Bond Length Matters

Duration describes the time it takes for a bond holder to get all their money back and/or the change in price for each 1% change in the interest rate.

Learn about our Refer-a-Friend Program. Terms and conditions apply.

Duration describes the time it takes for a bond holder to get all their money back and/or the change in price for each 1% change in the interest rate.

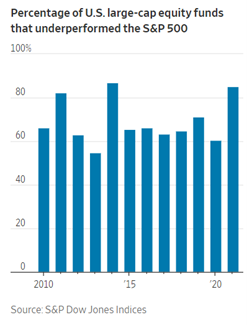

This chart from an article in today’s Wall Street Journal shows the percentage of funds that underperformed the S&P 500 in the last 12 years. Again,..

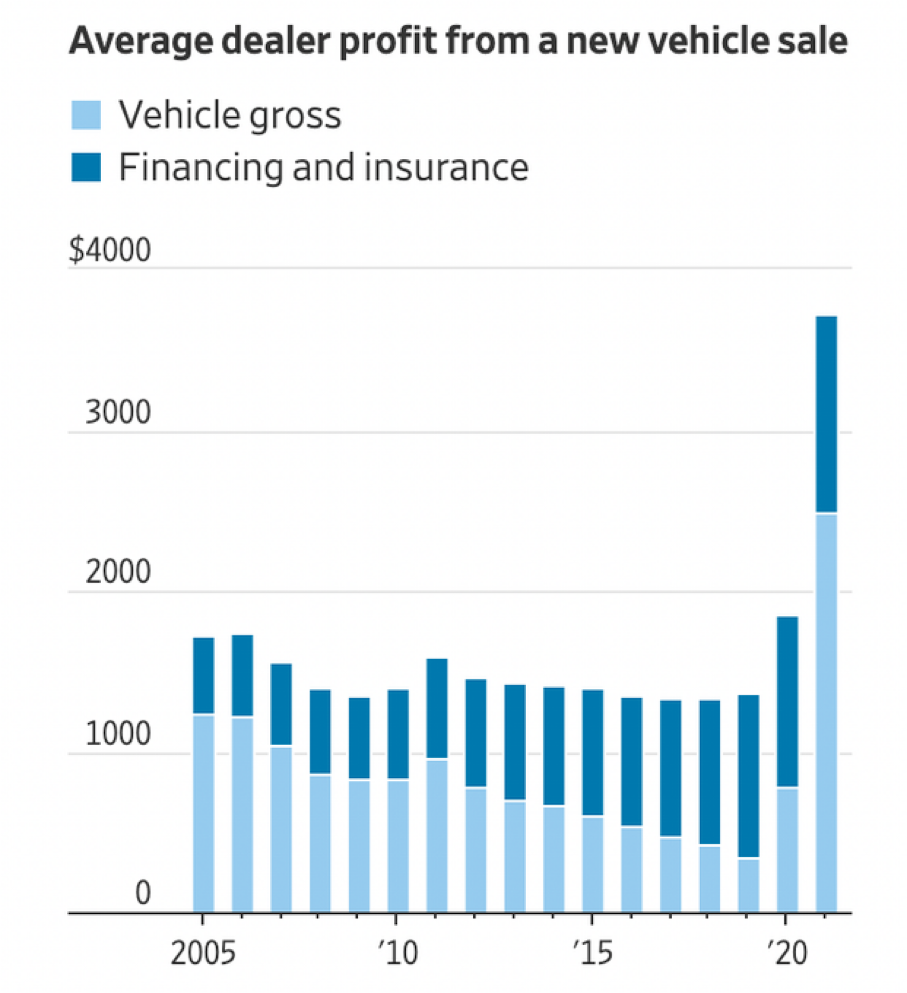

I am reminded of this chart every time I drive by a car lot. Before the pandemic, financing and insurance profits made up 70% of the dealer’s..

Below is a great chart from Putnam, which shows that over the last 15 years, if you missed the top 10 best days of market gains, your return would..

