Chart of the Day: Don't Simply Set and Forget

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar

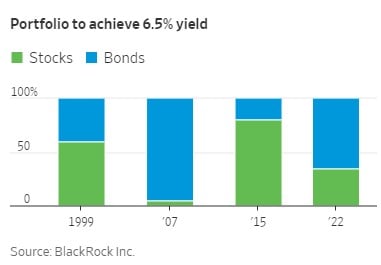

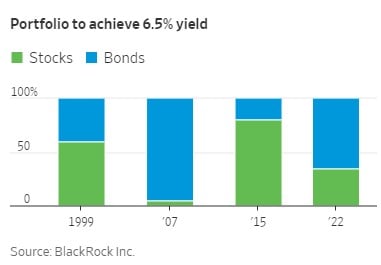

Today’s Chart of the Day comes from an article in the Wall Street Journal, “Bonds Over Stocks: The New 60-40 Portfolio.” There are a lot of nuisances in charts like these, and I have to ask, “What type of bonds and stocks do you have to get to this 6.50% yield touted in the article?” This is especially true because a portfolio of all the publicly held stocks and bonds only have a yield of 1.65% and 4.30%, respectively, and when combined with their suggested 40% stocks/60% bonds, it only works out to a yield of 3.25%.

Alas, further research shows their example includes junk and long-term bonds, high-yield low-growth stocks, and private equity into the mix. All of these can add significant risk for an average investor’s portfolio.

The chart does show, however, you cannot simply “set and forget” your allocations due to changing market conditions.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.