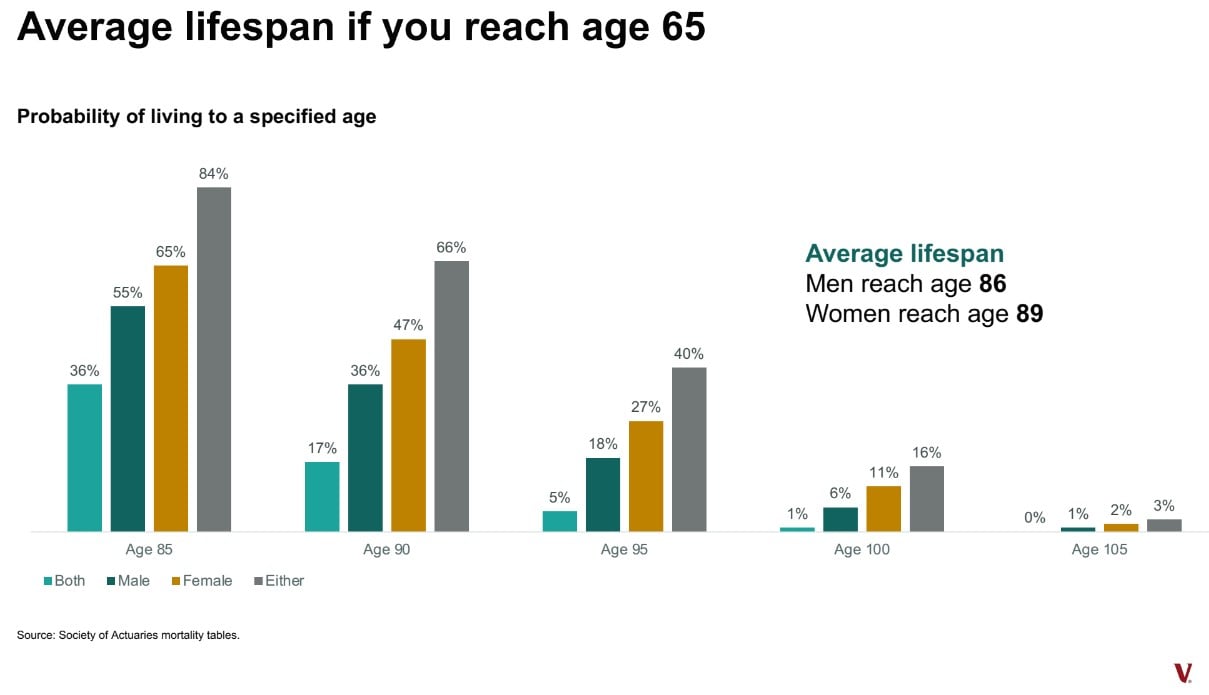

Chart of the Day: Ages 86 and 89

Today’s Chart of the Day from Vanguard shows that the average lifespan once someone reaches the age of 65 is 86 for men and 89 for women.

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar

Today’s Chart of the Day from Vanguard shows that the average lifespan once someone reaches the age of 65 is 86 for men and 89 for women.

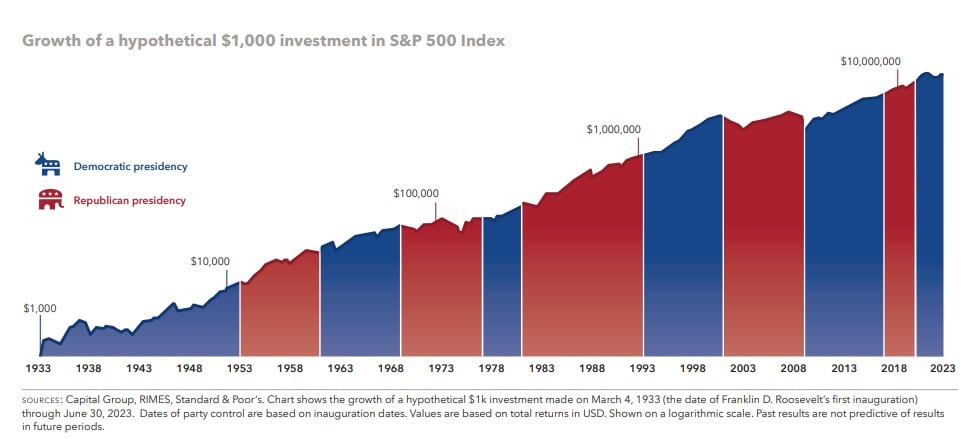

Happy New Year! With 2024 being a presidential election year, today’s Chart of the Day is from Capital Group and shows the hypothetical growth of..