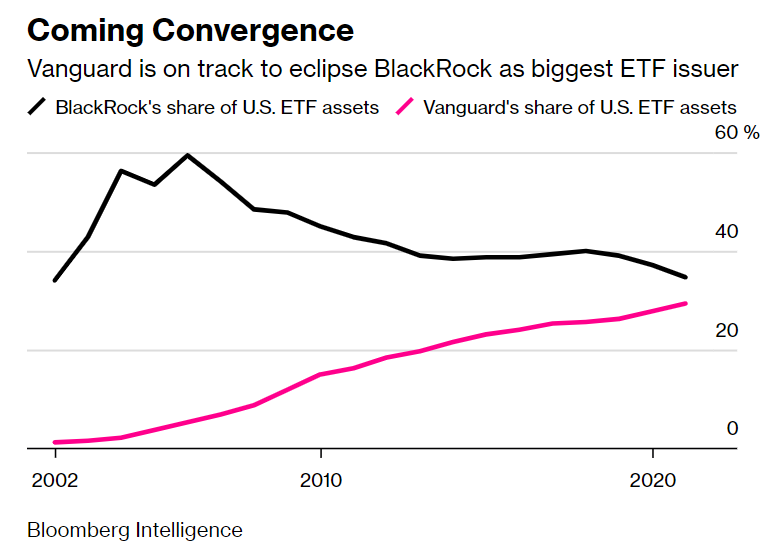

Since we use both Vanguard and iShares by BlackRock Exchange Traded Funds (ETFs) extensively, one of my pleasures over the last few years has been..

It’s hard to do commentary when in the morning, the markets are down, and by lunch they are level, and by the close they might be up, and vice versa.

