Commentary of the Day: NASDAQ 100 Concentration

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

We will be closed Monday, January 19, in observance of Dr. Martin Luther King, Jr. Day.

Production of the U.S. penny has officially ended. Learn what this means for you.

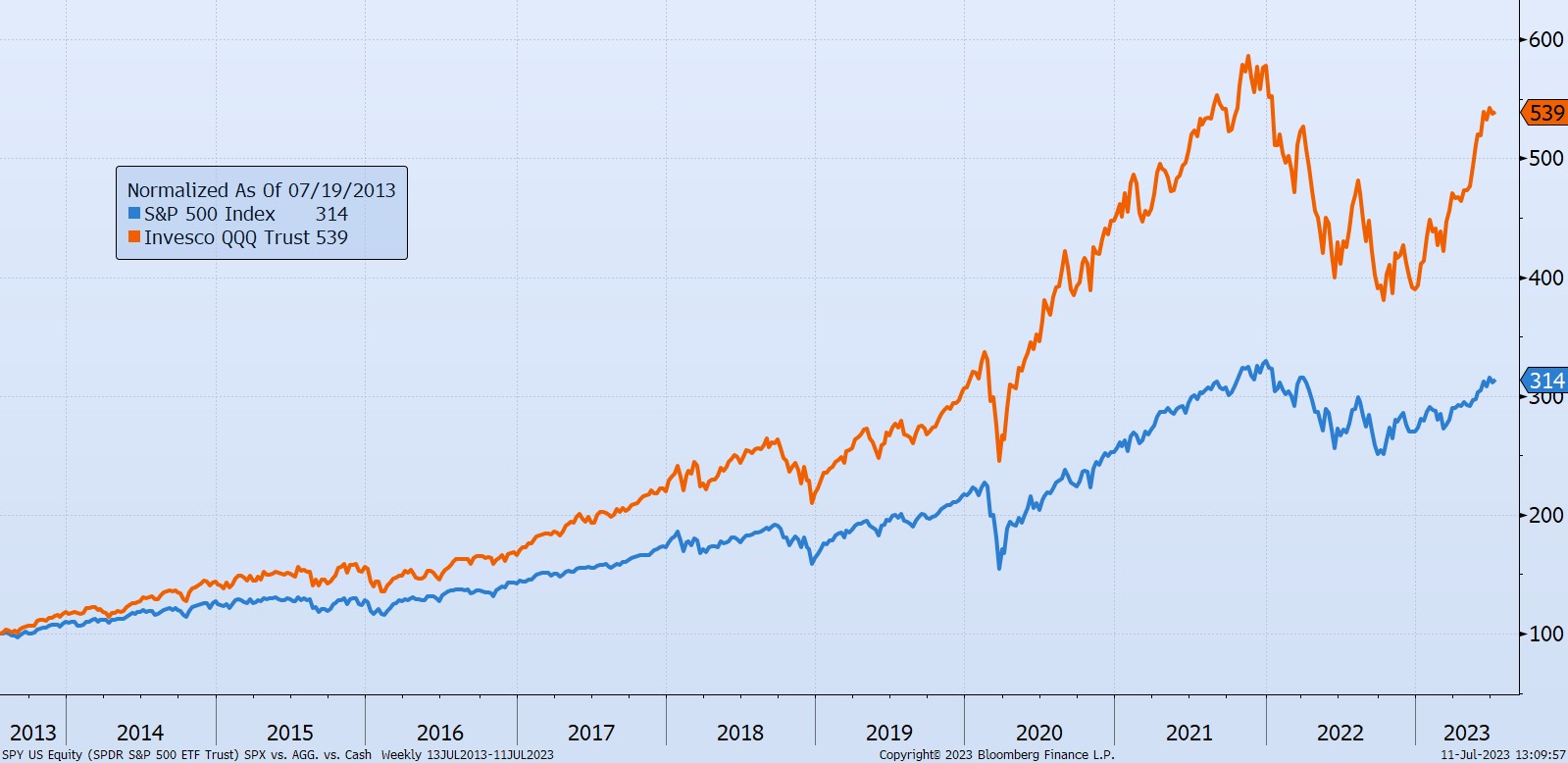

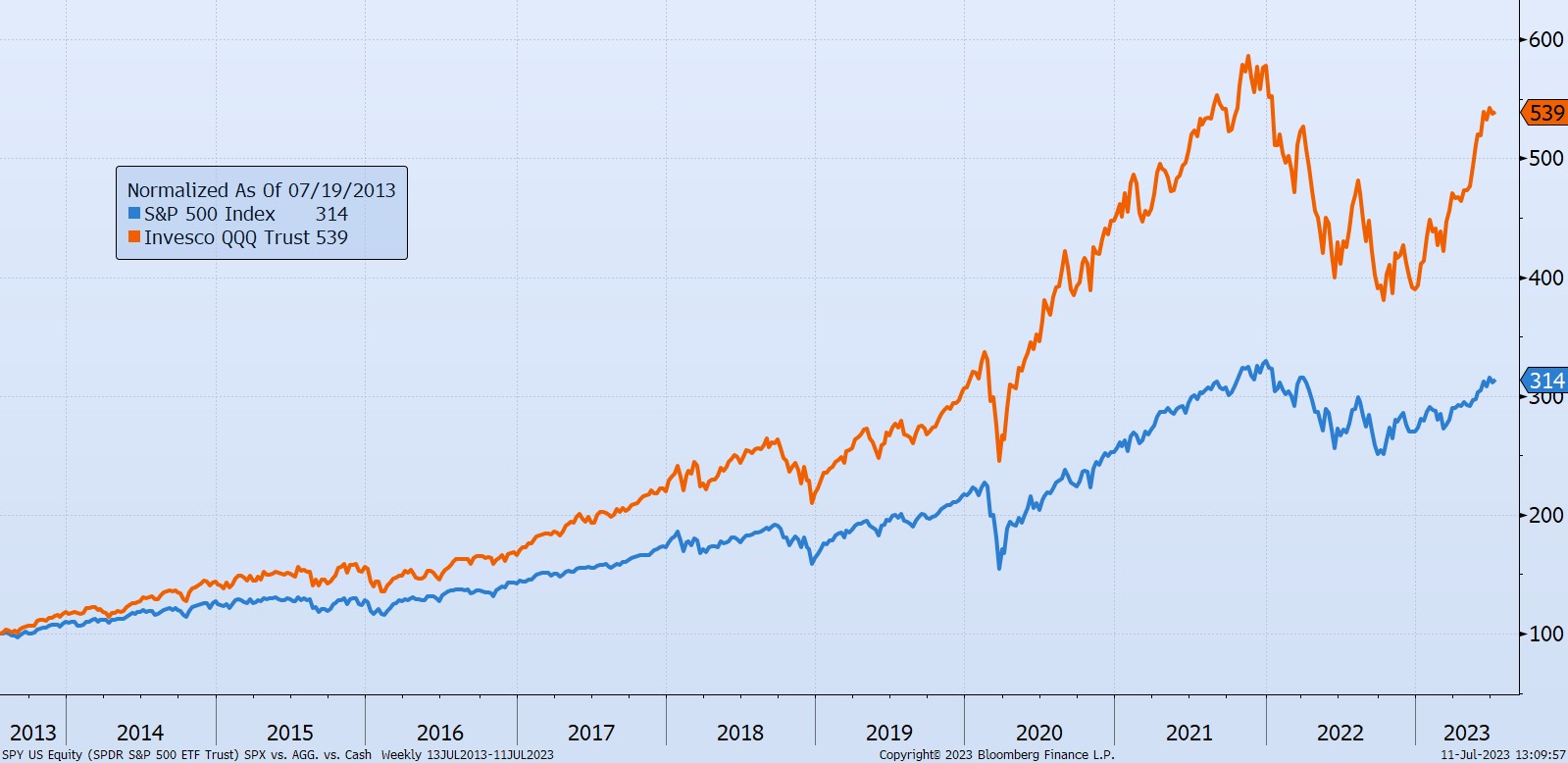

Today’s Chart of the Day is a comment about a unique risk that can occur in successful index funds. For instance, we often hear about what many call the “Tech-Heavy NASDAQ” which refers to the Invesco QQQ Trust Exchange Traded Fund (ETF), the 5th largest exchange-traded fund in the US. This fund represents the top 100 companies that trade on the NASDAQ stock exchange. The NASDAQ stock exchange is the second largest of 13 stock exchanges in the US and a close competitor of the New York Stock Exchange, which is the largest.

Out of the top 100 companies in the index, six stocks account for 55% of the total assets: Microsoft, Apple, NVIDIA, Amazon, Tesla, Meta, and Google. Since these six stocks have done so well versus other stocks over the last ten years, their percentage of the index continues to grow.

Index funds are fantastic investment products. However, as with all things, when the market changes, they change with it. This is why both the market and index funds need to be monitored and changes made to portfolios when needed. As the great Peter Lynch said, “Know what you own, and why you own it.”

The chart shows the value of $100 invested in the S&P 500 (in blue) versus the Invesco QQQ Trust (in orange) over the last 10 years.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.