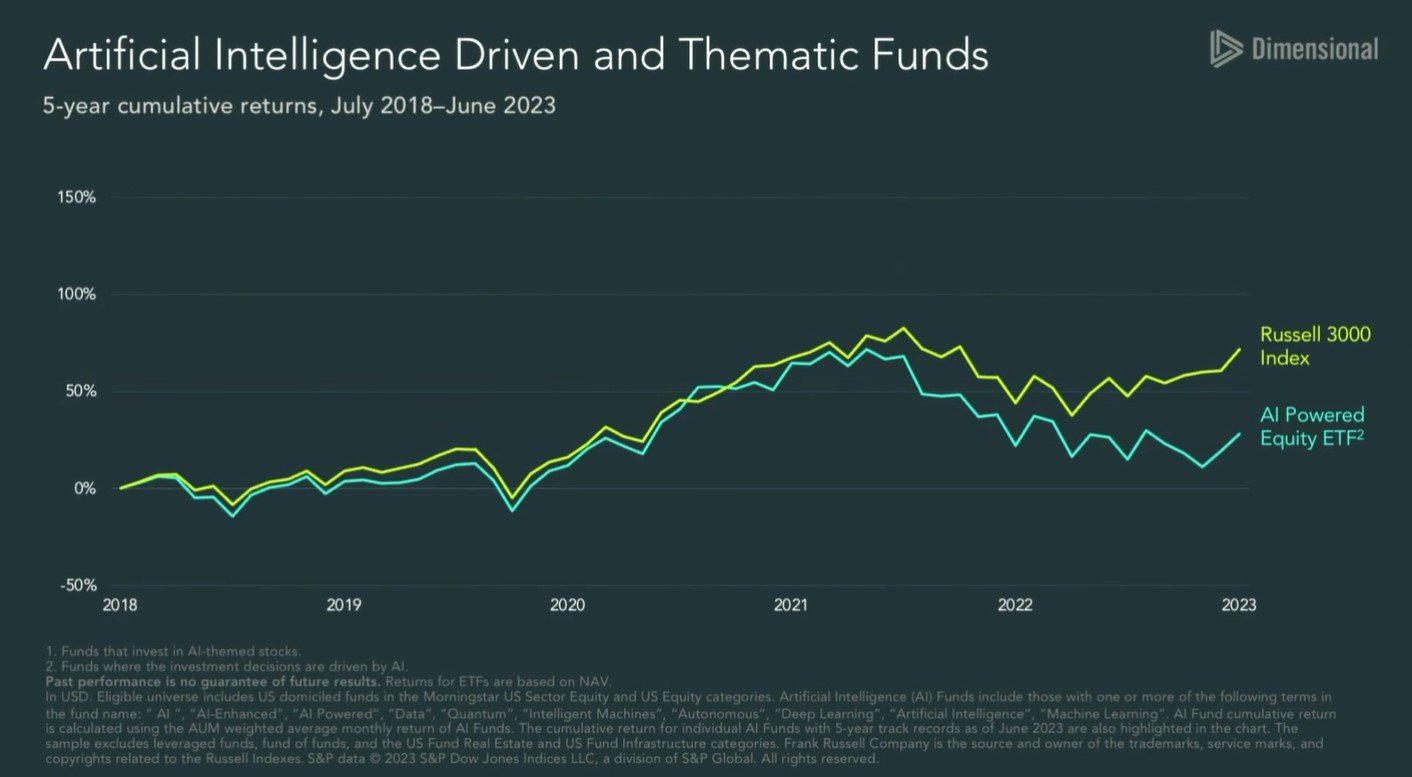

Today’s Chart of the Day is from Dimensional Advisors

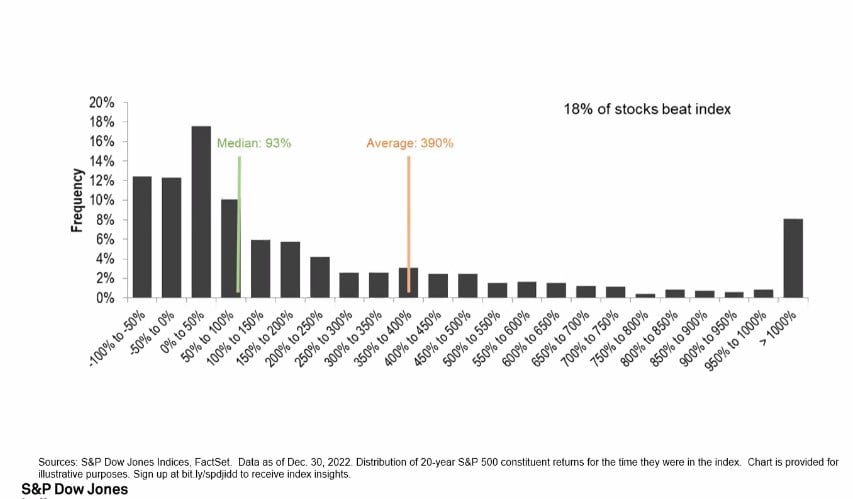

Today’s Chart of the Day comes from S&P Dow Jones, which just celebrated 20 years of tracking market metrics, and shows only 18% of stocks..

