Car Prices Are Falling

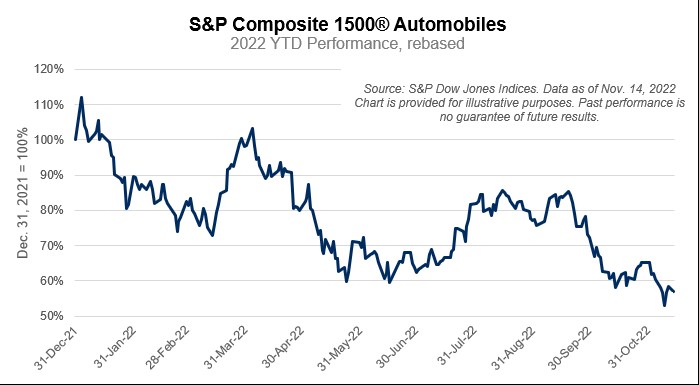

Today’s Chart of the Day is from S&P Dow Jones Indices.

Year-to-date, the S&P Composite 1500® Automobiles is down 43%, and is the

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Today’s Chart of the Day is from S&P Dow Jones Indices. Year-to-date, the S&P Composite 1500® Automobiles is down 43%, and is the

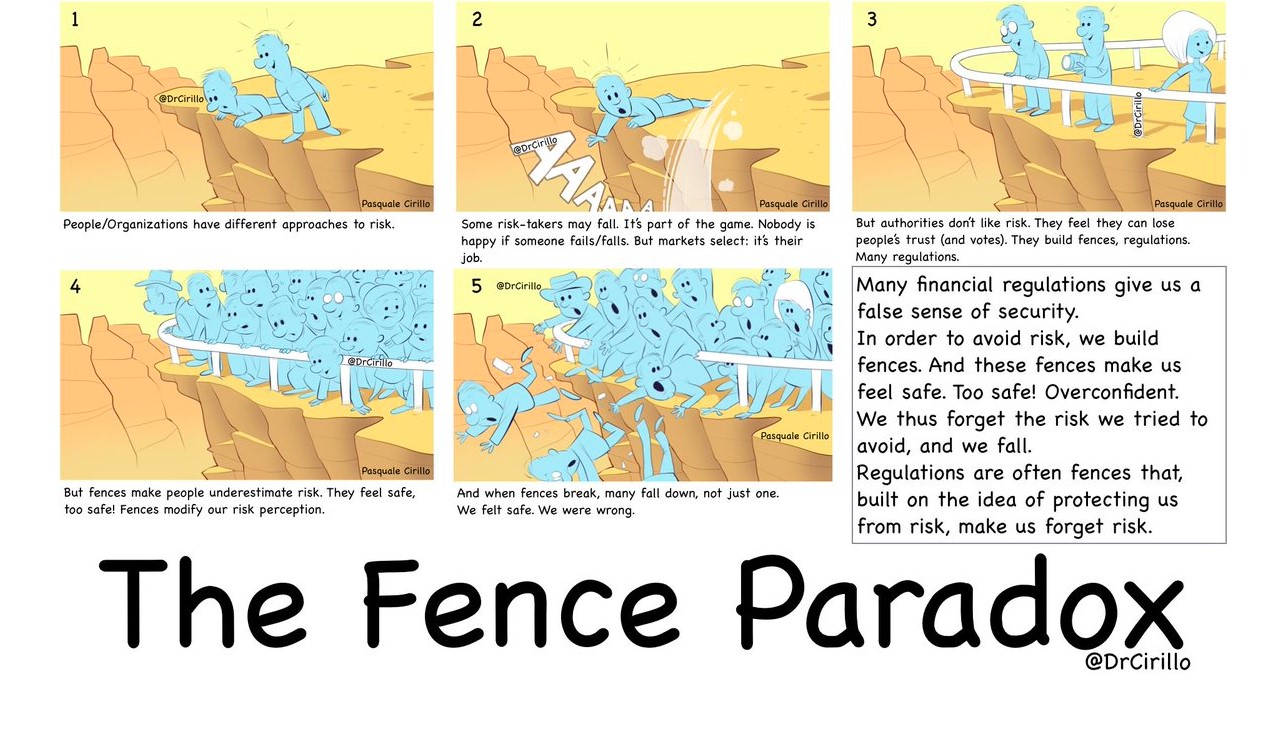

Today’s Chart of the Day is an infographic from Pasquale Cirillo, @DrCirillo on Twitter. We see this often when investors say, “They wouldn’t be..

