Today's Market Notes - Russian Edition

As with all things, patience is the name of the game in the long run. Below are three notes about today.

Learn about our Refer-a-Friend Program. Terms and conditions apply.

As with all things, patience is the name of the game in the long run. Below are three notes about today.

“A 1% decline in real interest rates should lead to a spike in home prices in certain cities in the U.S. ranging from 19% to 33%.” -Bloomberg (Feb...

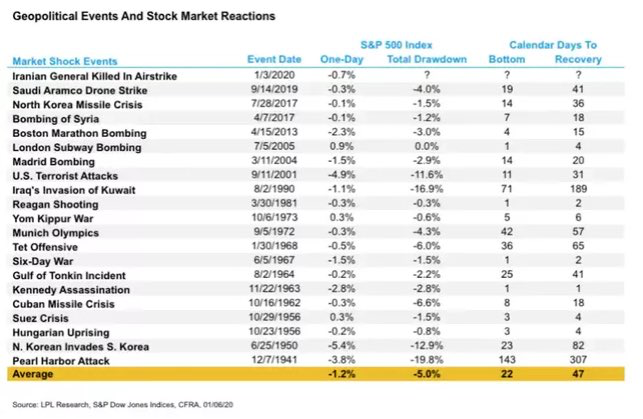

It’s been a long slow slog for Russia. Seeing investors saying “let’s buy the dip.” But before that, Russia has some serious structural problems they..

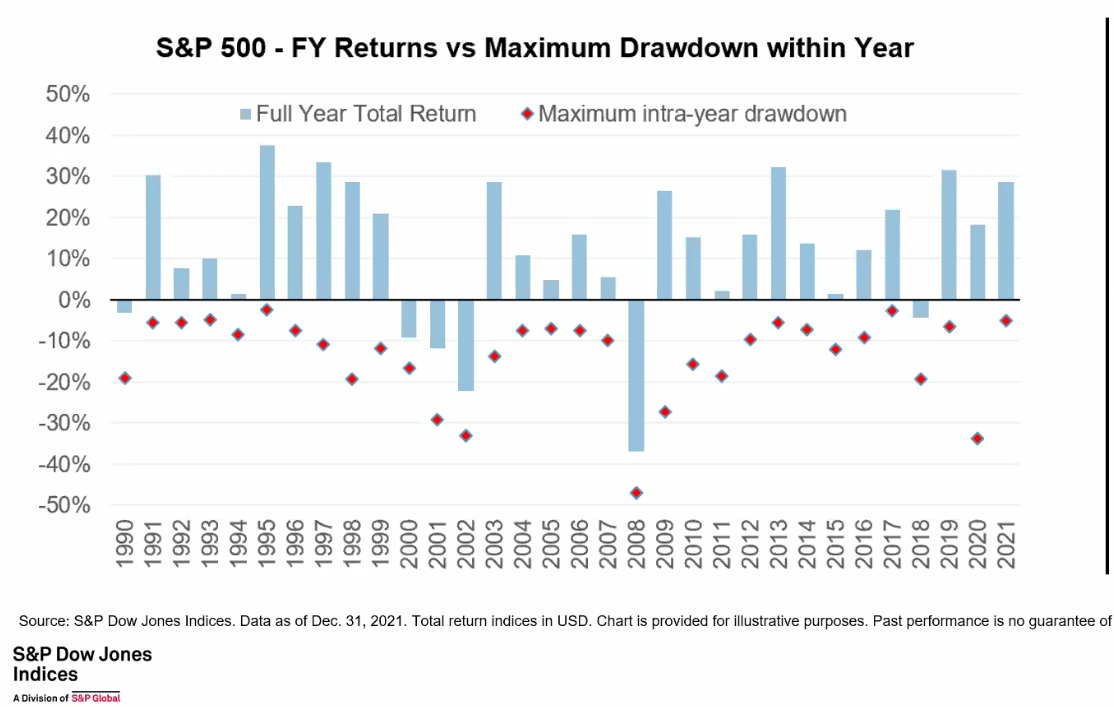

Since 1927, the S&P 500 has experienced a pullback of five percent approximately every 70 trading days (about every 3 ½ months.)

