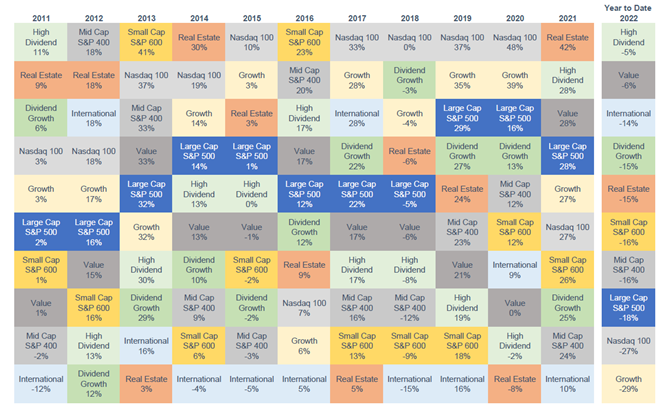

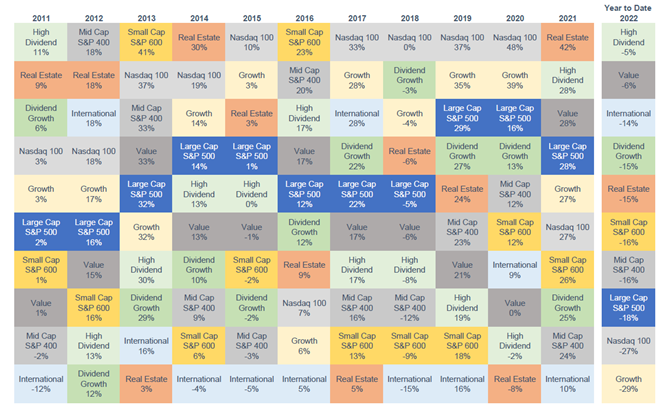

The "Chiclets Chart"

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

One of our clients calls this the “Chiclets Chart” because of its resemblance to that classic brand of candy-coated chewing gum.

Each column in the box represents a specific year, and the color of each box is a “style” of various equity indexes. Returns for each year are ranked from highest to lowest.

Lots going on in this chart, but it’s important to notice how random the returns are: Some equities do well for one year and then the next year do not. Others do well for several years, then the next year do not.

The chart reminds us that holding all of these investments in various allocations reduces both price swings and risk.

As Portfolio Managers, from time to time we use this information to identify opportunities in portfolio construction. For instance, if you wanted to “buy low” you could buy Growth Funds, which are down 29% year to date, and to fund this, you could “sell high” your Value Funds which are only down 6%.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.