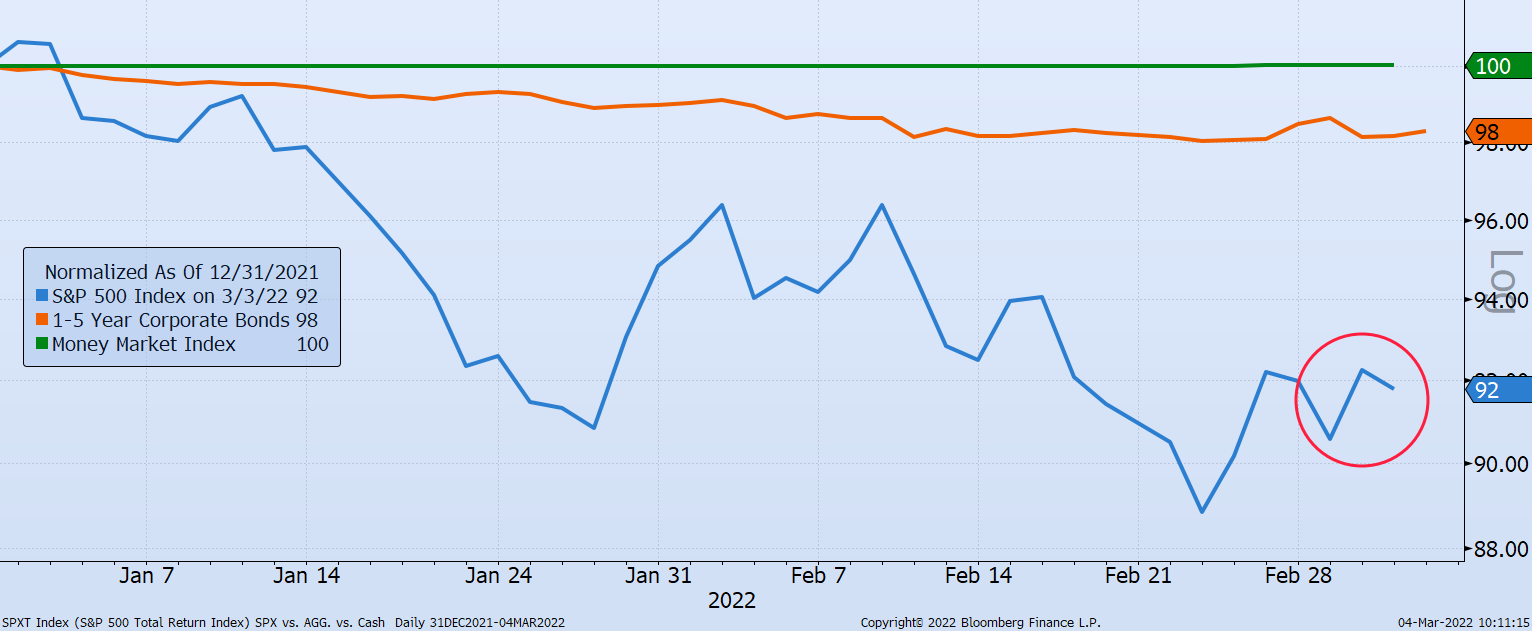

In a compelling article by BlackRock, they make an argument that even though we are facing higher than normal inflation and turmoil, that fear is..

As with all things, patience is the name of the game in the long run. Below are three notes about today.

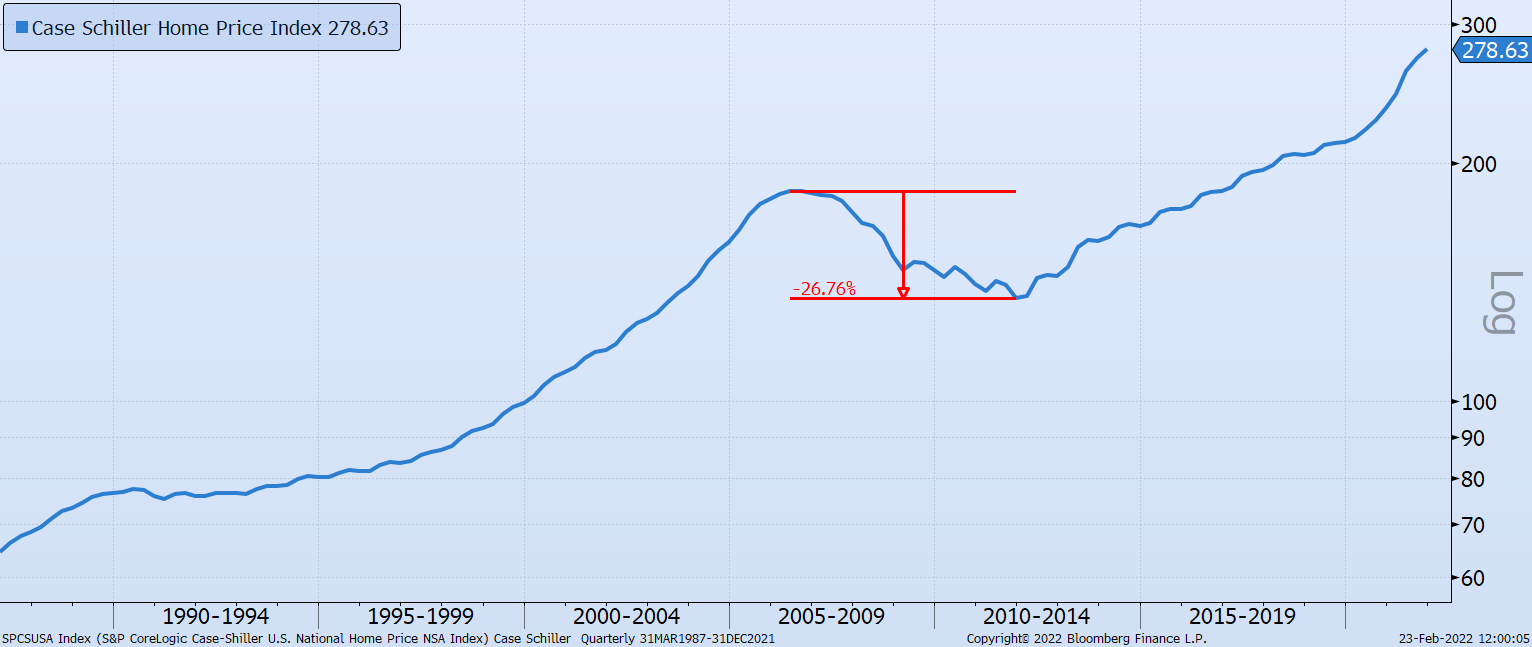

“A 1% decline in real interest rates should lead to a spike in home prices in certain cities in the U.S. ranging from 19% to 33%.” -Bloomberg (Feb...

