undervalued. Whatever the outcome, the divergence between the two does not linger long, signaling that there may be some volitivity in the price of both in the short term.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.