Stocks After Inflation Peaks

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

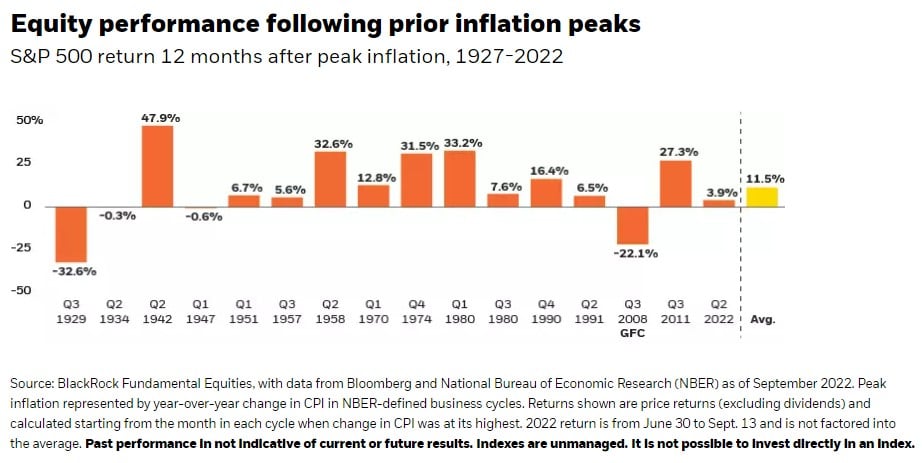

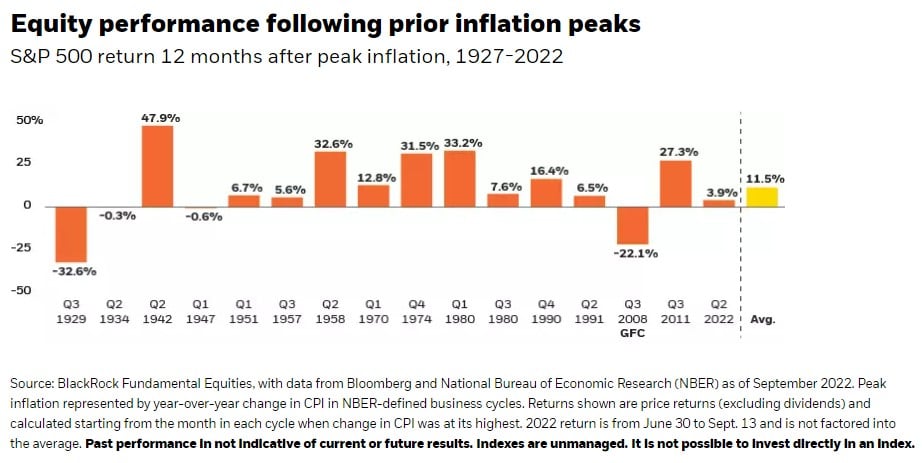

Today's Chart of the Day is in a BlackRock article. This is the organization who issues the iShares Exchange Traded Funds (ETFs) in our portfolios.

The article quotes, “Inflation peaks and market rallies often go hand in hand. Since 1927, the average S&P 500 return in the 12 months following an inflation crest was 11.5%.”

The past is not indicative of future results, and of course due to the unique situation (COVID, supply chain issues, low unemployment, etc.), a relief rally may take longer. However, history does support our long-term view of stocks.

That view is:

Stocks, although they can experience brutal declines in the short-term, over a long-term period they are historically the best hedge against inflation. This is because companies have the ability to raise prices and generate more profits, which subsequently increases their stock prices.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.