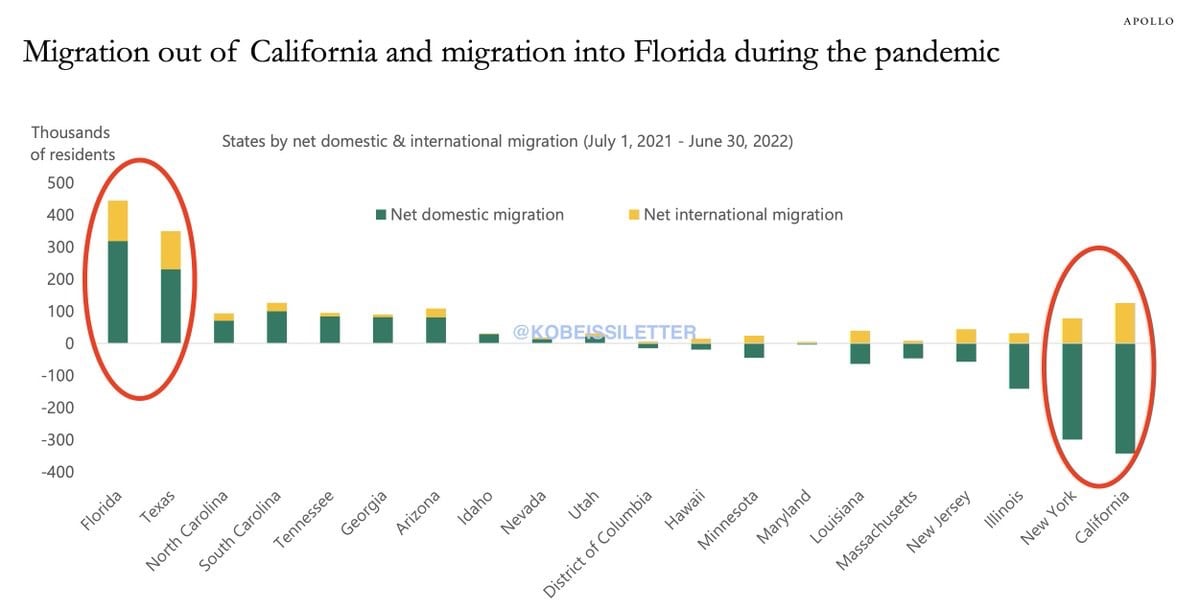

Today’s Chart of the Day from Apollo shows migration during the pandemic. Florida and Texas gained 800,000 people, including 750,000 who moved from..

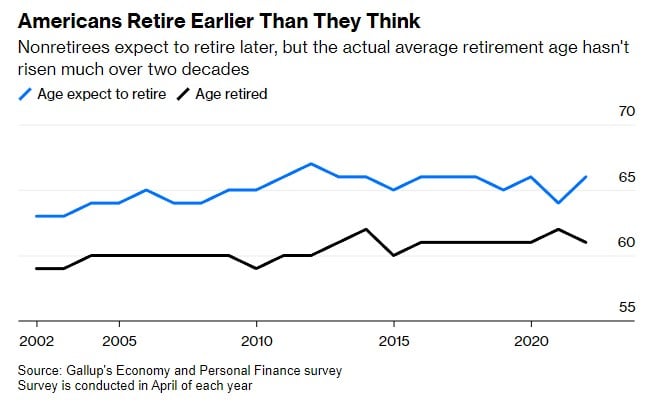

Today’s Chart of the Day from a Gallup Survey shows that the retirement age of 61 has not materially changed over the last 20 years.

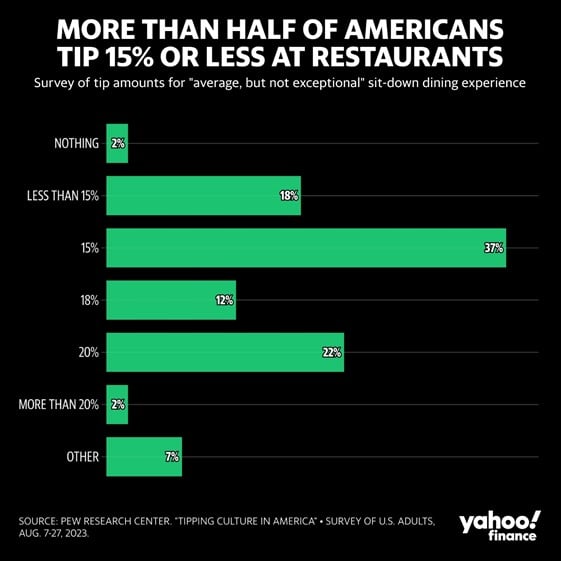

Today’s Chart of the Day comes from Yahoo Finance and shows the tipping amount percentages for “average" service.

