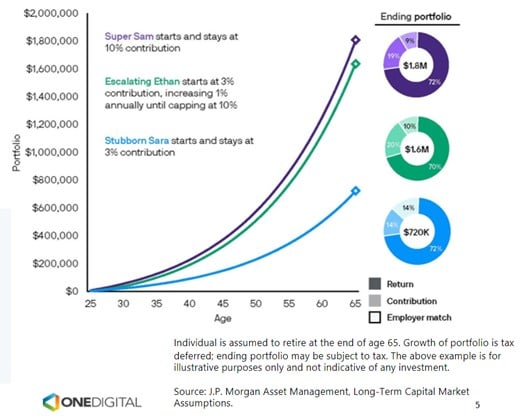

Chart of the Day: 1% Increase Annually to 10%

Today’s Chart supports the idea of, “Save early; save often.”

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar

Today’s Chart supports the idea of, “Save early; save often.”

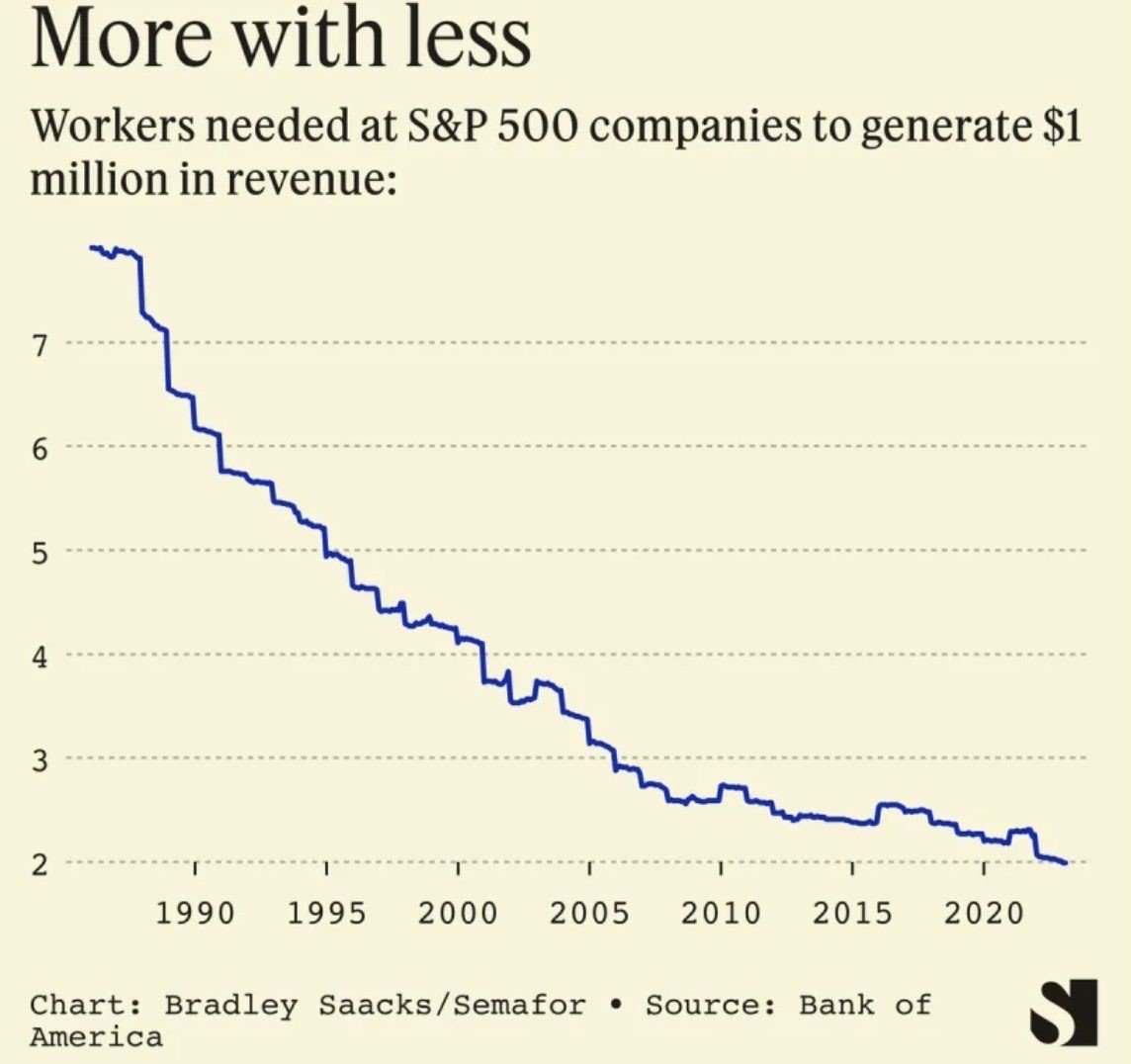

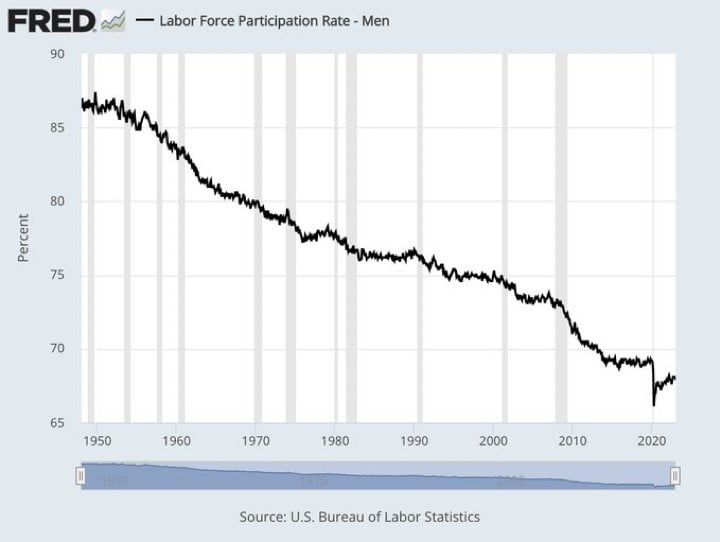

I often joke that when I started banking in 1996 there were three of me that do the level of work I do now. This chart supports it.