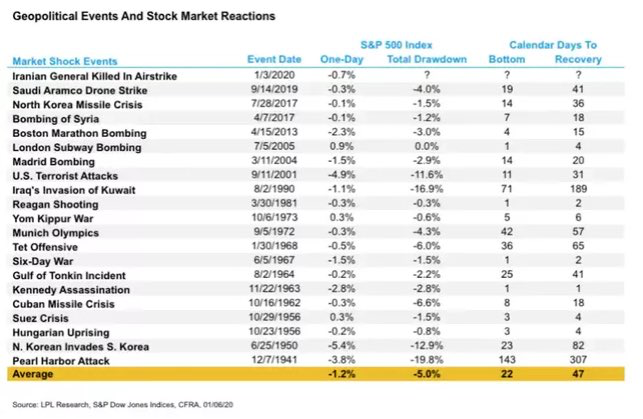

It’s been a long slow slog for Russia. Seeing investors saying “let’s buy the dip.” But before that, Russia has some serious structural problems they..

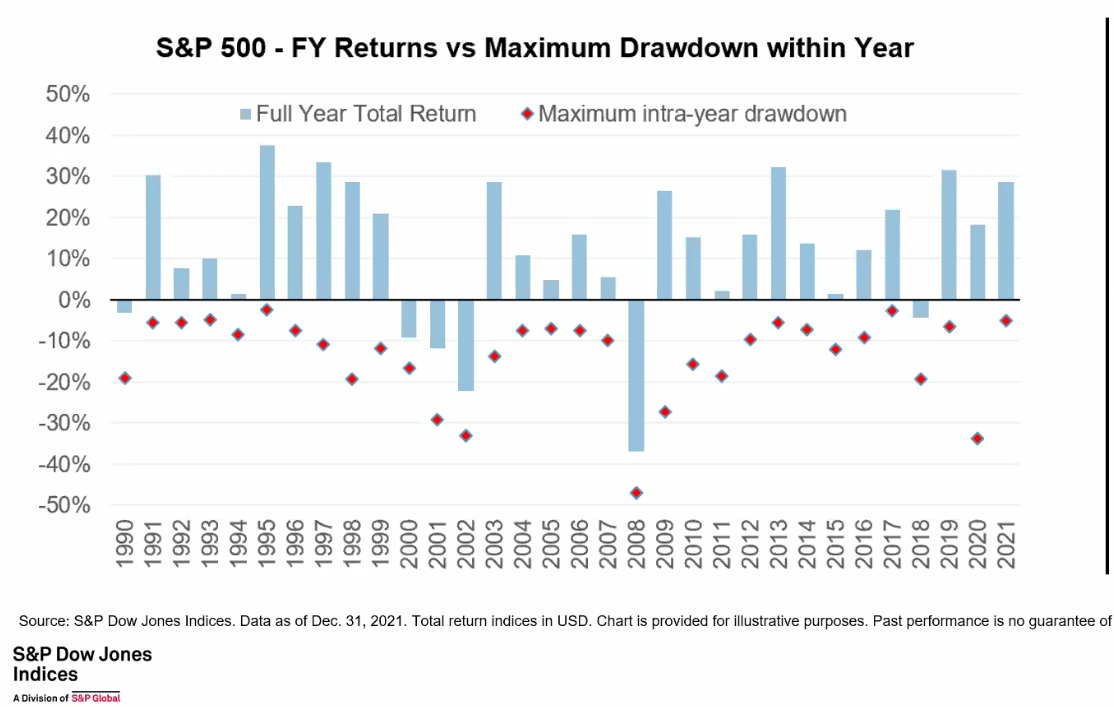

Since 1927, the S&P 500 has experienced a pullback of five percent approximately every 70 trading days (about every 3 ½ months.)