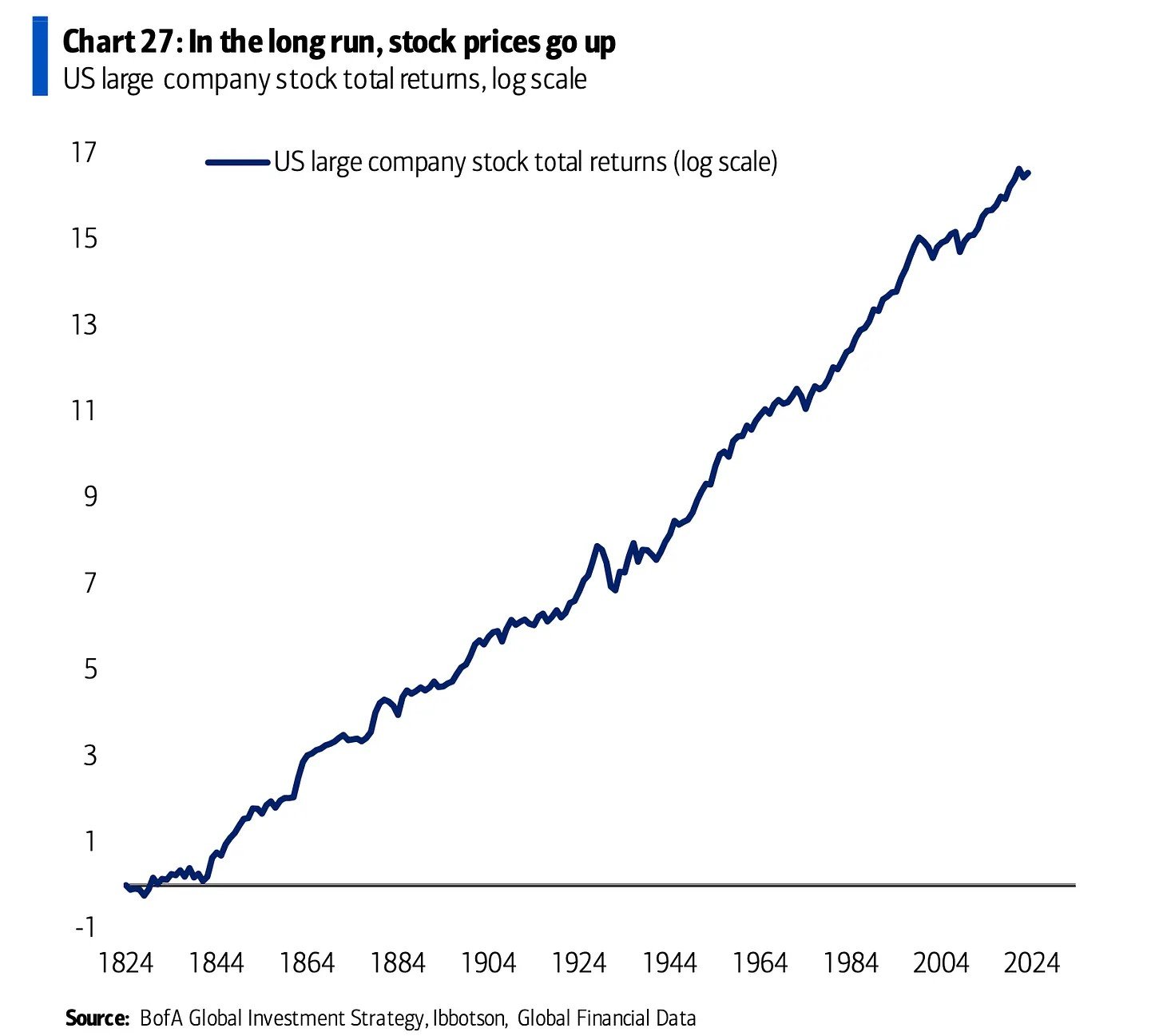

Today’s Chart of the Day comes from Bank of America research provided by Ibbotson, which is an investment research company. It is a nice follow up..