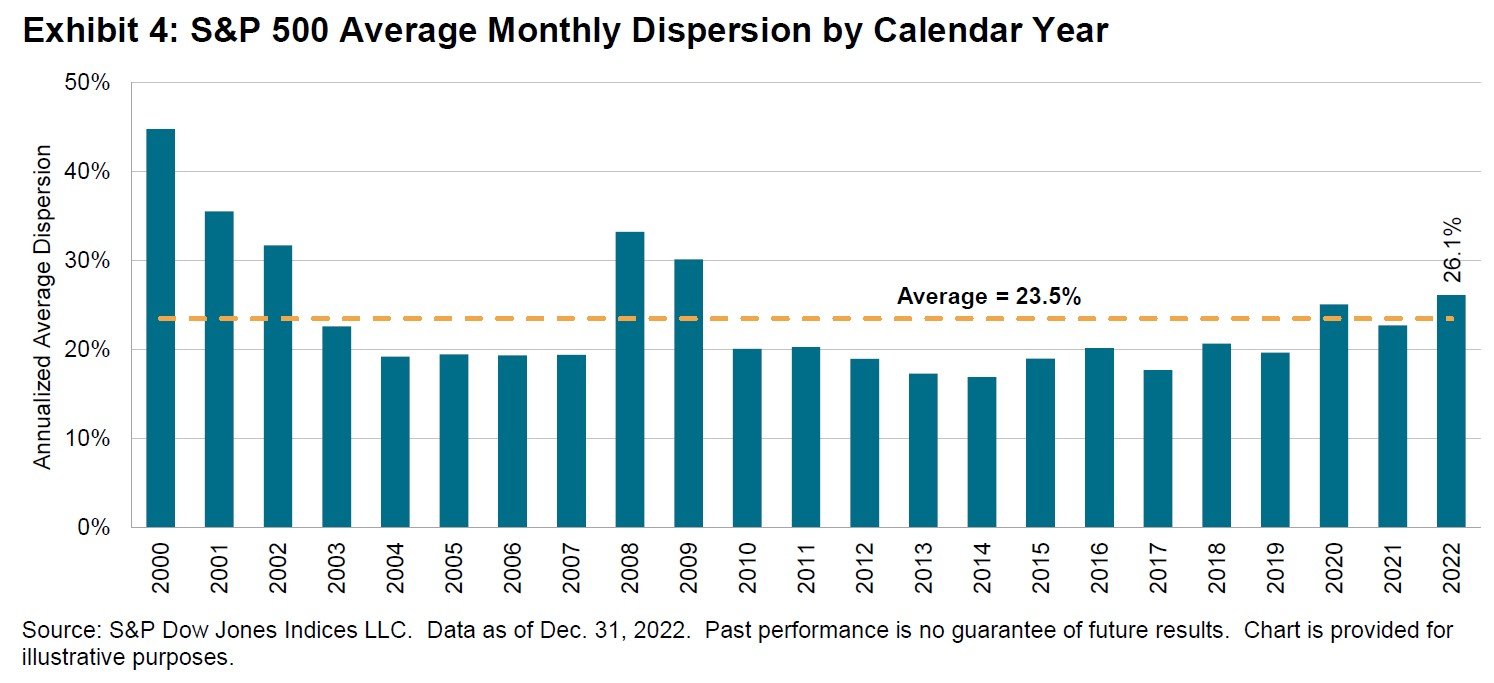

The semi-annual SPIVA (S&P Index Vs. Active) report was recently released.

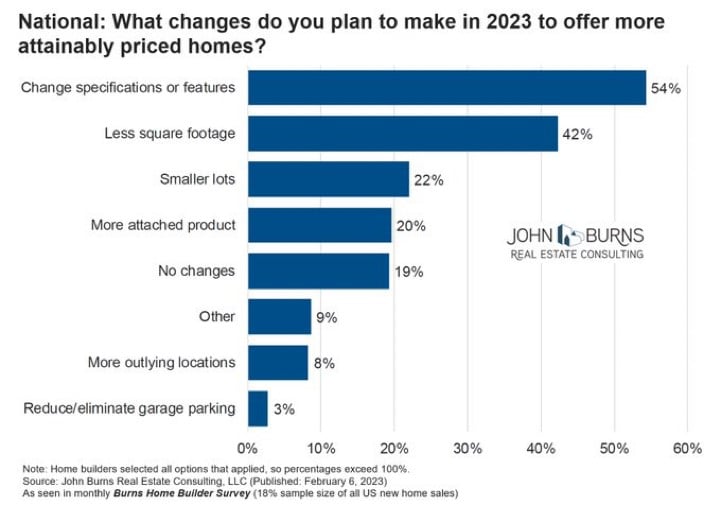

Today’s Chart of the Day is a survey of builders with data provided by John Burns Real Estate Consulting.

