WHY WAIT? BUY NOW, REFI LATER.

Does purchasing commercial property at today's rates concern you? Don’t let this impact your decision to buy. Close your loan with Crews Bank & Trust and know that if the rates go down, you can refinance for just $500.

No appraisal fees. No title insurance fees. No attorney fees. No recording fees.

To qualify for this program:

- At time of refinance, subject loan must not have any late payments of 10 days or more since origination.

- Loan must be refinanced within 24 months of loan closing.

- Subject mortgage must be in a first lien position.

- The property must be owner-occupied; investment properties are not eligible.

- Loan must have 20% down.

This promotion is one-time use. Refinance terms apply to rate and payment. All other terms of the note remain unchanged.

The Buy Now, Refi Later benefit applies to Crews Bank & Trust purchase mortgages. The Buy Now, Refi Later benefit is subject to revision or revocation by Crews Bank & Trust at any time without notice.

Loans subject to credit approval.

At Crews Bank & Trust, our local commercial real estate lending experts work with you to make it happen. We offer personal service, quick turnaround and a variety of terms at competitive fixed and floating loan rates. We offer a wide range of real estate loan products, including construction-to-permanent loans, owner-occupied property loans, and loans for cash-flowing investment commercial real estate.

Loans subject to credit approval.

Projects we’ll consider for financing include:

Purchase or construction

Refinance

Income Producing Property

Commercial mortgage financing (investment property)

Multi-family property

Owner-occupied mixed-use property

Is Buying or Renting Commercial Real Estate Right for You? Find Out with Our Quick Quiz!

Ready to make the right move for your business? Deciding whether to buy or rent commercial real estate is a huge step, and it’s not always clear what’s best for your company’s future. Our Buy or Rent Commercial Real Estate Quiz is here to help. Don't leave your business's next move to chance—take the quiz today and unlock the insights you need to make smarter, more confident real estate decisions that will set your business up for success!

FAQs

What is the process to get a commercial real estate loan?

Commercial real estate loans are mortgages used exclusively for commercial real estate, which is a business’s income-producing property.

Bankers are involved in the process of creating commercial real estate loans. When you’re working with a bank following information may be needed:

- Commercial loan application, fully completed and signed

- Three years of personal tax returns, including all K-1s (any borrower with 20 percent or more ownership in the proposed ownership will be required to provide this information)

- Three years of business tax returns

- Year-to-date balance sheet and income statement for the latest period

- Personal financial statement, fully completed and signed

- Verification of liquidity to acknowledge where the down payment is coming from (three months of bank statements that verify liquidity)

- Contract on sale and purchase of subject property

- If the property currently has or has had tenants, three years of financial statement on the subject property

- Copies of all leases for income-producing property purchases

Whether you’ve already identified a property to acquire or you’re just formulating dreams of acquiring new real estate, it’s the perfect time to talk to your Crews Bank & Trust lending professional. They will provide a quick and efficient answer on your loan request.

How do commercial real estate loans work?

Businesses use a commercial real estate loan to buy commercial property for income-producing purposes.

Commercial real estate loan terms typically include a term range from 5-20 years. The amortization period, which refers to the schedule of payments to pay off the loan, is typically longer than the loan term. For example, a commercial real estate (CRE) loan might have a term of seven years and a 30-year amortization, which means the monthly payments during the seven years are determined as if the loan were to be paid off over 30 years.

One of the key factors that differentiates Crews Bank from other banks is that we offer both fixed and adjustable rates. We’re not here to spring any surprises on you—not with payments or terms.

To learn more, contact us and we’ll be happy to provide guidance.

What types of commercial real estate does Crews Bank & Trust finance?

We offer a full range of commercial real estate loans that Florida business owners require. These CRE loans can be used for the following types of businesses or real estate properties:

- Multi-tenant retail centers

- Owner-occupied commercial real estate

- Investment commercial real estate

- Special purpose properties

- Office buildings

- Retail strip centers

- Multi-family apartments

- NNN investment restaurants

- Tenant-occupied CRE

- NNN investment commercial property

- Chain restaurants

What are the current interest rates for commercial real estate loans?

Commercial real estate loan interest rates fluctuate often and depend on the commercial real estate loan requirements and structure. The four main interest rate drivers include:

- Bank relationship: Are you currently banking with the lender you intend to receive a loan from?

- Product type: Will the property be owner-occupied or investment real estate?

- Market conditions: Are interest rates moving up or are they declining?

- Cash flow to service the proposed request: Do the borrower and guarantor have adequate cash flow resources to service the loan request?