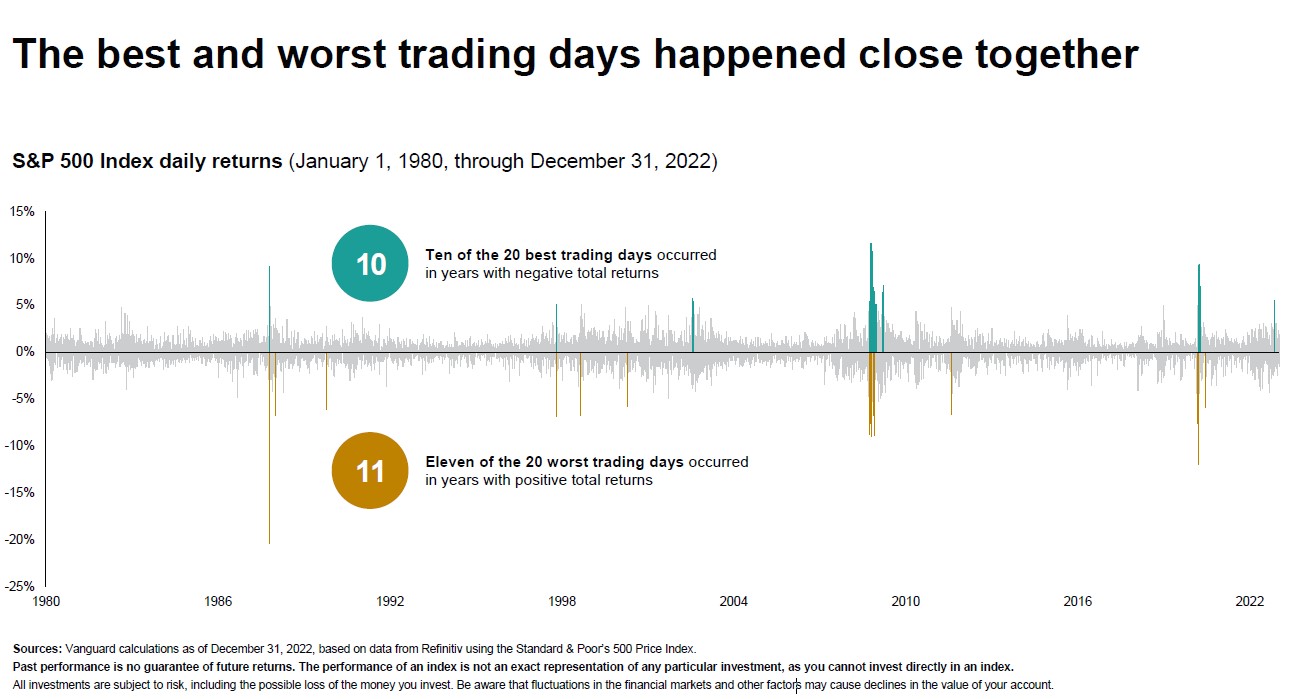

Today’s Chart of the Day comes from Vanguard, and though it is not true in all cases, it is true in most, that since 1980 the best time to buy is..

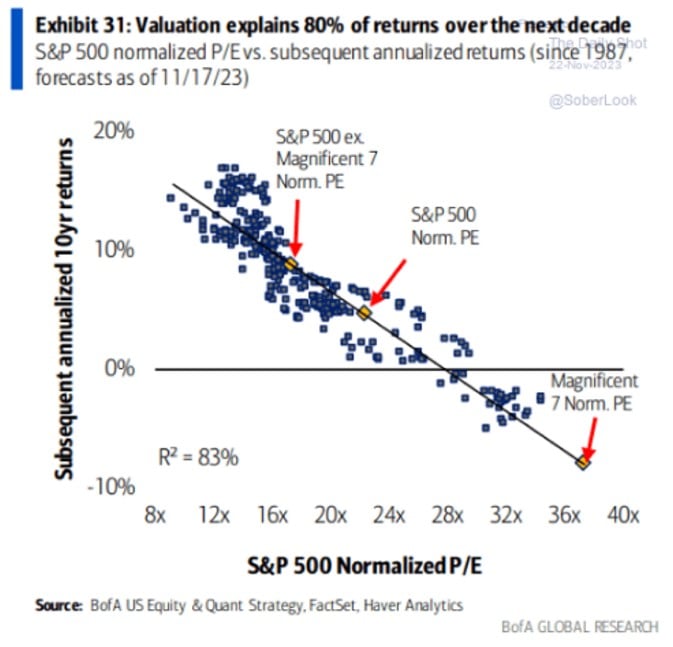

Today’s Chart of the Day from Bank of America Equity & Quant Strategy shows the price you pay for future earnings explains 80% of the returns for the..