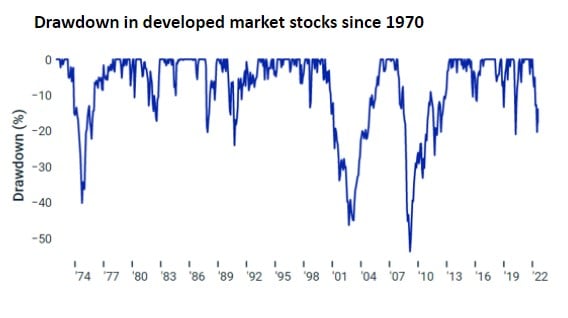

Today’s chart comes from Wealthmanagement.com. It shows the drawdowns, which is the percent the market is down from the previous record high, going..

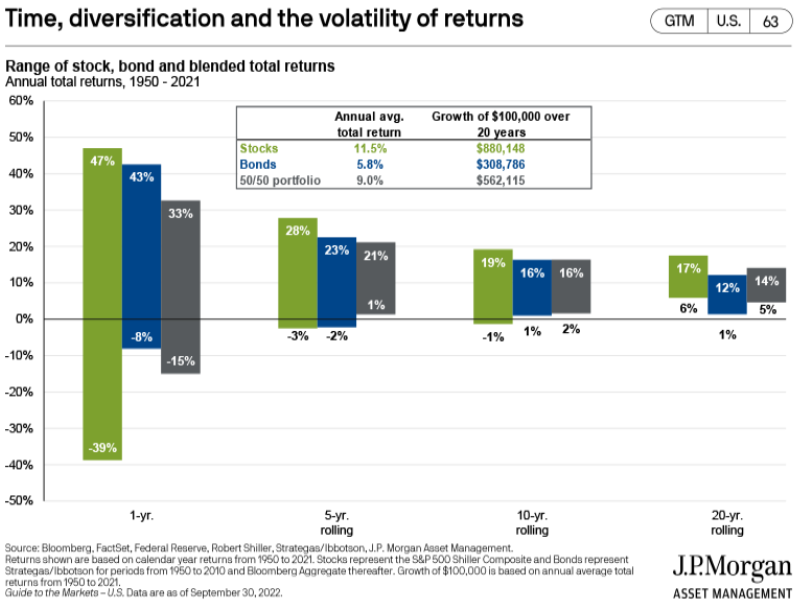

Today’s chart from JP Morgan Asset Management’s Guide to the Markets quarterly presentation shows the cumulative returns based on 1, 5, 10, and 20..

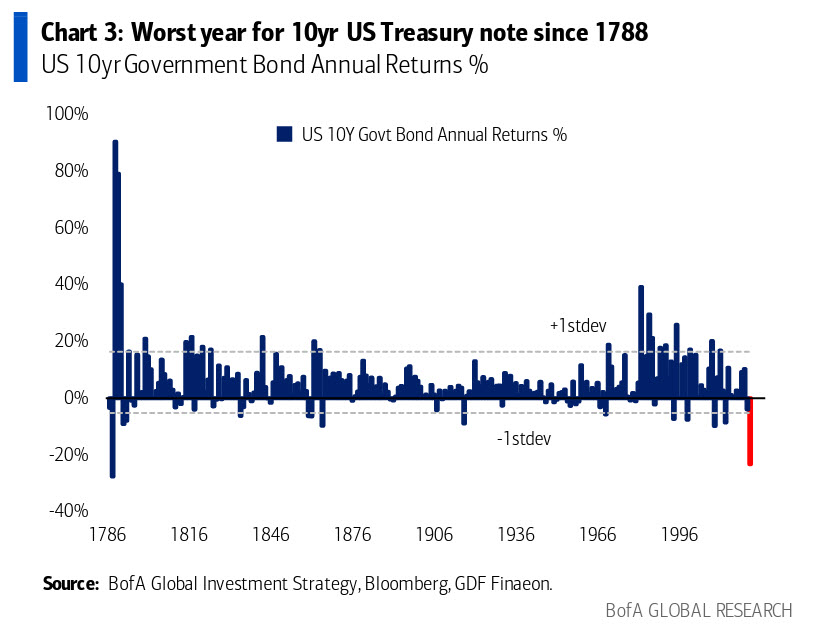

Today's chart comes from Bank of America’s Global Investment Strategy team. We have all heard that this was a bad year for longer term bonds, but how..