From a banking perspective, the golden rule about interest rate pricing is “the lower the risk, the lower the rate.”

Typical down payments will vary based on real estate type. Owner-occupied will be a minimum of 20 percent cash equity injection. Real estate investment acquisitions will be a minimum of 30 percent cash equity injections.

Some banks will provide financing with the SBA 504 and SBA (7a) programs. Please ask your lending professional for more details regarding lower down payments for owner/occupied properties via this program. Commercial real estate loan structures could be up to 25-year amortizations with no balloon payment, no call, and no prepayment penalties.

Talk to your Crews lending professional — there’s a lot more information we can provide if you contact us.

What is the difference between a business term loan and a commercial real estate loan?

A business term loan is a specific amount of borrowed money that is paid back on a fixed schedule, or term. Term loans usually have a fixed interest rate or a variable rate that adjusts based on the market. Term loans are used for business needs, such as equipment purchasing or office space renovation.

A commercial real estate loan is an amount of money used specifically for property, either for the purchase of an already existing structure or to build the structure. The commercial real estate loan process can often be more stringent.

Why choose Crews Bank & Trust for your commercial real estate loan?

Our commercial real estate loans are as diverse as your needs. When you’ve found the perfect commercial site, Crews Bank & Trust’s local commercial real estate lending experts will help you secure it at a competitive rate. Our loan experts will walk you through the commercial real estate qualifications needed to acquire the loan.

We offer a full range of real estate loans, including acquisition and development, construction, and permanent loans. Over the years, we have provided loans for owner-occupied commercial real estate, investment commercial real estate, and special purpose properties.

Need commercial real estate loans explained in greater detail? Contact us today.

