Chart of the Day: 7, 11, 17 Years

Contents

Today’s Chart of the Day is based on calculations I did from discussions with a client. It is important to remember, there are only two ways to get your money back from an investment. The first is selling that investment to someone else and the second is receiving distributions in the form of dividends.

Let's take a deeper look at the first way. When selling an investment, the buyer is often only willing to pay based on what they eventually expect to get back in future dividends. Imagine if you invested $100 into a company, and it wasn’t profitable, and NEVER returned any dividends to you - no one would want to buy it, and the value of the stock would be zero.

This is not to say that companies who do not pay a dividend are not good investments. Some companies wisely keep their profits and re-invest back into the company by buying more machinery, equipment, and/or hiring more people. This is done in hopes that they will be able to pay higher dividends in the future.

The point is that a company’s ability to pay future dividends is the most important measurement of value of an investment. Understanding this, in the short term, a company’s stock price rises and falls with news that would affect the level of those future dividends.

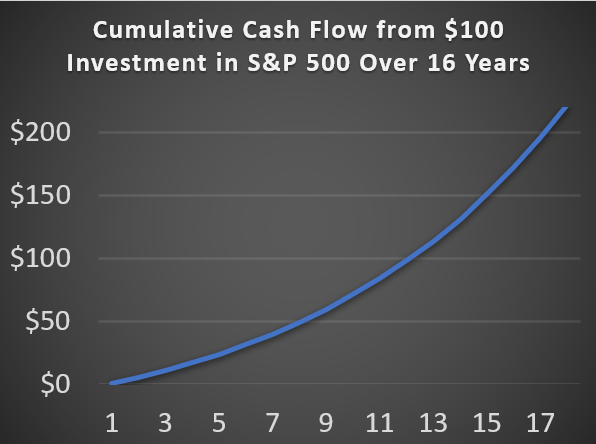

Here's an example: The chart assumes you invested $100 into a typical stock in the S&P 500 that earns 5%, or $5, a year in profit and has a long-term growth rate of 11%. (Both figures are historically accurate approximations.) It then compiles the total dividends you receive over the next 17 years. You’ll notice that it takes seven years to reach 50% ($50) of your original investment, 11 years to get all your money back, and 17 years to double your money.

This demonstrates why many professional money managers don’t get excited about price movements from quarter to quarter, or even over one, three, or five years. As a true buy and hold, long-term investor, it’s better to focus on the company's ability and the dividends they can pay over the long run.

In the investment world, to look at a company’s profit and ability to distribute future dividends is called Fundamental Analysis and is one of the cornerstones of our investment philosophy at Crews Bank & Trust.

About the Author

Samuel A. Kiburz, Senior Vice President, Chief Investment Officer

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.