Individual Retirement Accounts (IRA)

Feel great about retirement.

Our Retirement Specialists help you prepare for your future.

When you’re ready to retire, we want you to really be ready. Our IRA options are designed to help you maximize your retirement savings, so you’ll be set for your golden years.

We Offer Two IRA Options:

Traditional IRA

This retirement account allows you to defer taxes on your earnings made and deductibility of your contribution is based on your IRS guidelines. All earnings of your traditional IRA remain tax deferred until you make withdrawals, which are taxed as ordinary income during the tax year of their withdrawal.

Roth IRA

An IRA is a non-deductible retirement account that features tax-free withdrawals for certain distribution reasons after five years. To qualify for a Roth IRA, you must have earned income (or your spouse must have earned income). You may contribute any amount up to 100% of your compensation or $6,000 (whichever is less), as long as your Modified Adjusted Gross Income is within the limits established by the government (last set in 2019). An additional $1,000 is allowed to be contributed for those over 50.

Our Retirement Specialists are ready to answer any questions you may have regarding Individual Retirement Accounts and how we can help you!

Meet the Team

Get to know the local team of smiling faces managing your Crews Bank & Trust account.

Blog

On Our Minds

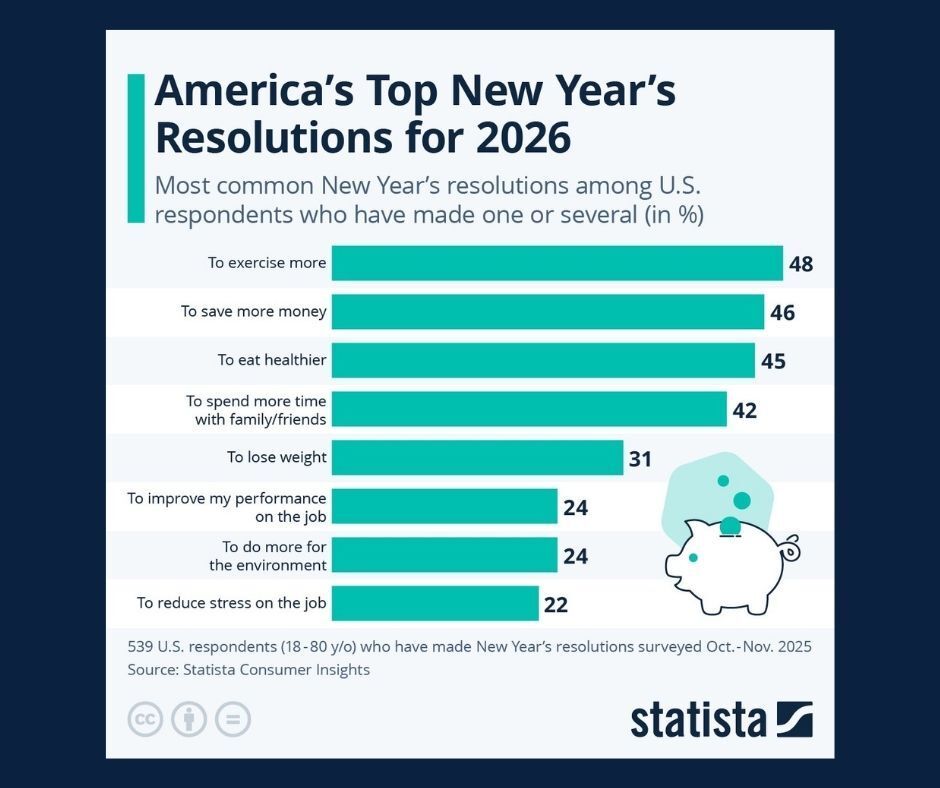

Chart of the Day: Top New Year's Resolutions

January 22, 2026

This chart comes from Statista and displays New Year’s resolution data for 2026.

What Happens If You Don’t Have an Estate Plan?

January 21, 2026

Contrary to popular belief, estate planning isn’t just for the wealthy—it’s for anyone who wants to protect their loved ones and ensure their wishes...