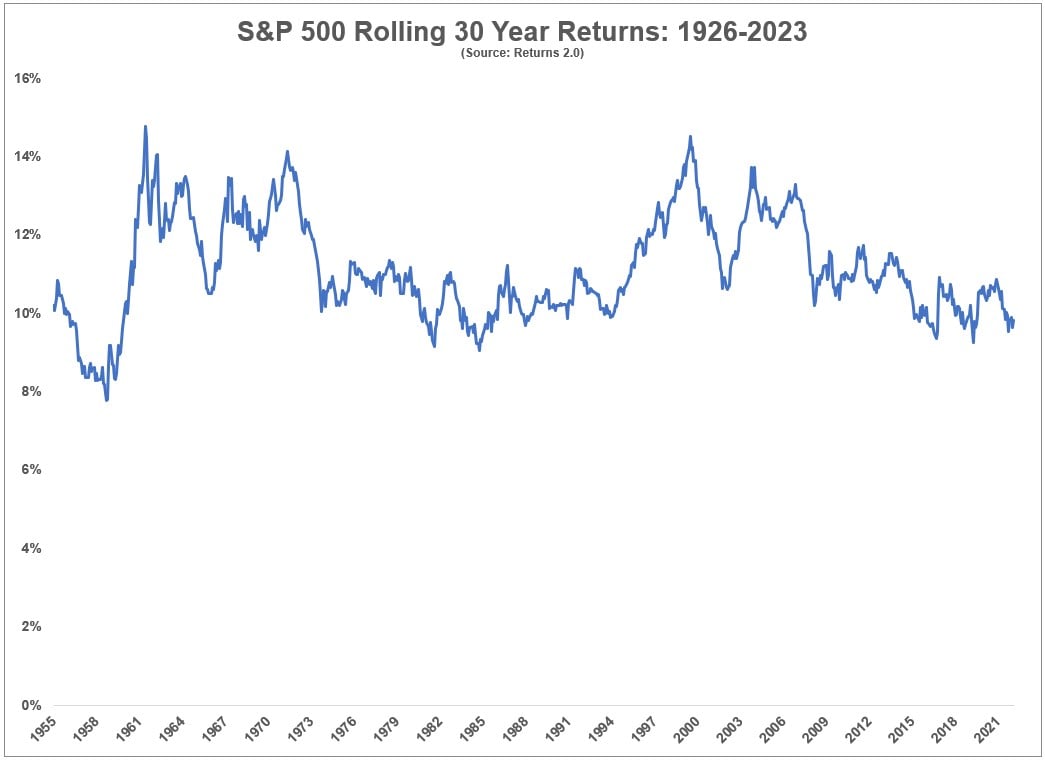

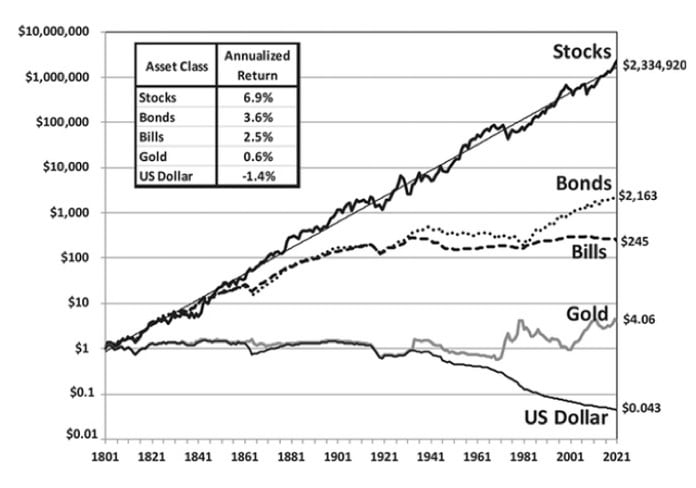

Today’s Chart of the Day comes from an article written by Ben Carlson on A Wealth of Common Sense. The chart shows rolling 30-year returns of the..

Today’s Chart of the Day comes from FRED (Federal Reserve Economic Data), a fascinating website for charts of economic data.

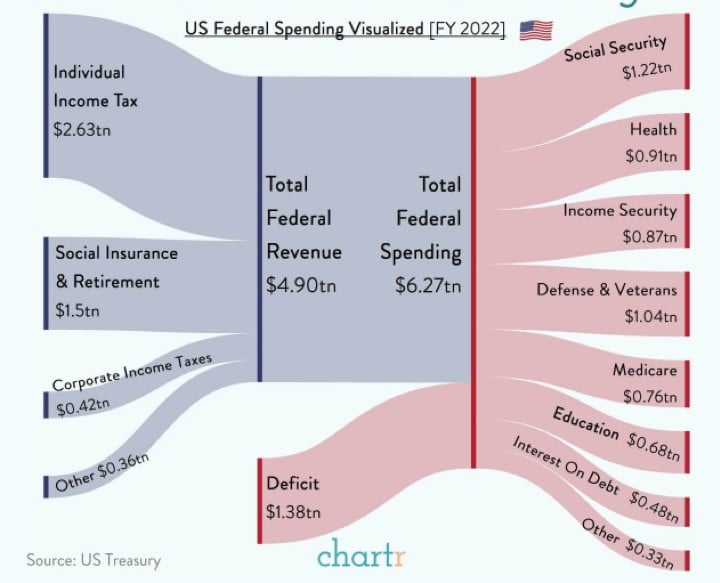

Today’s Chart of the Day comes from chartr with figures provided by the US Treasury to help us understand where our Federal Government taxes and..