Today's chart from Refinitive shows that over the last 30 years, China has delivered a cumulative return of zero dollars, meaning $100 invested 30..

Today we’re taking a quick side note away from the Chart of the Day to make a couple of comments on cryptocurrencies and FTX’s bankruptcy. FTX is a..

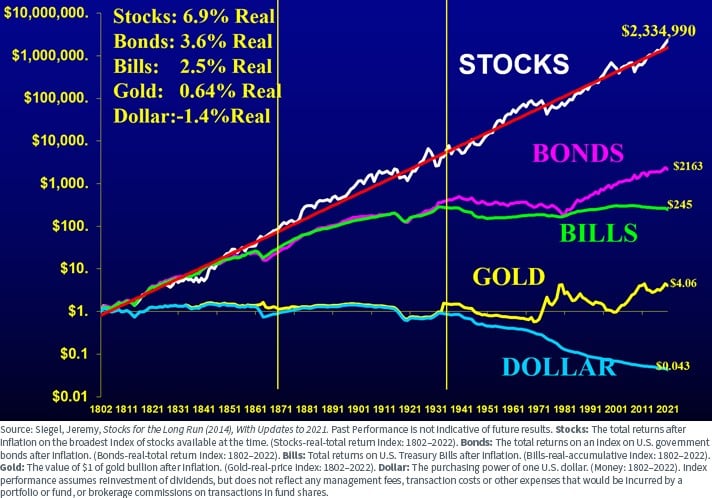

This chart shows the value of $1 going all the way back to 1802 and was previously shared as a Chart of the Day. However, I'd like to share it once..

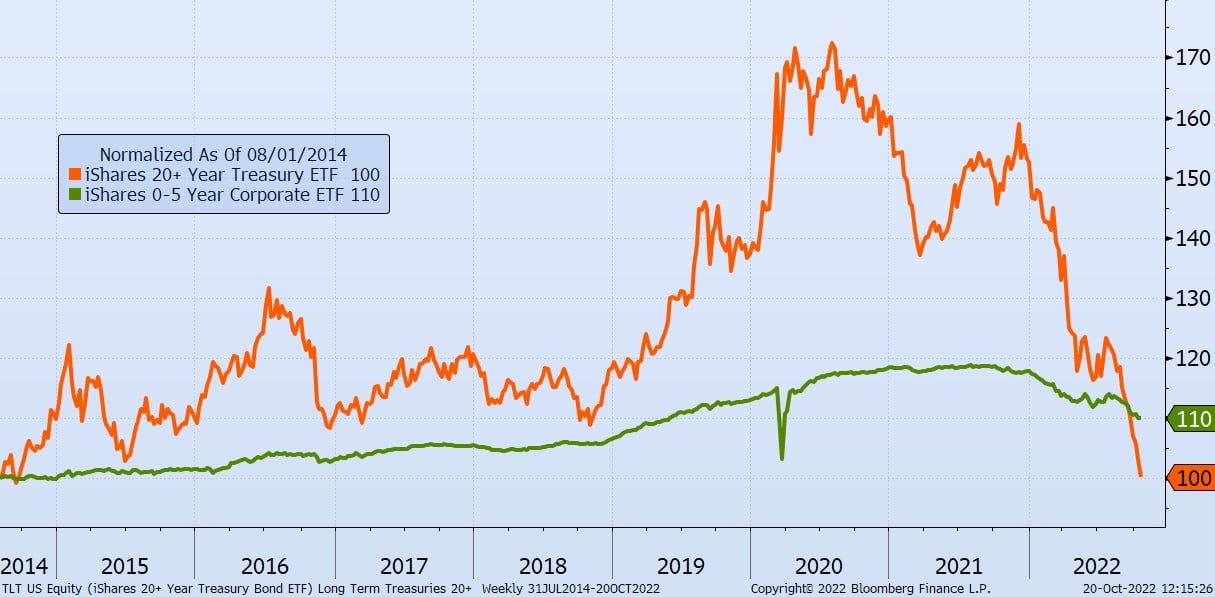

It’s been a challenging few years for Long-Term Treasury Bonds, which are defined as bonds that have maturities of 20+ years and are noted in orange..