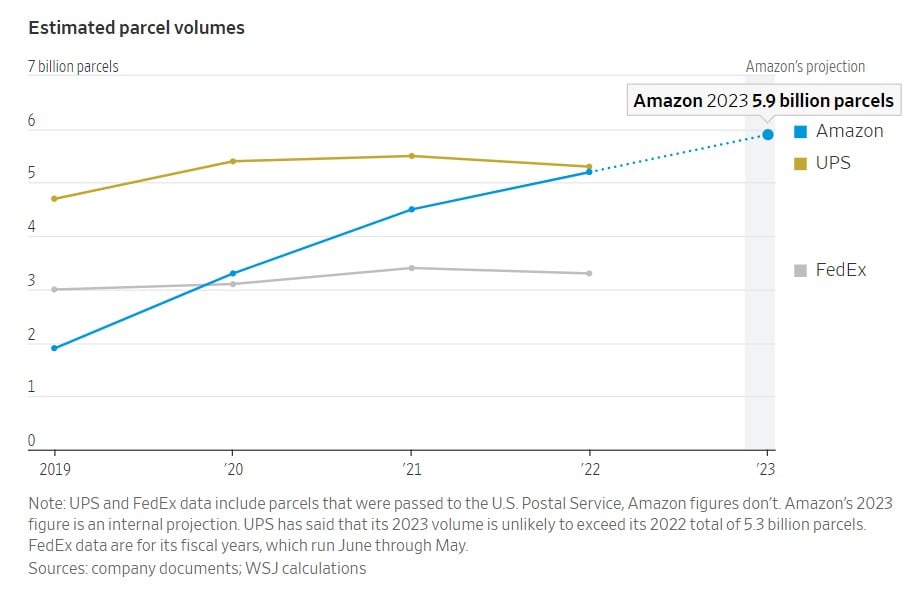

While receiving packages this holiday season, remember today’s Chart of the Day from an article in the Wall Street Journal titled, “The Biggest..

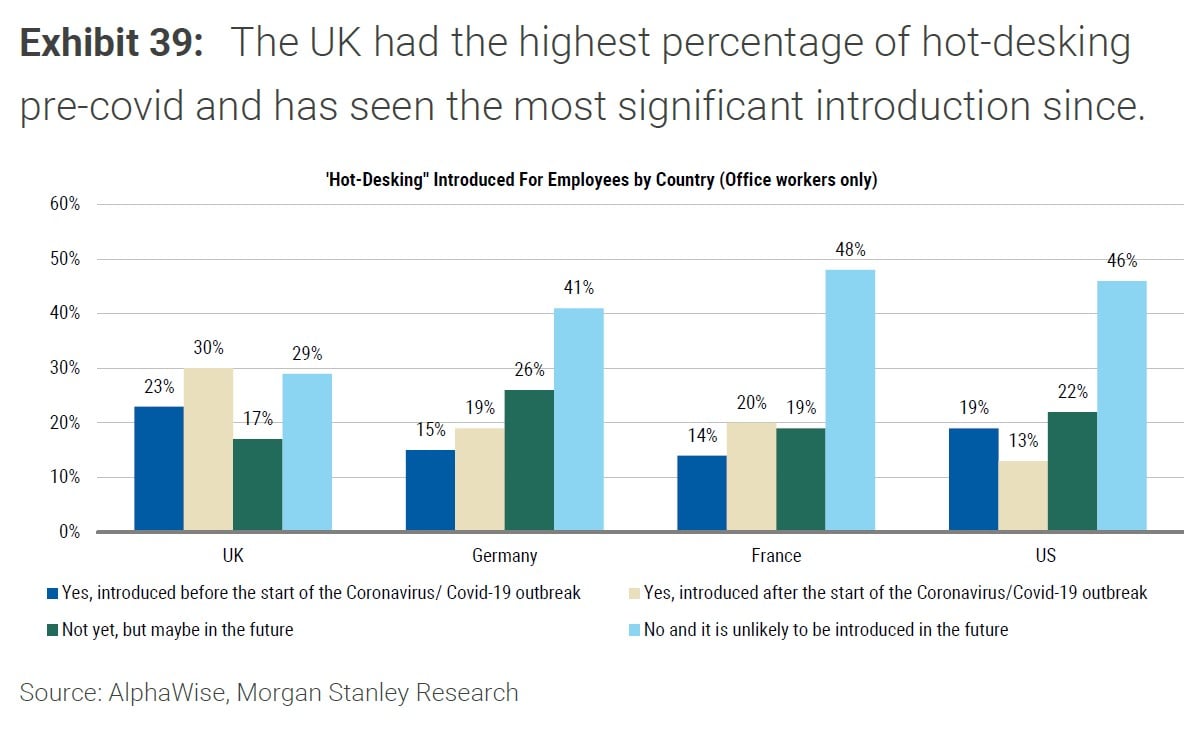

Today’s Chart of the Day comes from AlphaWise in a Bloomberg article about the rise of “Hot Desking.” This is when work areas, such as desks, are not..