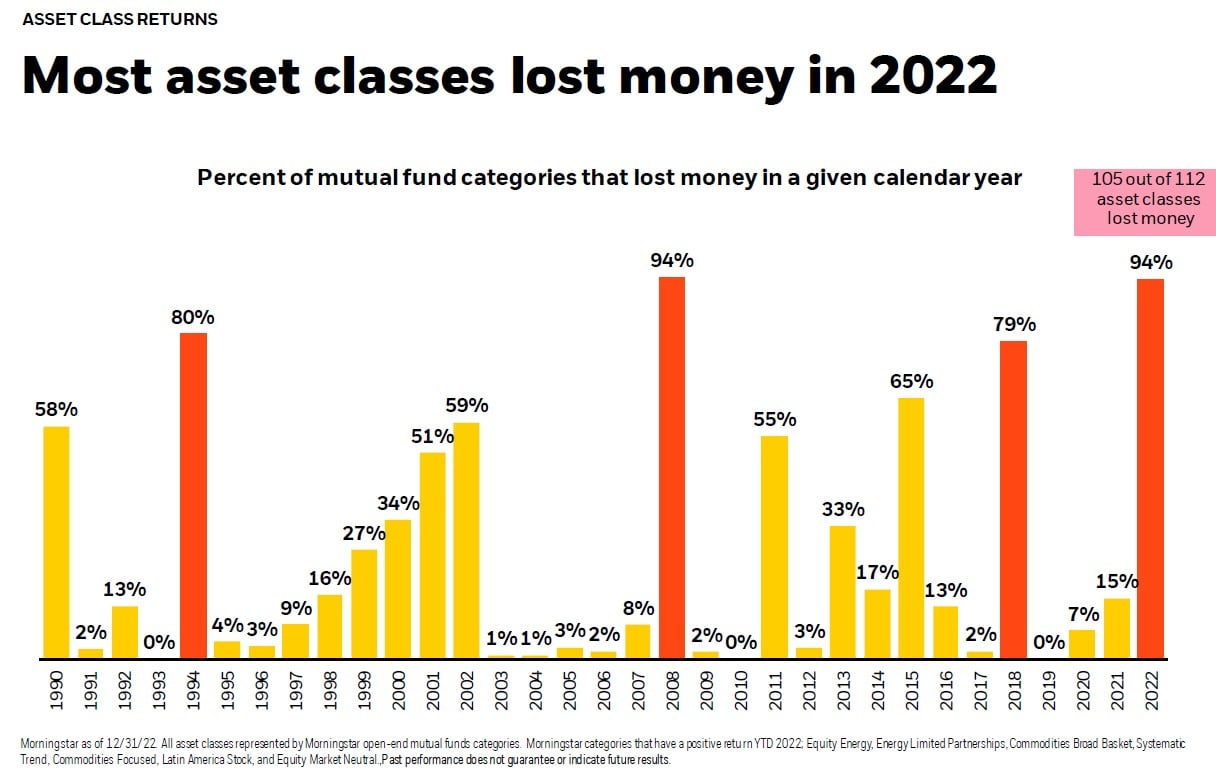

Today’s Chart of the Day comes from BlackRock and shows that 105 of 112 asset classes lost money in 2022.

As our communities continue to recover from recent hurricanes, and with everyone knee deep in tax season, we are updating a blog from December with..