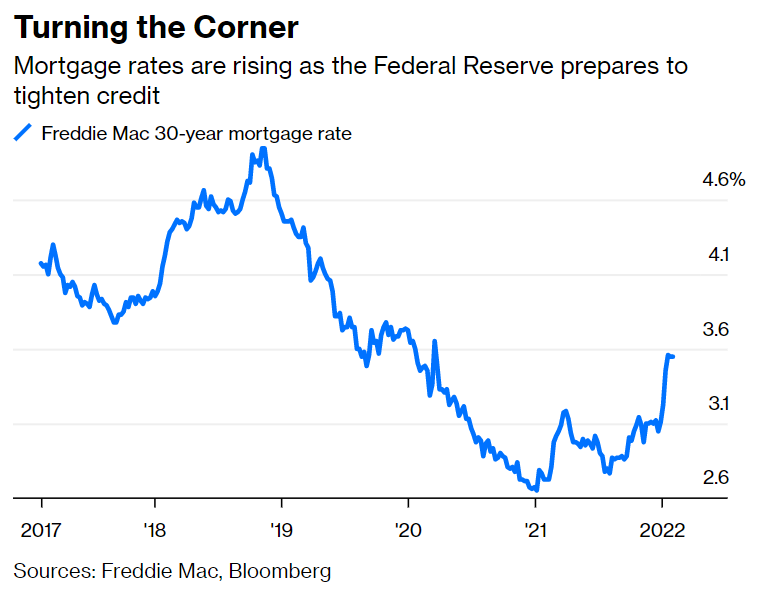

Three charts from an article in Bloomberg that shows the housing market may be cooling from higher rates, higher prices (making homes less..

Yes, rates have climbed from their lows, but let’s hope we don’t look back on this and think that locking in a zero real return (1) for 30 years was..

Lower cost, increased liquidity, better transparency, greater tax efficiencies, often more diversified, and for indexed ETFs there is no “drift” of..

Thinking about retirement? The average retirement age in the United States, according to U.S. Census Bureau data, is 63 for women and 65 for men...

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.

Duration describes the time it takes for a bond holder to get all their money back and/or the change in price for each 1% change in the interest rate.

This chart from an article in today’s Wall Street Journal shows the percentage of funds that underperformed the S&P 500 in the last 12 years. Again, passive indexes beat 85% of the active managers last year, and the majority have done so for 12 consecutive years. This is one of the reasons why we champion passive index funds.

I am reminded of this chart every time I drive by a car lot. Before the pandemic, financing and insurance profits made up 70% of the dealer’s profits. Now, due to price appreciation of their inventory, that percentage has changed. However, the dollar profits from financing and insurance continue to increase. Car dealers have become more like finance and insurance companies.

Below is a great chart from Putnam, which shows that over the last 15 years, if you missed the top 10 best days of market gains, your return would have gone from 10.66% to only 5.05%.