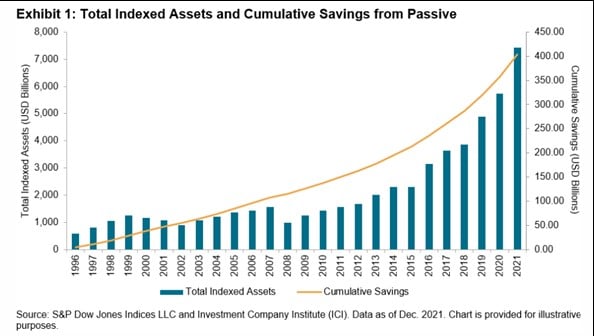

Today’s Chart of the Day comes from S&P Dow Jones Indices and shows the cumulative savings from using index funds vs. actively managed funds, as well..

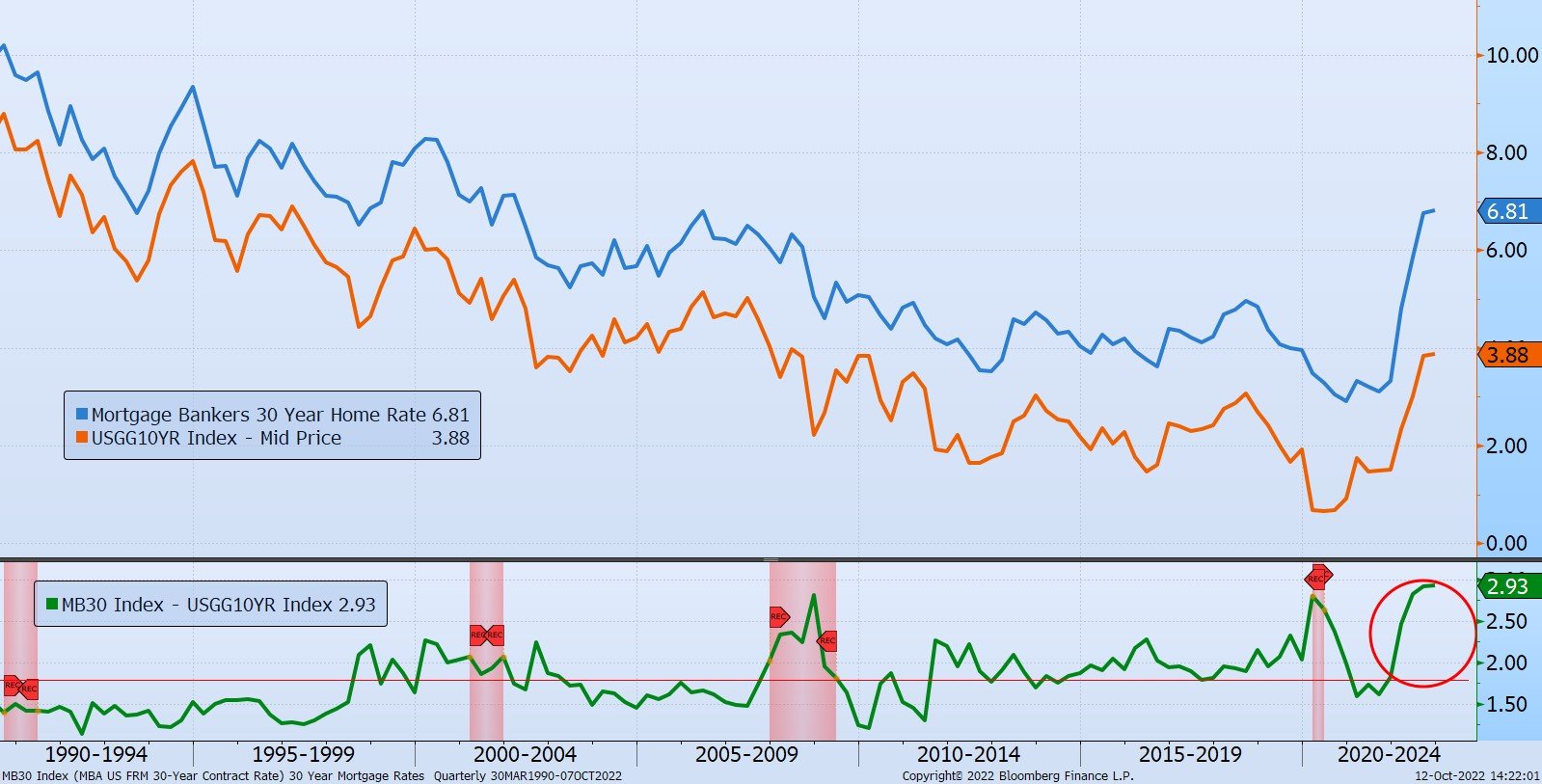

The history of the Mortgage Banker’s 30-Year Home Rate, in blue, going all the way back to when they started the index in 1990 is displayed in..

The Chart of the Day is from S&P Global. As eternal optimists, which has worked for our clients over the last 20+ years, we like to say, “It could..

The following Chart of the Day from State Street Global Advisors shows the flow of funds in investments going all the way back to 2001.

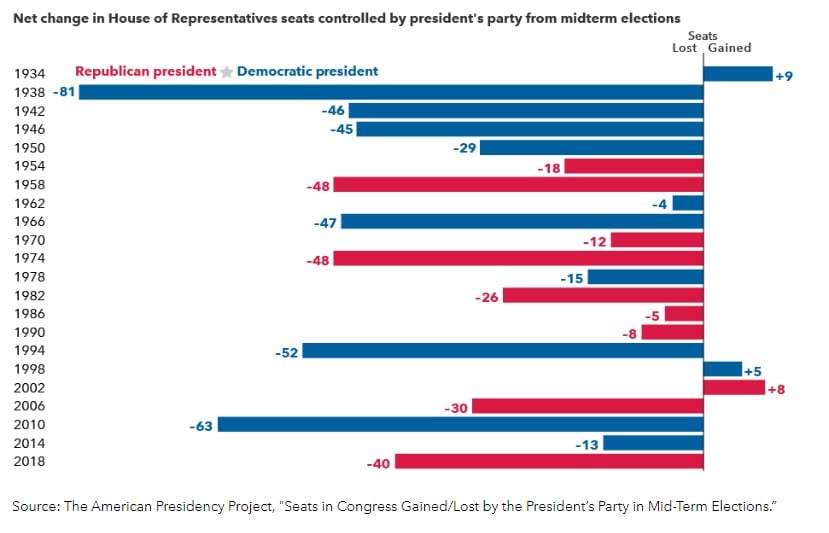

Today's Chart of the Day is a second chart from the Capital Group article called “Can midterm elections move markets?”

Today’s Chart of the Day comes from a Capital Group article called “Can midterm elections move markets?”

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.

Today’s Chart of the Day is from S&P Dow Jones Indices.

Year-to-date, the S&P Composite 1500® Automobiles is down 43%, and is the

Today’s Chart of the Day is an infographic from Pasquale Cirillo, @DrCirillo on Twitter. We see this often when investors say, “They wouldn’t be allowed to sell this, if it wasn’t safe.” Yes, there needs to be fences, but don’t let their security lull you into forgetting the risks on the other side.

Today’s chart comes from Wealthmanagement.com. It shows the drawdowns, which is the percent the market is down from the previous record high, going back to 1970. As you would expect, the chart shows most the time the market is “down” and investors spend a lot of time having “lost” money.

Today’s chart from JP Morgan Asset Management’s Guide to the Markets quarterly presentation shows the cumulative returns based on 1, 5, 10, and 20 years for all stocks (in green), all bonds (in blue), and a 50/50 mix (in grey) since 1950.

Essentially, the longer you hold your investments, the higher probability you have of positive returns. In fact, there was never a period over 20 years that any of the options lost money.

The chart also shows the average annual total return for stocks was an impressive 11.5% during last 20 years. It will be interesting to see how the next 20 years look.