Recent Deals

Agricultural Land

$3,500,000

Purchase

Hardee County

Owner-Occupied Office

$150,000

Refinance

Venice | Sarasota County

Owner-Occupied Hotel

$1,700,000

Refinance

Crawfordville | Wakulla County

Chain Restaurant

$1,212,000

Commercial Construction

Chiefland | Levy County

Owner-Occupied Dental Office

$346,400

Purchase

Wesley Chapel | Pasco County

Owner-Occupied Restaurant

$425,000

Purchase

Sebring | Highlands County

Hotel

$1,690,000

Purchase

Charleston, SC

Industrial Park

$2,900,000

Purchase

Port Charlotte | Charlotte County

Mixed Use Residential/Restaurant

$900,000

Purchase

Lake Placid | Highlands County

Owner-Occupied Retail Outlet

$115,000

Refinance

Lakeland | Polk County

Owner-Occupied Industrial Office/Warehouse

$1,695,000

Construction

Sarasota | Sarasota County

Owner-Occupied Business Building

$1,335,000

Refinance

Punta Gorda |Charlotte County

Owner-Occupied Restaurant

$1,000,000

Refinance

Bartow | Polk County

Owner-Occupied Office Warehouse

$750,000

Purchase

Sarasota | Sarasota County

Multi-Family Apartment Complex

$770,000

Purchase

New Smyrna Beach | Volusia County

Owner-Occupied Office Space

$703,000

Purchase

Port Charlotte | Charlotte County

Owner-Occupied Medical Building

$370,000

Purchase

Englewood | Sarasota County

Professional Office Building

$2,629,000

Purchase

Venice | Sarasota County

Owner-Occupied Industrial Property

$284,000

Purchase

Punta Gorda | Charlotte County

Multi-Family Unit

$510,000

New Construction

Cape Coral | Lee County

Office Building

$854,000

Purchase

Charlotte County

Owner-Occupied Retail - Improvements

$260,000

Loan

Arcadia | DeSoto County

Retail

$700,000

Purchase

Punta Gorda | Charlotte County

Owner-Occupied Business

$220,500

Purchase

Naples | Collier County

Owner-Occupied Commercial Condo Office

$280,000

Purchase

Venice, FL | Sarasota

Owner-Occupied Business Location

$1,680,000

Purchase

Punta Gorda | Charlotte County

Office Building

$1,400,000

Purchase

Punta Gorda | Charlotte County

Owner-Occupied Medical Office

$320,000

Purchase

Venice | Sarasota County

Retail

$790,000

Purchase

Punta Gorda | Charlotte County

RV Park Resort

$3,300,000

Purchase

Kenansville | Osceola County

Owner-Occupied

Family- Owned Business

$200,000

Purchase

Wauchula | Hardee County

Industrial Warehouses

$500,000

Purchase

Port Charlotte | Charlotte County

Hotel

$6,900,000

Purchase

Jacksonville | Duval County

Multi-Family Unit

$515,000

New Construction

Cape Coral | Lee County

Realtor Office, Owner-Occupied

$320,000

Purchase

Osprey | Sarasota County

Senior Living Facility

$4,537,500

Purchase

Lakeland | Polk County

Commercial Building

$238,875

Purchase

Lakeland | Polk County

Multi-Tenant Retail Building

$3,400,000

Construction to Perm

Palmetto | Manatee County

Office Investment Property

$937,000

Purchase

Sarasota | Sarasota County

Rental Property

$130,000

Purchase

Port Charlotte | Charlotte County

Multiple Industrial/Office Buildings, Owner-Occupied

$1,945,195

Construction

Palmetto | Manatee County

Single Family - Investment Condo

$780,000

Purchase

Sarasota | Sarasota County

Multi-Family Apartment Complex

$753,000

Purchase

Orlando | Orange County

Multi-Unit Retail

$1,280,000

Purchase

Ft. Myers | Lee County

Office Warehouse

$1,350,000

Refinance

Englewood | Charlotte County

Residential Investment

$285,000

Refinance

Lake Placid | Highlands County

Residential Condo Investment

$1,683,750

Purchase

Boca Grande | Lee County

Retail Plaza - Multi-Unit Building

$1,500,000

Purchase

Punta Gorda | Charlotte County

Single-Family Condo Investment

$1,770,000

Purchase

Boca Grande | Lee County

Investment Retail Building

$1,207,500

Purchase

Cape Coral | Lee County

Multi-Family Apartments

$2,350,000

Refinance

Titusville | Brevard County

NNN Investment Commercial Property

$565,000

Purchase

Ft. Myers | Lee County

Office Warehouse/Condo

$500,000

Construction

Sarasota | Sarasota County

Retail Plaza Center

$1,500,000

Refinance

Cape Coral | Lee County

Light Industrial Investment Property

$915,000

Purchase

Sarasota | Sarasota County

Multi-Family Investment

$1,100,000

Construction

Cape Coral | Lee County

NNN Investment Restaurant

$1,000,000

Purchase

Orlando | Orange County

Office/Warehouse Investment

$4,350,000

Purchase

Sarasota | Sarasota County

Residential Investment Property

$410,000

New Construction

Port Charlotte | Charlotte County

Retail Property

$620,000

Purchase

Winter Haven | Polk County

Vacant Commercial Lot

$169,000

Purchase

Sebring | Highlands County

Medical Office Building

$2,135,000

Purchase

Punta Gorda | Charlotte County

Light Industrial Investment Property

$915,000

Purchase

Sarasota | Sarasota County

Retail Use

$1,680,600

Purchase

Winter Park | Orange County

Owner-Occupied

$800,000

Purchase

Naples | Collier County

Residential Multi-Family Investment Property

$1,500,000

Purchase

Venice | Sarasota County

Retail Store

$315,000

Purchase

Ruskin | Hillsborough County

Warehouse

$1,200,000

Purchase

Charlotte County

Mini Storage

$550,000

Construction

Rotonda | Charlotte County

Multi-Family Apartment Complex

$1,000,000

Purchase

Tallahassee | Leon County

Office Building

$355,000

Purchase

Lake Placid | Highlands County

