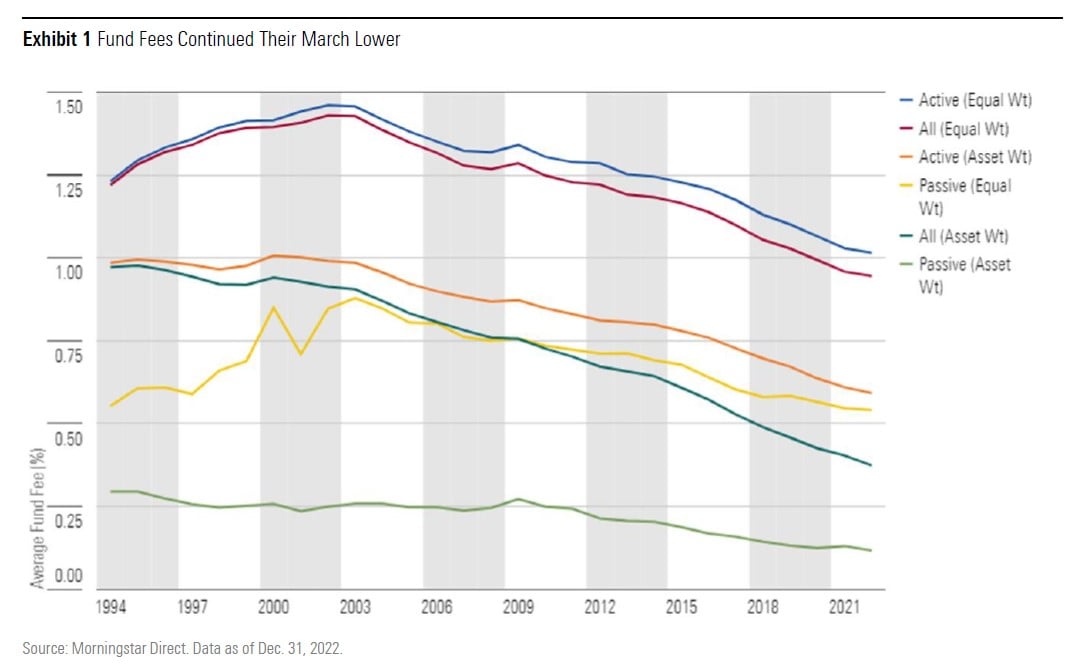

Chart of the Day: Fund Fees Are Declining

Today’s Chart of the Day comes from the annual 2022 US Fund Fee Study, which was released last month. Conducted by Morningstar, this study goes back to 1994 and shows that since 2002 investment fund fees have steadily declined from a peak of 1.40% to now just under 1.00%.