Why Indexing Works

Contents

The theory that index/passive funds perform better than actively managed funds is backed by the fact that 90% of active funds underperformed their benchmarks over the last 10 years. So, it begs the question, “Why?”

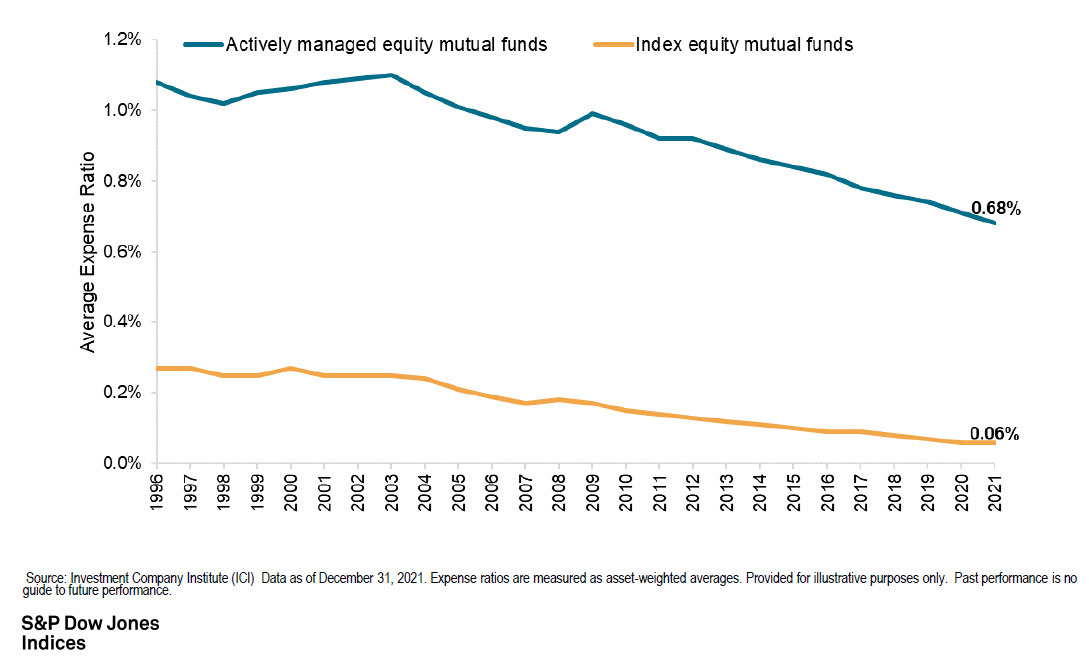

Firstly, index funds do not have the added expenses of investment analysists and advisors, lowering overall cost and ultimately leaving more returns for investors to keep.

The chart above from S&P Dow Jones Indices shows the average actively managed fund costs 0.68% versus index funds of only 0.06%. So, right off the bat, every year the actively managed fund starts 0.62% in the hole.

Secondly, nearly everyone, everywhere has access to the same information about the economy, news, and markets. Think about how access to information has changed from the old ticker tape machine to the invention of the smart phone. In the old days, it was possible to trade off and profit off of “inside” information before others had access. Now, we all know instantly when things happen, and prices change to reflect any new information instantaneously.

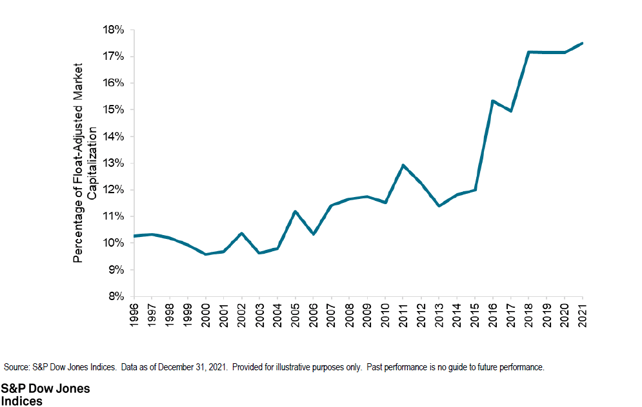

The chart below shows that since 1996 the percentage of assets that are now indexed has reached 17% for the entire market, and as much as 58% for US stocks. In addition to this, there are some estimates that 75% of the market is held by institutional investors which tend to be more pragmatic about prices. As the market becomes less and less speculative and retail driven, there are less and less “active” market participants to gain an advantage over and achieve a higher-than-average rate of return.

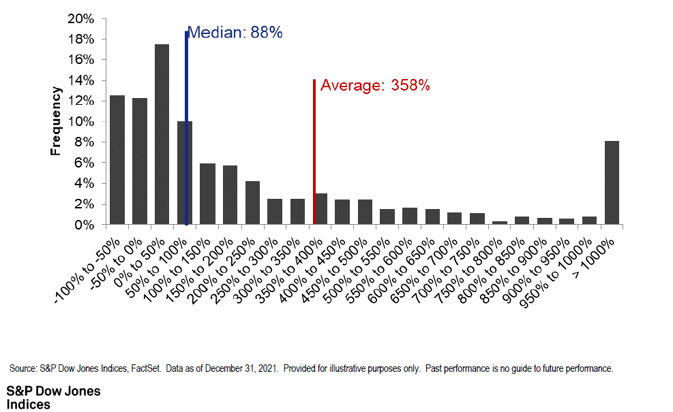

Lastly, but most significantly, only a handful of stocks become super stars and have epic returns. For instance, Amazon has had a 135,000% return since inception. When included, this moves the average returns of all stocks to 358% which is much more than the median return of all stocks of only 88% as seen in the chart below.

Generally speaking, stocks have a range of returns of 0% to infinity. There is no negative return since lenders to a company cannot require you to pay off the company’s debts. Your stock value can go to zero and that’s all.

The chart shows the dispersion of individual stock returns over the last 20 years, which shows that only 18% of stocks beat the market. Quite simply, if you didn’t own Amazon, which is one of the stocks on the far right of the chart, and didn’t hold it the entire time, you would have underperformed. Therefore, since there are so few stocks that beat the market, there are few managers that beat the market as well. The odds they will pick the right stocks are against them.

About the Author

Samuel A. Kiburz, Senior Vice President, Chief Investment Officer

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.