SBA + Conventional Loan - Owner-Occupied Business

$843,000

Purchase

Englewood | Charlotte County

Retail Strip

$2,095,000

Commercial Construction

Orlando | Orange County

Industrial Office & Warehouse

$616,000

Purchase

Sarasota | Sarasota County

SBA + Conventional Loan - Owner-Occupied Office

$384,300

Purchase & Renovation

Wauchula | Hardee County

Office Building

$2,235,000

Purchase

Fort Myers | Lee County

Owner-Occupied Local Business

$840,000

Purchase

Port Charlotte | Charlotte County

RV Park

$840,000

Purchase

Homosassa | Citrus County

Industrial Warehouse Flex Unit

$188,000

Purchase

Venice | Sarasota County

Office

$600,000

Purchase

Cape Coral | Lee County

Owner-Occupied Retail Space

$500,000

Purchase

Venice | Sarasota County

Multi-Tenant Retail Center

$2,476.875

Purchase/Improvements

Lakewood Ranch | Manatee County

6-Unit Commercial Property

$1,400,000

Investment

Punta Gorda | Charlotte County

Owner Occupied Retail

$1,100,000

Investment

Boca Grande | Lee County

Mixed Use Property

$900,000

Investment

Union City, NJ | Hudson County

Residential Properties

$552,000

Purchase/Investment

Highlands County

Owner Occupied Commercial Property

$380,000

Purchase

Englewood | Charlotte County

Residential Investment Properties

$367,500

Purchase

Highlands County

Cash Out Refinance

$368,500

Debt Consolidation

Sarasota | Sarasota County

Retail Strip Mall

$300,000

Refinance Investment

Port Charlotte | Charlotte County

Condo - Retail

$330,250

Second Mortgage

Sarasota | Sarasota County

Fast Food Restaurant

$300,000

Line of Credit

Nokomis | Sarasota County

Residential Property

$247,500

Purchase/Investment

Highlands County

Multi-Family Property

$3,400,000

Construction

Punta Gorda | Charlotte County

Hotel / Refinance

$2,500,000

Investment

Lakeland | Highlands County

Mobile Home Community

$2,000,000

Refinance Current Mortgage

Kissimmee | Osceola County

Aquisition - Retail Office

$950,000

Purchase

Bonita Springs | Lee County

New Retail Location

$525,400

Purchase

Sarasota | Sarasota County

Multi-Family Unit

$388,000

Cash Out Refinance

Punta Gorda | Charlotte County

CRE Investment

$325,000

Refinance

Venice | Sarasota County

Construction Business

$250,000

Working Capital Loan

Sebring | Highlands County

Investment Condominium

$230,000

Delayed Financing

Babcock Ranch | Charlotte County

Commercial Investment

$102,000

Refinance Private Note

Inglis | Levy County

Retail Expansion - New Location

$420,000

Purchase

Sarasota | Sarasota County

Retail Office

$981,250

Purchase

Zavalla, TX

Commercial Owner-Occupied

$750,000

Purchase

Dade City | Pasco County

Commercial Investment Property

$660,000

Purchase

Winter Haven | Polk County

Residential Investment Property

$640,000

Refinance

Delray Beach | Palm Beach County

Convenience Store

$500,000

CRE Improvement Loan

Okeechobee | Okeechobee County

Owner-Occupied Office/Condo Unit

$376,000

Purchase

Venice | Sarasota County

Art Studio

$300,000

Refinance

Jacksonville | Duval County

Residential Duplex

$276,000

Refinance

Punta Gorda | Charlotte County

Owner-Occupied Office/Condo Unit

$240,000

Purchase

Punta Gorda | Charlotte County

Investment Property

$60,000

Purchase

Arcadia | DeSoto County

Downtown Investment Building

$6,700,000

Refinance

Lakeland | Polk County

Mobile Home Park

$3,125,000

Refinance

Winter Springs | Seminole County

Income Producing Investment Property

$2,800,000

Purchase

Port Charlotte | Charlotte County

Industrial Office/Warehouse Property

$1,855,000

Refinance

Cape Coral | Lee County

Commercial Development

$400,000

Construction

Englewood | Sarasota County

Commercial Investment Retail Strip Center

$7,500,000

Refinance

Ft Myers | Lee County

Construction Owner-Occupied Warehouse

$1,000,000

Purchase

Bradenton | Manatee County

Investment Commercial Real Estate

$700,000

Purchase

Orlando | orange County

Remodel Investment Rental Property

$450,000

Refinance

Sebring | Highlands County

Investment Rental Property

$425,000

Purchase

Boca Grande | Lee County

Commercial Investment Rental Property

$325,000

Refinance

Wauchula | Hardee County

Commercial Owner-Occupied Business

$105,000

Refinance

Lakeland | Polk County

New Residential Apartments

$1,520,000

Construction

Cape Coral | Lee County

Owner-Occupied Retail Space

$200,000

Refinance

Sebring | Highlands County

Owner-Occupied Office Location

$330,000

Purchase

Lake Placid | Highlands County

Owner-Occupied Office/Rental Space

$350,000

Refinance

Avon Park | Highlands County

Owner-Occupied Dental Practice

$736,000

Purchase

Sarasota | Sarasota County

Owner-Occupied Auto Sales

$660,000

Purchase

Lakeland | Polk County

Owner-Occupied Retail Location

$780,000

Refinance

Port Charlotte | Charlotte County

Owner-Occupied Condo Office

$910,000

Refinance

Naples | Collier County

Owner-Occupied Restaurant Expansion

$2,590,000

Refinance

Englewood | Charlotte County

Owner Occupied Business

$917,500

Purchase

Winter Haven | Polk County

Owner Occupied Commercial Property

$198,750

Purchase

Avon Park | Highlands County

Owner Occupied Business

$721,500

Purchase

Bradenton | Manatee County

Commercial 1-4 Unit Property

$767,000

Purchase

Arcadia | DeSoto County

SEE WHY LOCAL BUSINESSES CHOOSE TO WORK WITH US.