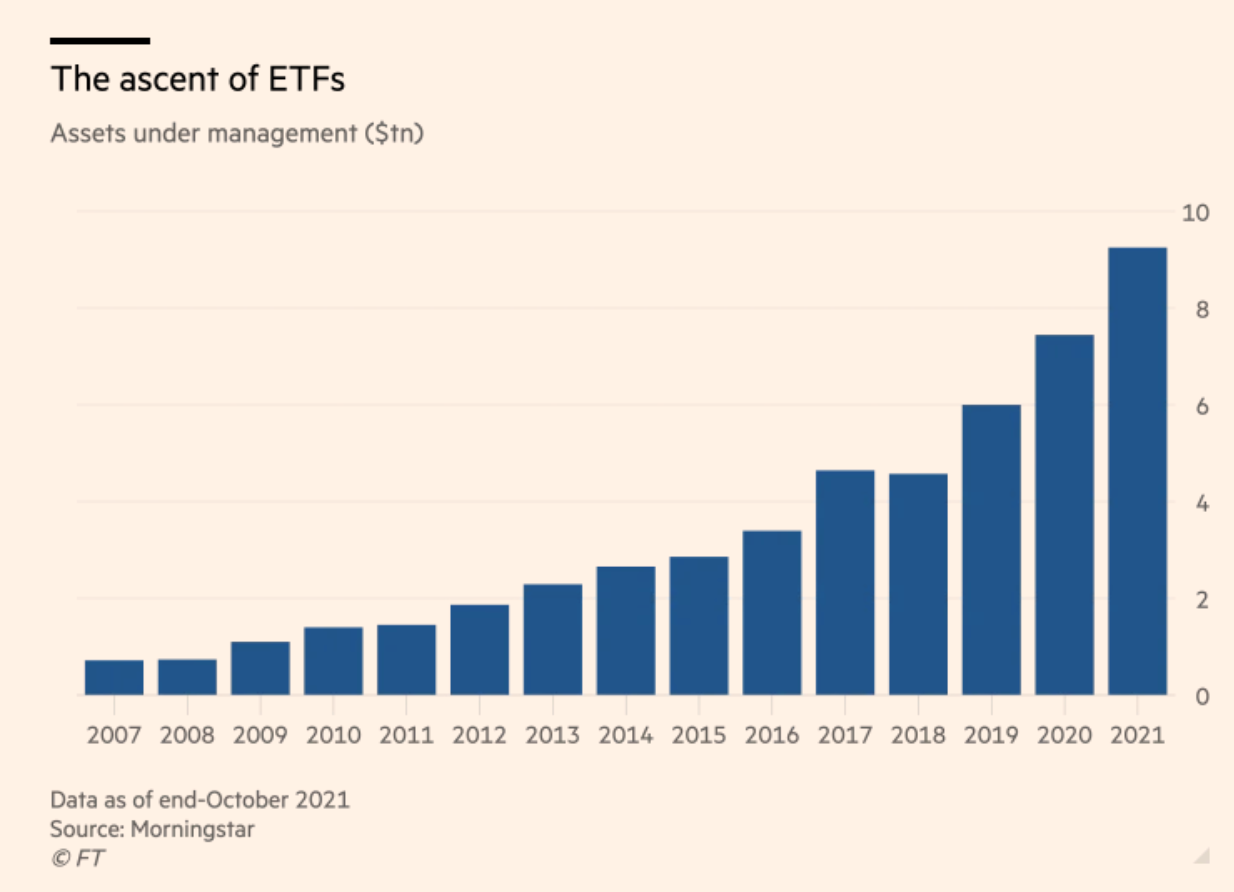

Since we use both Vanguard and iShares by BlackRock Exchange Traded Funds (ETFs) extensively, one of my pleasures over the last few years has been seeing each company try to outdo the other by lowering costs. As they continue to lower costs, they gather more and more investments. As referenced in a recent Bloomberg article, together they account for 64% of the ETF market as Vanguard is getting close to the size of BlackRock.

It’s hard to do commentary when in the morning, the markets are down, and by lunch they are level, and by the close they might be up, and vice versa.

In a compelling article by BlackRock, they make an argument that even though we are facing higher than normal inflation and turmoil, that fear is driving investors to hold too much cash.

As with all things, patience is the name of the game in the long run. Below are three notes about today.

“A 1% decline in real interest rates should lead to a spike in home prices in certain cities in the U.S. ranging from 19% to 33%.” -Bloomberg (Feb. 23, 2022)

It’s been a long slow slog for Russia. Seeing investors saying “let’s buy the dip.” But before that, Russia has some serious structural problems they need to overcome to become a good long term investment.

Since 1927, the S&P 500 has experienced a pullback of five percent approximately every 70 trading days (about every 3 ½ months.)

Three charts from an article in Bloomberg that shows the housing market may be cooling from higher rates, higher prices (making homes less affordable), and builders starting to ramp up supply.

Yes, rates have climbed from their lows, but let’s hope we don’t look back on this and think that locking in a zero real return (1) for 30 years was a good investment at the time.

Lower cost, increased liquidity, better transparency, greater tax efficiencies, often more diversified, and for indexed ETFs there is no “drift” of the types of investments they make.

Thinking about retirement? The average retirement age in the United States, according to U.S. Census Bureau data, is 63 for women and 65 for men. While you may not actually retire until your late 60s or 70s, you should start thinking about it as soon as you start working. Some experts suggest you start saving in your 20s, when you begin earning paychecks, because the sooner you begin saving, the more time your money has to grow.

current_page_num+2: 26 - disabled