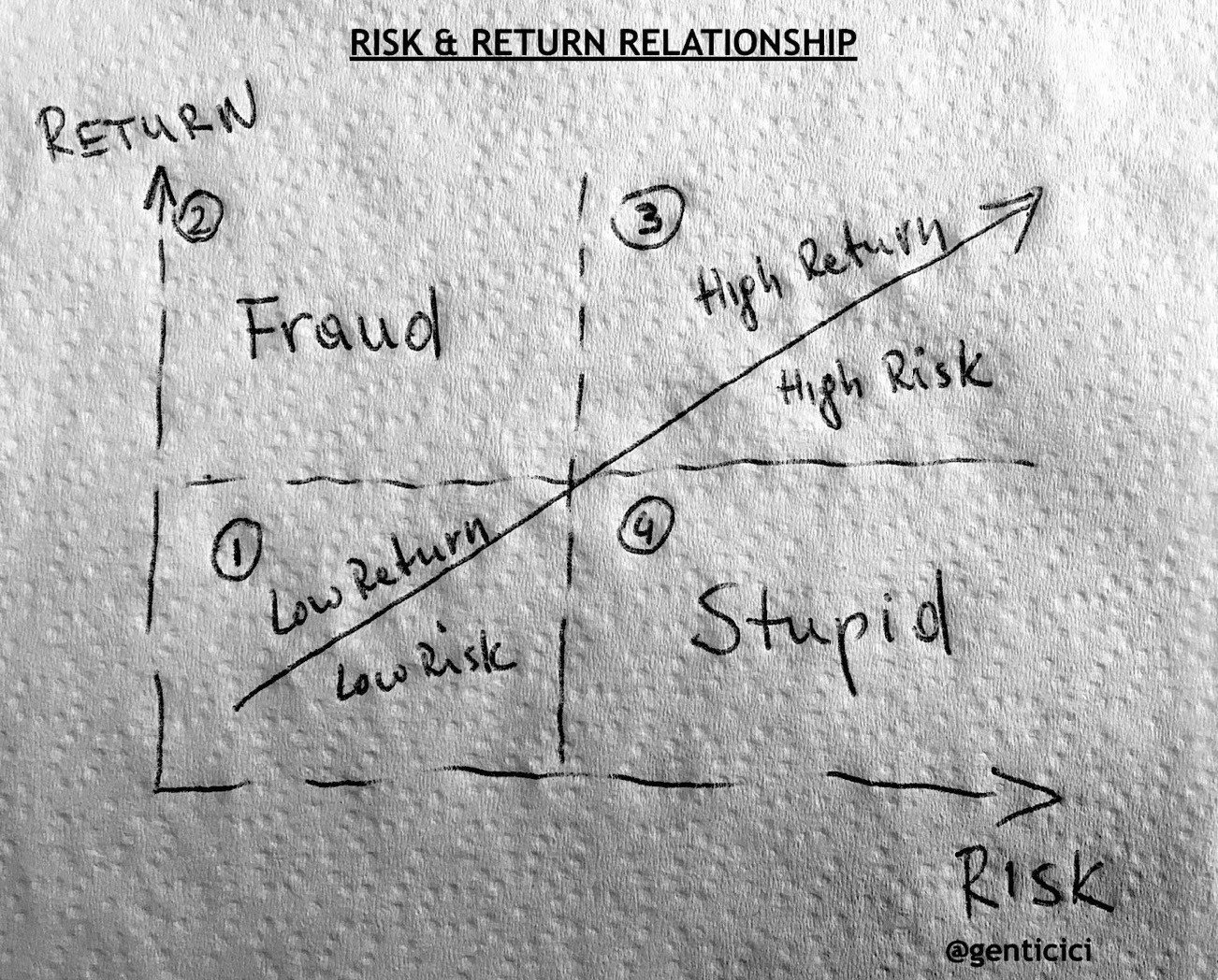

Today’s Chart of the Day comes from @genticici on Twitter. I was impressed by the simplicity of the concept, and it's very apropos to be on the back..

Today’s Chart of the Day is a reoccurring one we like to keep updated with current data.

Today's Chart of the Day, compiled from information from the Mortgage Bankers Association, shows the 30-year residential rates dating back to 1993.