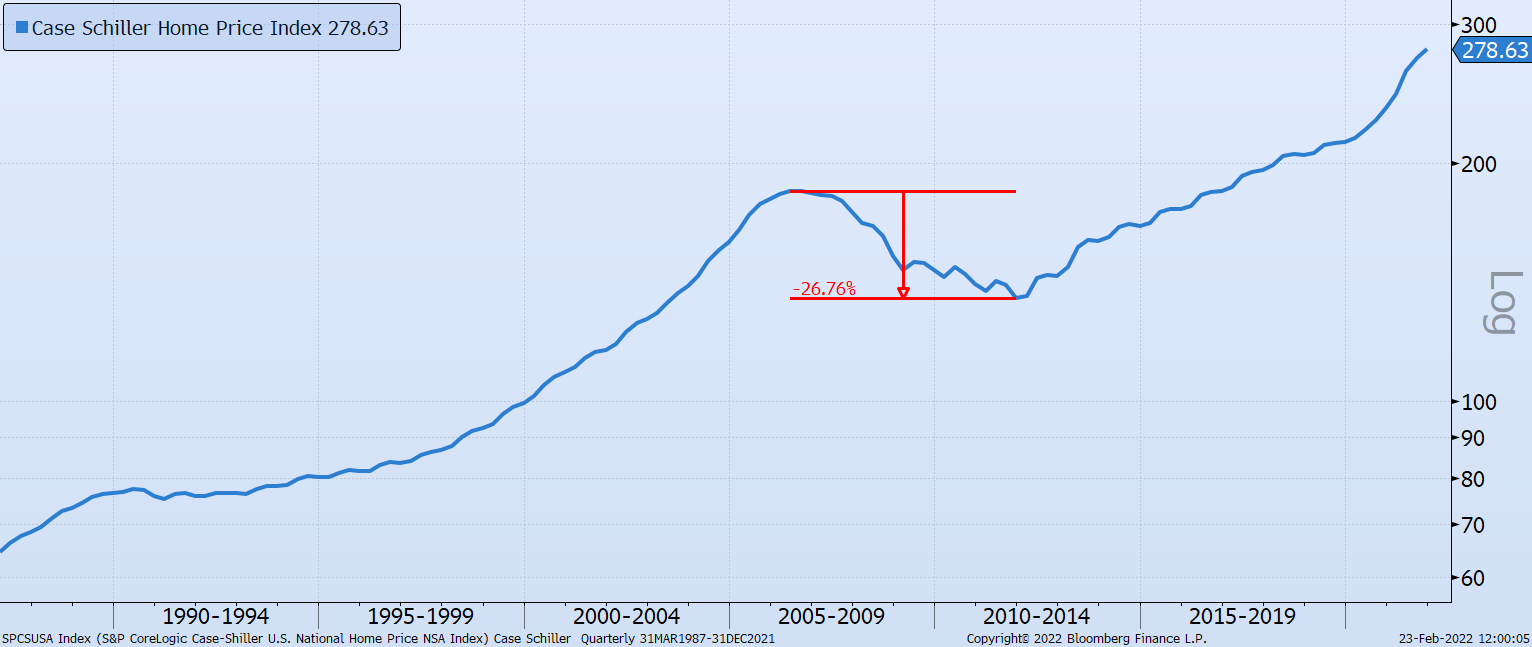

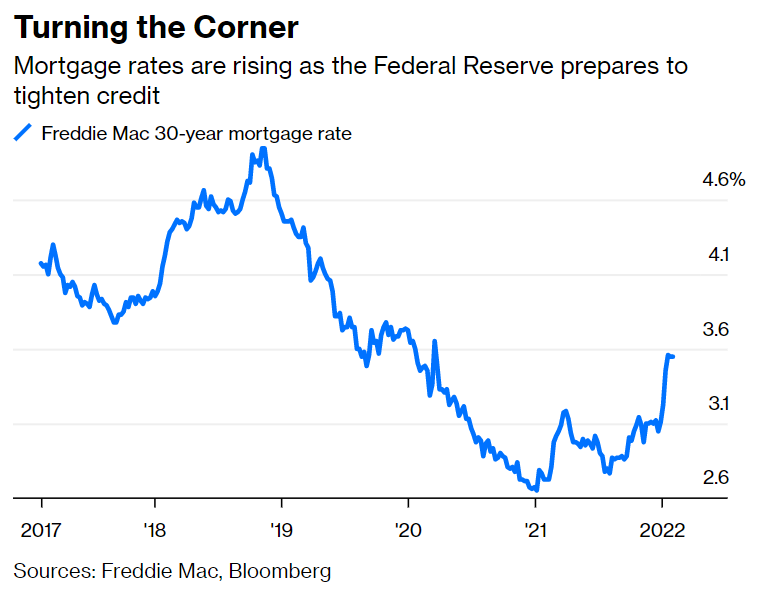

Three charts from an article in Bloomberg that shows the housing market may be cooling from higher rates, higher prices (making homes less..

Yes, rates have climbed from their lows, but let’s hope we don’t look back on this and think that locking in a zero real return (1) for 30 years was..