Today's chart comes from Bank of America’s Global Investment Strategy team. We have all heard that this was a bad year for longer term bonds, but how bad? Well, for the 10-year treasury this is the worst year since 1788, so basically the worst year ever.

The reason is, since the beginning of this year, the yield went from 1.50% to the current 4.00%, which equates to a 166% increase, causing the price to fall an incredible 20%.

Today's chart from Refinitive shows that over the last 30 years, China has delivered a cumulative return of zero dollars, meaning $100 invested 30 years ago is still worth only $100 today.

Today we’re taking a quick side note away from the Chart of the Day to make a couple of comments on cryptocurrencies and FTX’s bankruptcy. FTX is a popular online cryptocurrency exchange, and its bankruptcy may turn out to be the biggest in history.

This chart shows the value of $1 going all the way back to 1802 and was previously shared as a Chart of the Day. However, I'd like to share it once again as the figures were updated to include data from 2021. The chart was created by Jeremy Seigel in his book called “Stocks for the Long Run” published in 2014.

It’s been a challenging few years for Long-Term Treasury Bonds, which are defined as bonds that have maturities of 20+ years and are noted in orange on today's Chart of the Day. Since 2020, they have lost 42% of their value, erasing all the accumulated value for the last six years.

Today’s Chart of the Day comes from S&P Dow Jones Indices and shows the cumulative savings from using index funds vs. actively managed funds, as well as the growth of indexed funds since 1996.

Index funds have reached a staggering $7 trillion in total assets. Since active funds costs more vs. indexed funds, investors have saved an equally impressive $400 billon in fees, which is more than the entire market value of Wal-Mart.

The reason for growth in index funds? Since S&P started keeping score 20 years ago, only a paltry 6% of active funds have outperformed them.

As you can see in the chart, more and more are starting to say, “Why pay more and earn less?” and moving their investments accordingly.

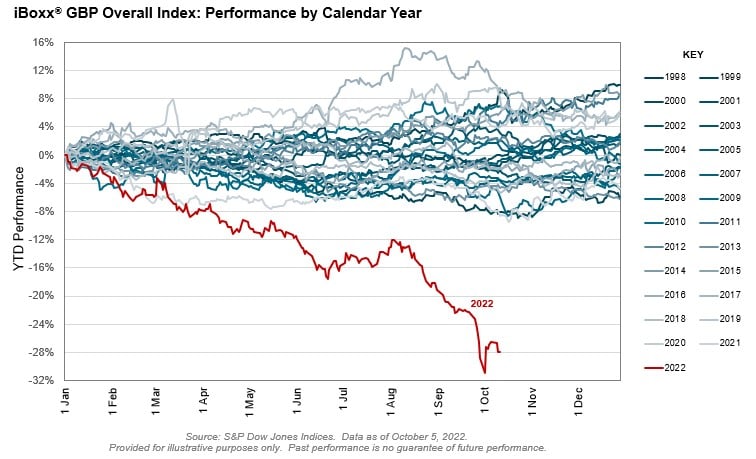

The Chart of the Day is from S&P Global. As eternal optimists, which has worked for our clients over the last 20+ years, we like to say, “It could always be worse.” Though the United States equivalent investment grade bond index in the US is down 20%, the iBoxx GPB (which stands for the Great Britain Pound) bond index is down 28%, which is the worst in 25 years.

They are calling it “the Bondmaggeddon.”

Though we may have some of these US equivalent bond ETFs in the portfolio we manage, they are more than offset by many shorter-term bonds, which in most cases have resulted in a total loss of only 6%. Still not great, but it could have been worse.