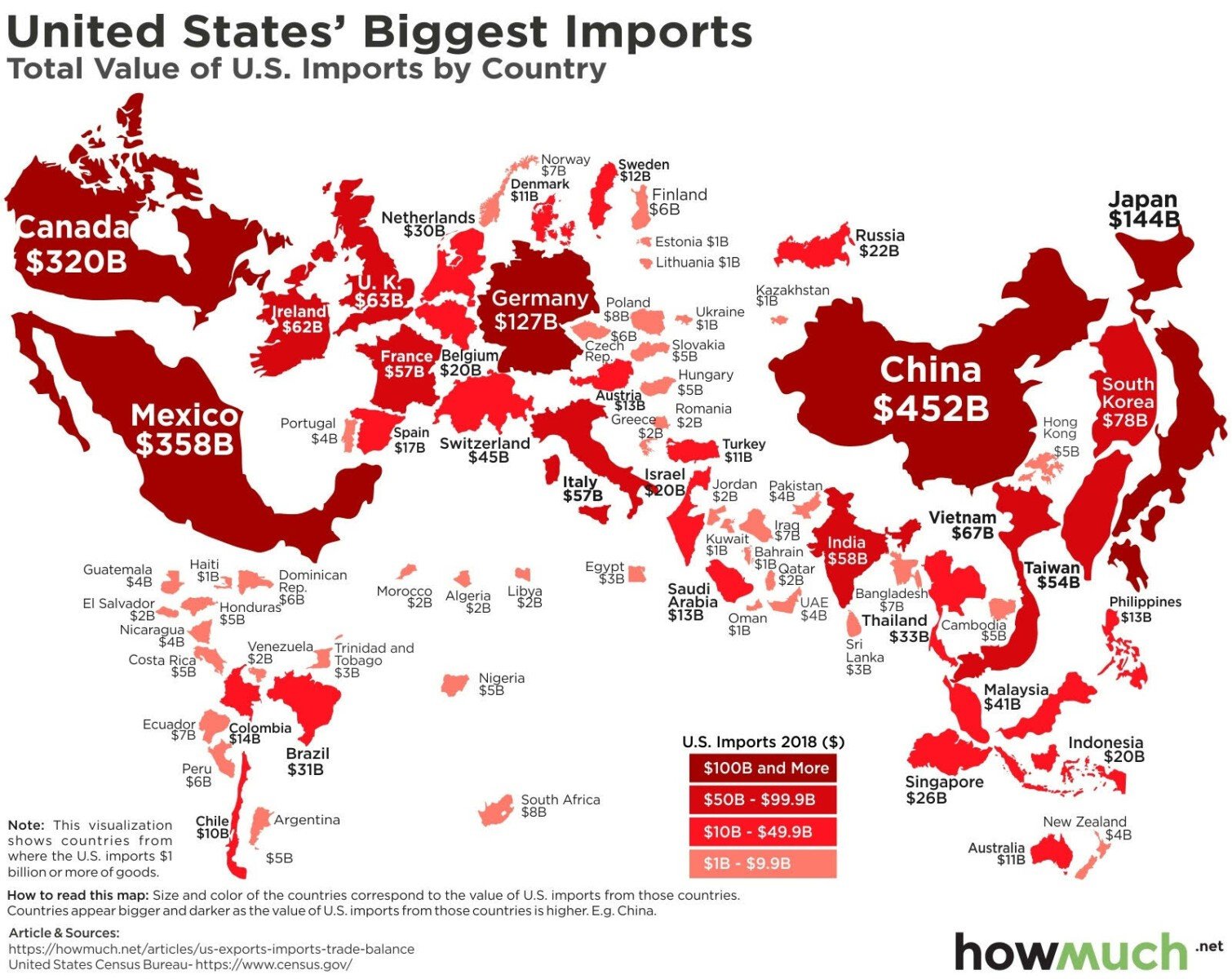

Today’s Chart of the Day is a chart from howmuch.net shared by ritholz.com showing the biggest imports into the US per country.

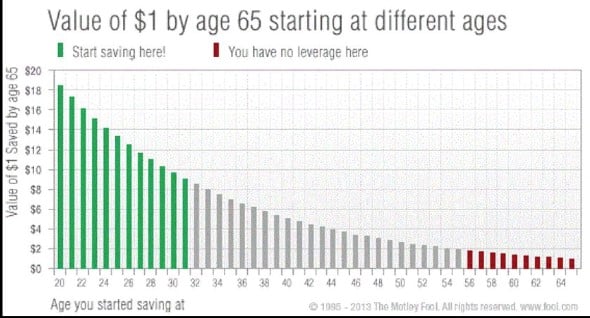

There are three big factors that influence investments one has by retirement: how much, what investments, and how long. Today’s Chart of the Day from..