Miguel Centeno, Commercial Real Estate Investor

Blog

On Our Minds

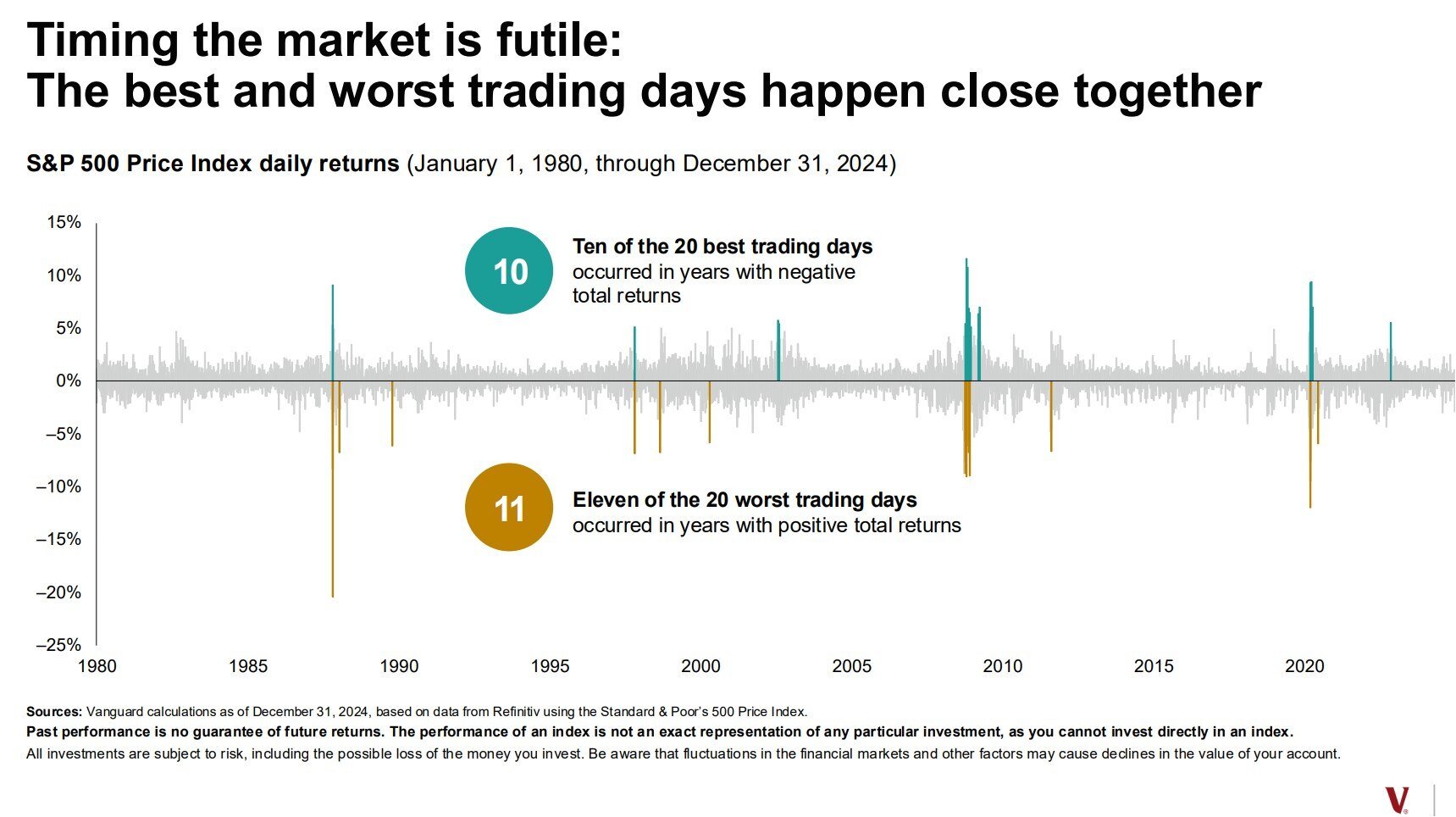

Chart of the Day: Darkest Before the Light

April 10, 2025

Today’s Chart of the Day is a classic one provided by Vanguard and was recently updated to reflect 2024 performance. It highlights the best and worst...

Crews Bank & Trust - We Are Your Hometown Bank

April 9, 2025

We opened our first branch in Wauchula in 1929 and never looked back. Now, as Crews Bank & Trust, we have been a cornerstone of Central and Southwest...

.jpg)