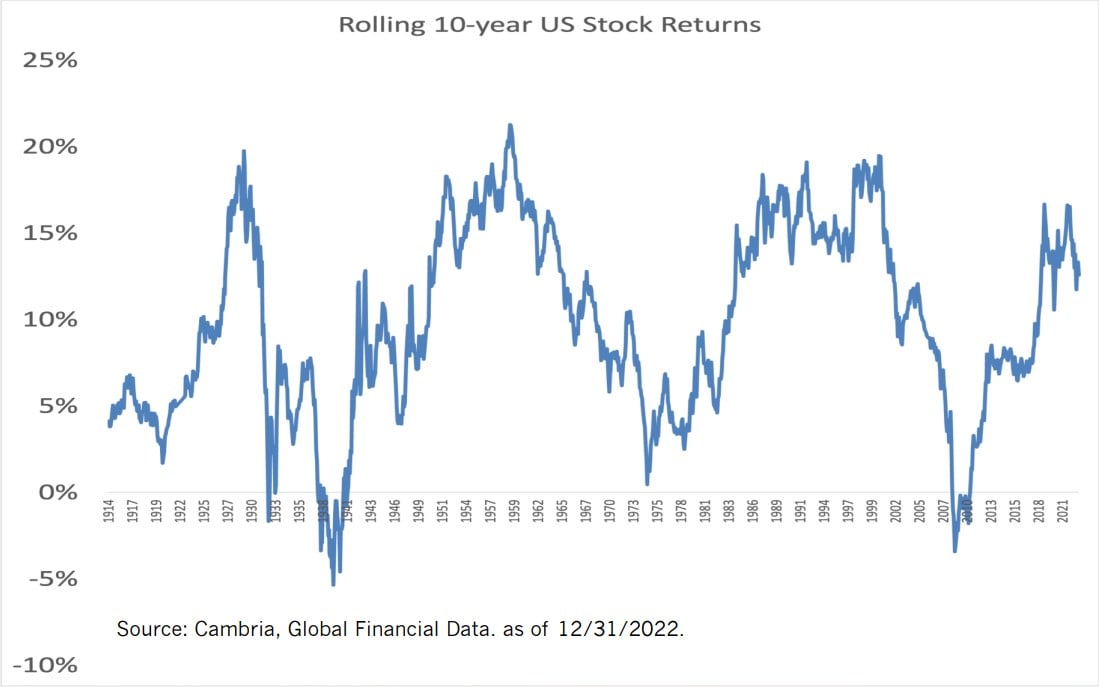

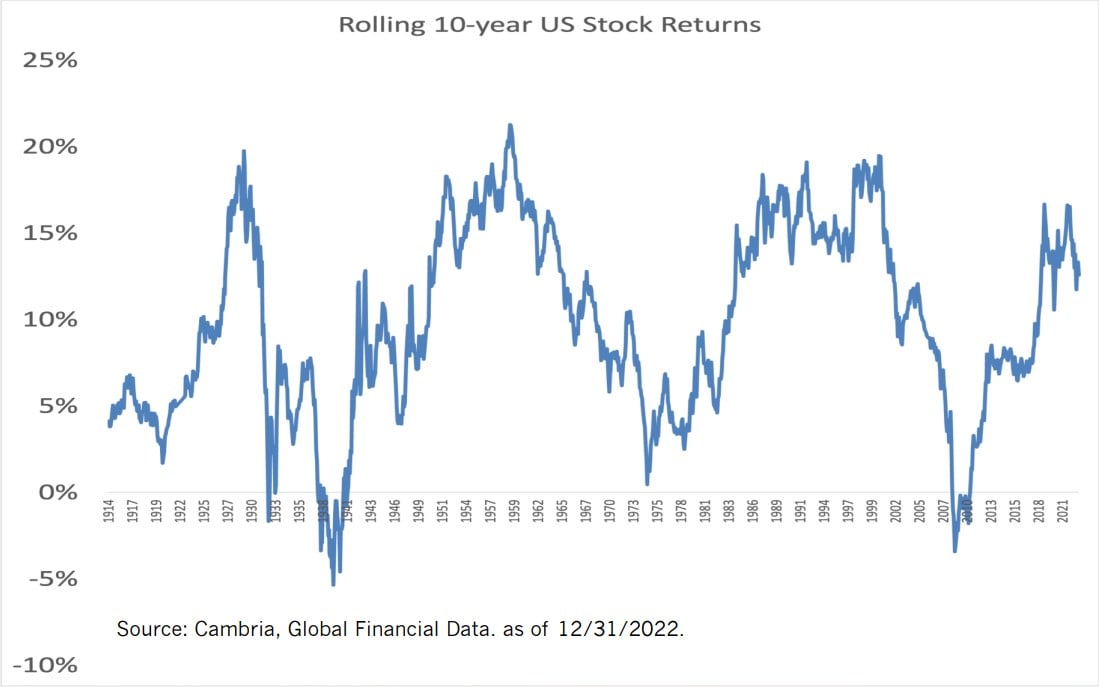

Chart of the Day: Rolling 10-Year Returns

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Today’s Chart of the Day from Cambria shows the rolling 10-year US stock return going back 108 years to 1914. There are two general periods where stocks realized a negative return over a 10-year span: one during the Great Depression in the 1930s and the other during the Great Recession in 2008. Notice that these periods were brief and returns quickly recovered to 10%+. It's good to remember the quote from Warren Buffet, “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.” Discipline comes from being prepared: know downturns have happened and will happen again, but selling when the market is down locks in losses and avoiding knee-jerk reactions to market dips has been the best strategy.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.