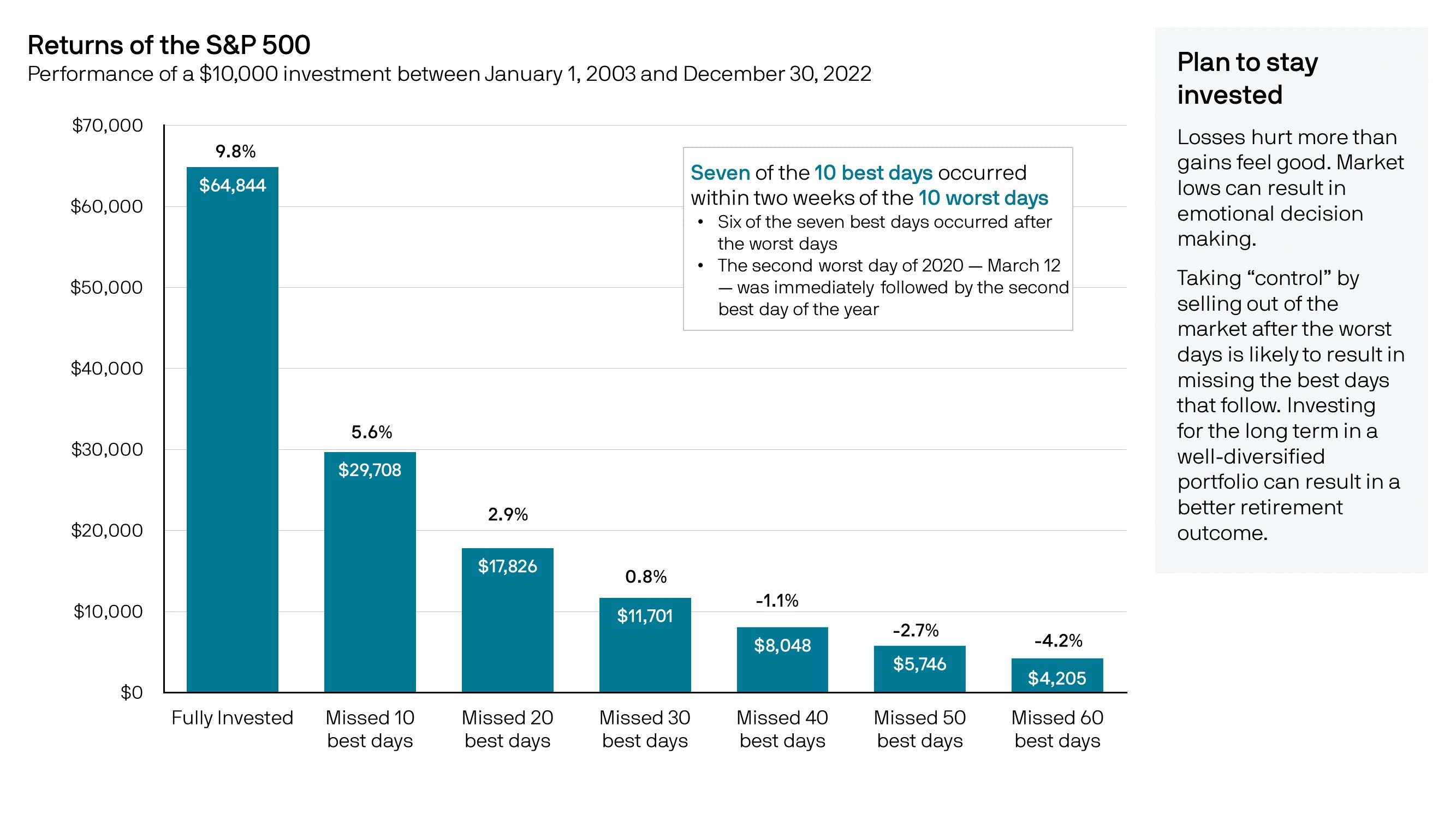

Today’s Chart of the Day from JP Morgan shows the returns of the stock market if you missed a certain amount of “best days” dating back 20 years.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.

Today’s Chart of the Day from Vanguard shows that the average lifespan once someone reaches the age of 65 is 86 for men and 89 for women.

Happy New Year! With 2024 being a presidential election year, today’s Chart of the Day is from Capital Group and shows the hypothetical growth of $1,000 invested in March 1933, when Franklin D. Roosevelt was first inaugurated.

Today’s Chart of the Day comes from S&P Dow Jones, which just celebrated 20 years of tracking market metrics, and shows only 18% of stocks outperformed the average during that time.

Today’s Chart of the Day from Apollo shows migration during the pandemic. Florida and Texas gained 800,000 people, including 750,000 who moved from Illinois, New York, and California.

Today’s Chart of the Day from a Gallup Survey shows that the retirement age of 61 has not materially changed over the last 20 years.

Today’s Chart of the Day comes from Bank of America research provided by Ibbotson, which is an investment research company. It is a nice follow up chart to the View from the Top of the Hill presentation we recently provided.

Today’s Chart of the Day comes from Vanguard, and though it is not true in all cases, it is true in most, that since 1980 the best time to buy is right after a sharp decline in prices.

Today’s Chart of the Day from Bank of America Equity & Quant Strategy shows the price you pay for future earnings explains 80% of the returns for the next 10 years.

While receiving packages this holiday season, remember today’s Chart of the Day from an article in the Wall Street Journal titled, “The Biggest Delivery Business in the U.S. Is No Longer UPS or FedEx.”

Today’s Chart of the Day comes from AlphaWise in a Bloomberg article about the rise of “Hot Desking.” This is when work areas, such as desks, are not assigned to specific employees.

Today’s Chart of the Day is a chart from howmuch.net shared by ritholz.com showing the biggest imports into the US per country.

There are three big factors that influence investments one has by retirement: how much, what investments, and how long. Today’s Chart of the Day from the Motley Fool shows the importance of the third one, how long.

Today’s Chart of the Day from JP Morgan shows the returns of the stock market if you missed a certain amount of “best days” dating back 20 years.

current_page_num+2: 16 -