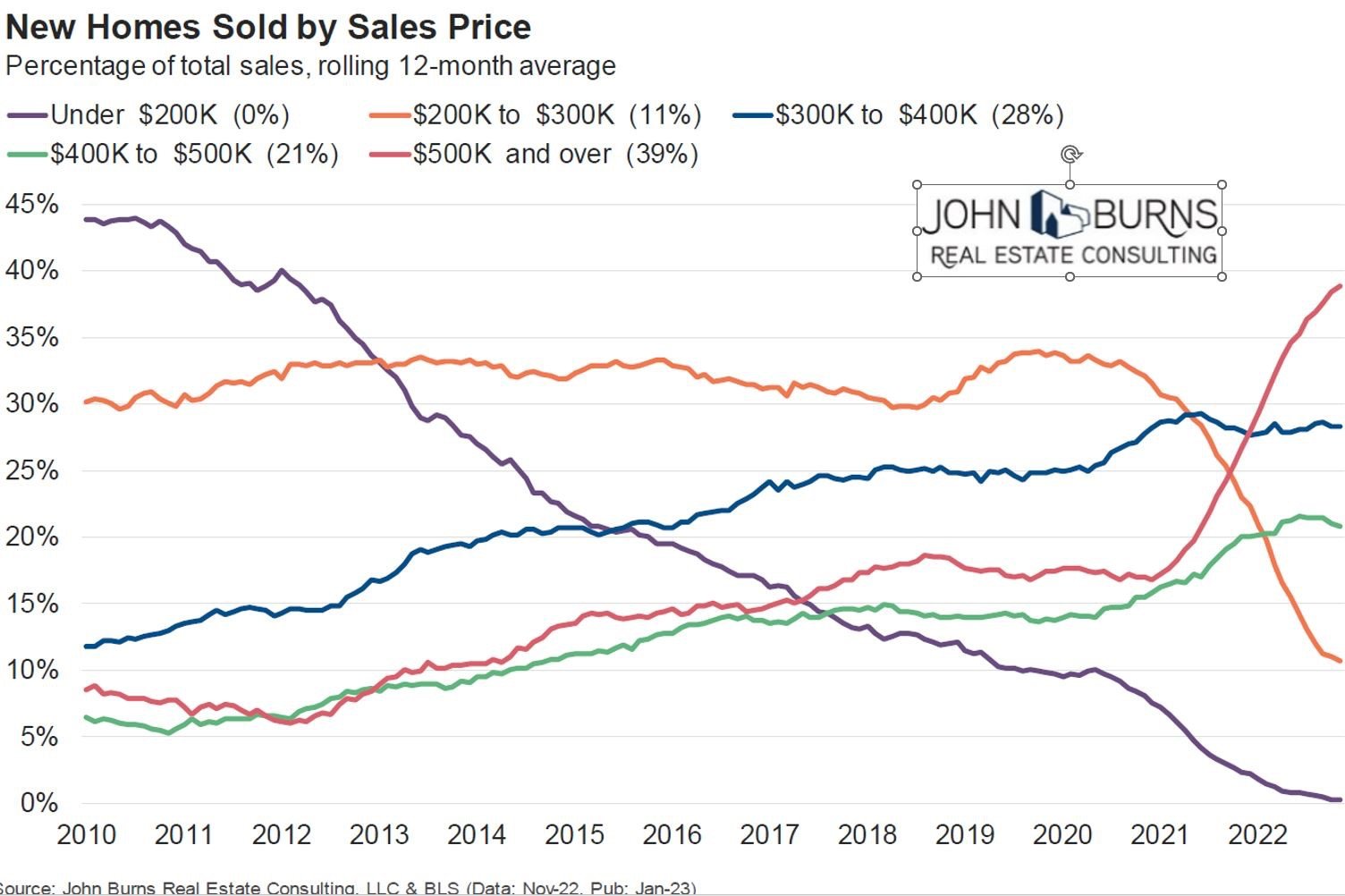

Today’s Chart of the Day comes from John Burns and shows the historical percentages of homes sold by sales price going back to 2010.

