Why Pay More and Earn Less?

Learn about our Refer-a-Friend Program. Terms and conditions apply.

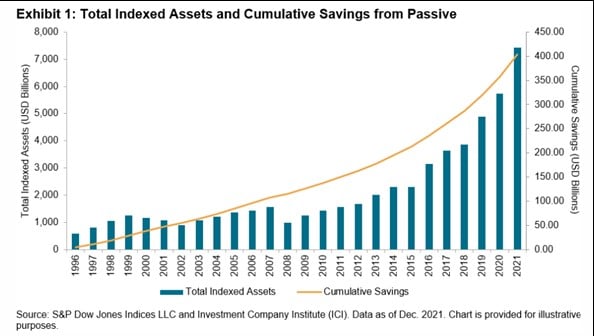

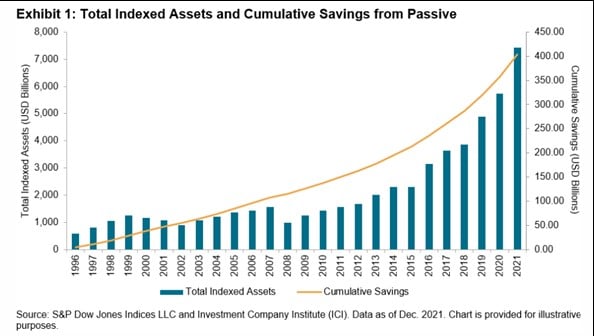

Today’s Chart of the Day comes from S&P Dow Jones Indices and shows the cumulative savings from using index funds vs. actively managed funds, as well as the growth of indexed funds since 1996.

Index funds have reached a staggering $7 trillion in total assets. Since active funds costs more vs. indexed funds, investors have saved an equally impressive $400 billon in fees, which is more than the entire market value of Wal-Mart.

The reason for growth in index funds? Since S&P started keeping score 20 years ago, only a paltry 6% of active funds have outperformed them.

As you can see in the chart, more and more are starting to say, “Why pay more and earn less?” and moving their investments accordingly.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.