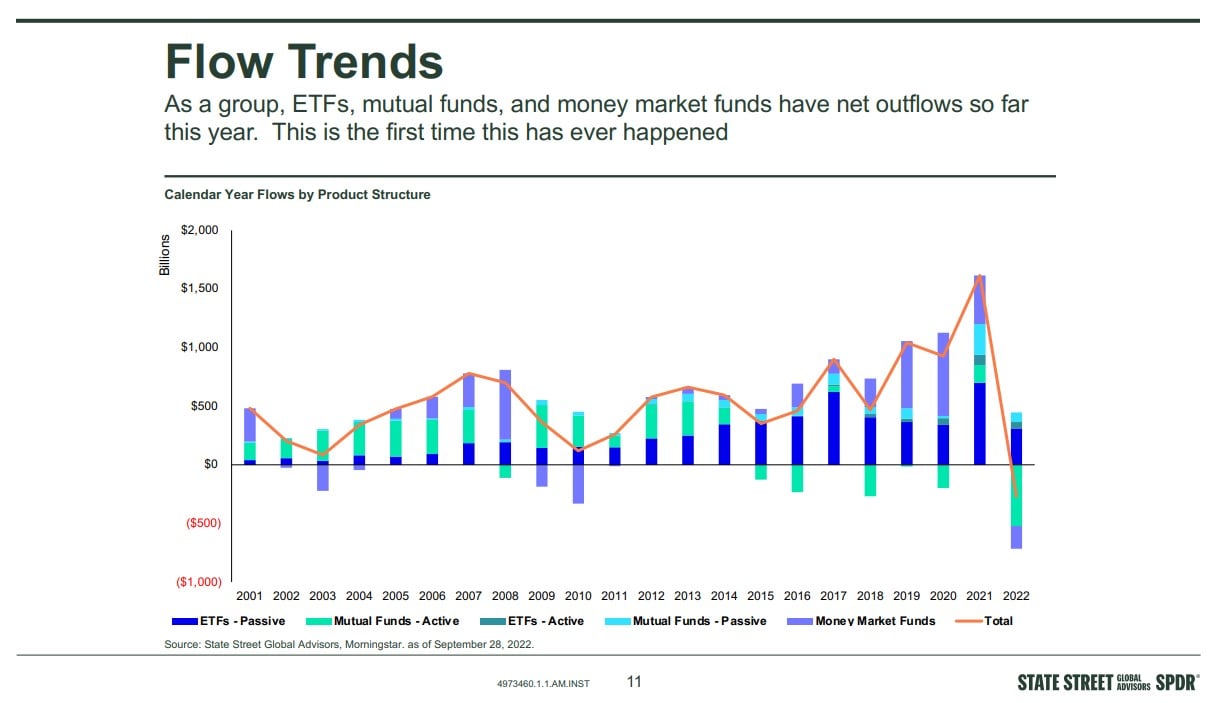

The following Chart of the Day from State Street Global Advisors shows the flow of funds in investments going all the way back to 2001.

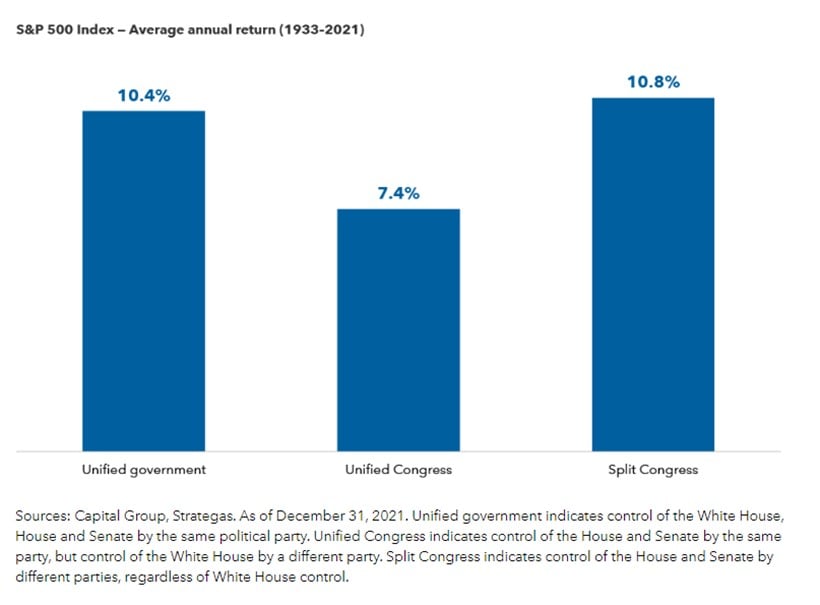

Today's Chart of the Day is a second chart from the Capital Group article called “Can midterm elections move markets?”

Today’s Chart of the Day comes from a Capital Group article called “Can midterm elections move markets?”

current_page_num+2: 22 -