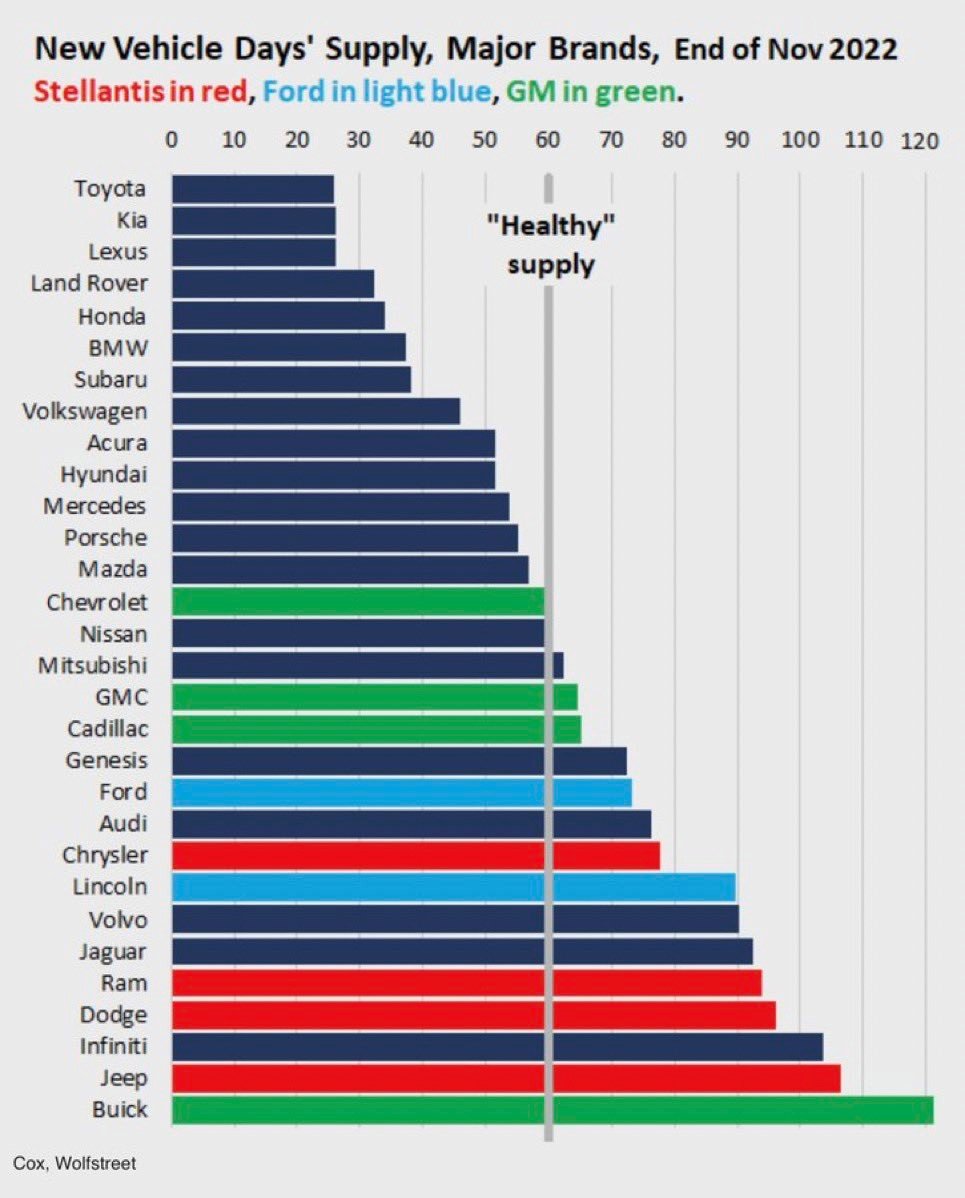

Today’s Chart of the Day comes from Wolfstreet and shows the supply of new vehicles in number of days.

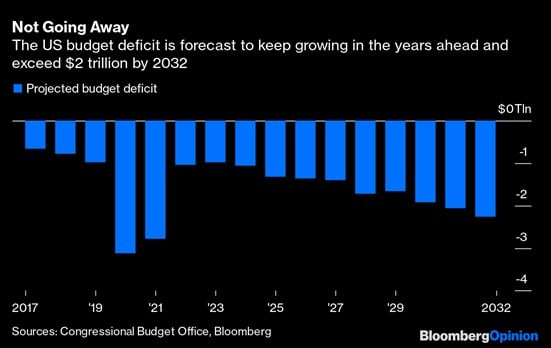

Today’s Chart of the Day is the projected budget deficits for the next 10 years provided by the Congressional Budget Office. It is not a rosy picture.

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.

Today’s Chart supports the idea of, “Save early; save often.”

I often joke that when I started banking in 1996 there were three of me that do the level of work I do now. This chart supports it.

The semi-annual SPIVA (S&P Index Vs. Active) report was recently released.

Today’s Chart of the Day is a survey of builders with data provided by John Burns Real Estate Consulting.

Today’s Chart of the Day comes from an article written by Ben Carlson on A Wealth of Common Sense. The chart shows rolling 30-year returns of the stock market dating back to 1926.

Today’s Chart of the Day comes from FRED (Federal Reserve Economic Data), a fascinating website for charts of economic data.

Today’s Chart of the Day comes from chartr with figures provided by the US Treasury to help us understand where our Federal Government taxes and spends.

Today’s Chart of the Day comes from BlackRock and shows that 105 of 112 asset classes lost money in 2022.

As our communities continue to recover from recent hurricanes, and with everyone knee deep in tax season, we are updating a blog from December with information from local tax professionals that might help those who have losses or damage.

Today’s Chart of the Day comes from @genticici on Twitter. I was impressed by the simplicity of the concept, and it's very apropos to be on the back of a napkin.

Today’s Chart of the Day is a reoccurring one we like to keep updated with current data.

Today's Chart of the Day, compiled from information from the Mortgage Bankers Association, shows the 30-year residential rates dating back to 1993.

Today’s Chart of the Day comes from John Burns and shows the historical percentages of homes sold by sales price going back to 2010.

Today’s Chart of the Day comes from Wolfstreet and shows the supply of new vehicles in number of days.

Today’s Chart of the Day is the projected budget deficits for the next 10 years provided by the Congressional Budget Office. It is not a rosy picture.

current_page_num+2: 23 -