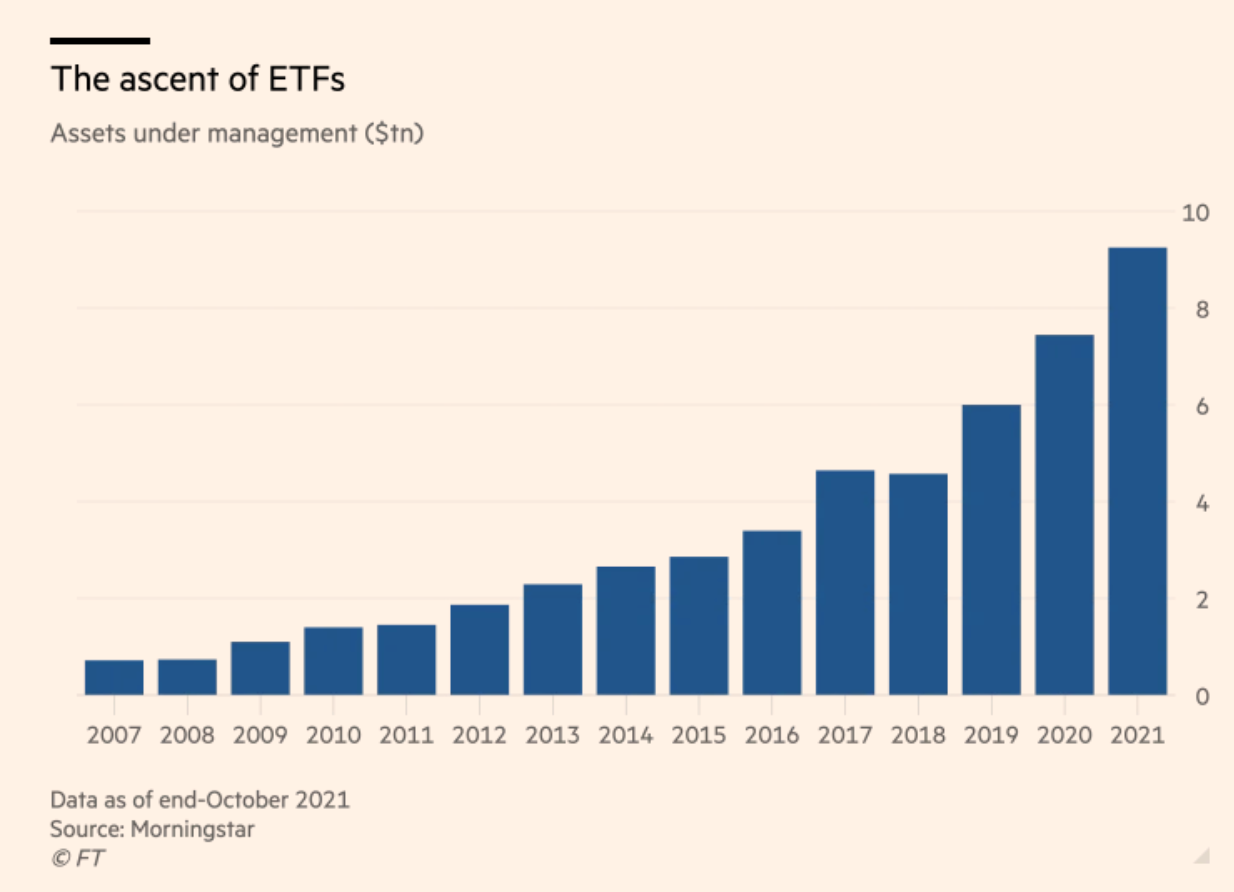

Lower cost, increased liquidity, better transparency, greater tax efficiencies, often more diversified, and for indexed ETFs there is no “drift” of..

As with all things, patience is the name of the game in the long run. Below are three notes about today.

“A 1% decline in real interest rates should lead to a spike in home prices in certain cities in the U.S. ranging from 19% to 33%.” -Bloomberg (Feb. 23, 2022)

It’s been a long slow slog for Russia. Seeing investors saying “let’s buy the dip.” But before that, Russia has some serious structural problems they need to overcome to become a good long term investment.

Since 1927, the S&P 500 has experienced a pullback of five percent approximately every 70 trading days (about every 3 ½ months.)

Three charts from an article in Bloomberg that shows the housing market may be cooling from higher rates, higher prices (making homes less affordable), and builders starting to ramp up supply.

Yes, rates have climbed from their lows, but let’s hope we don’t look back on this and think that locking in a zero real return (1) for 30 years was a good investment at the time.

Lower cost, increased liquidity, better transparency, greater tax efficiencies, often more diversified, and for indexed ETFs there is no “drift” of the types of investments they make.

current_page_num+2: 25 - disabled