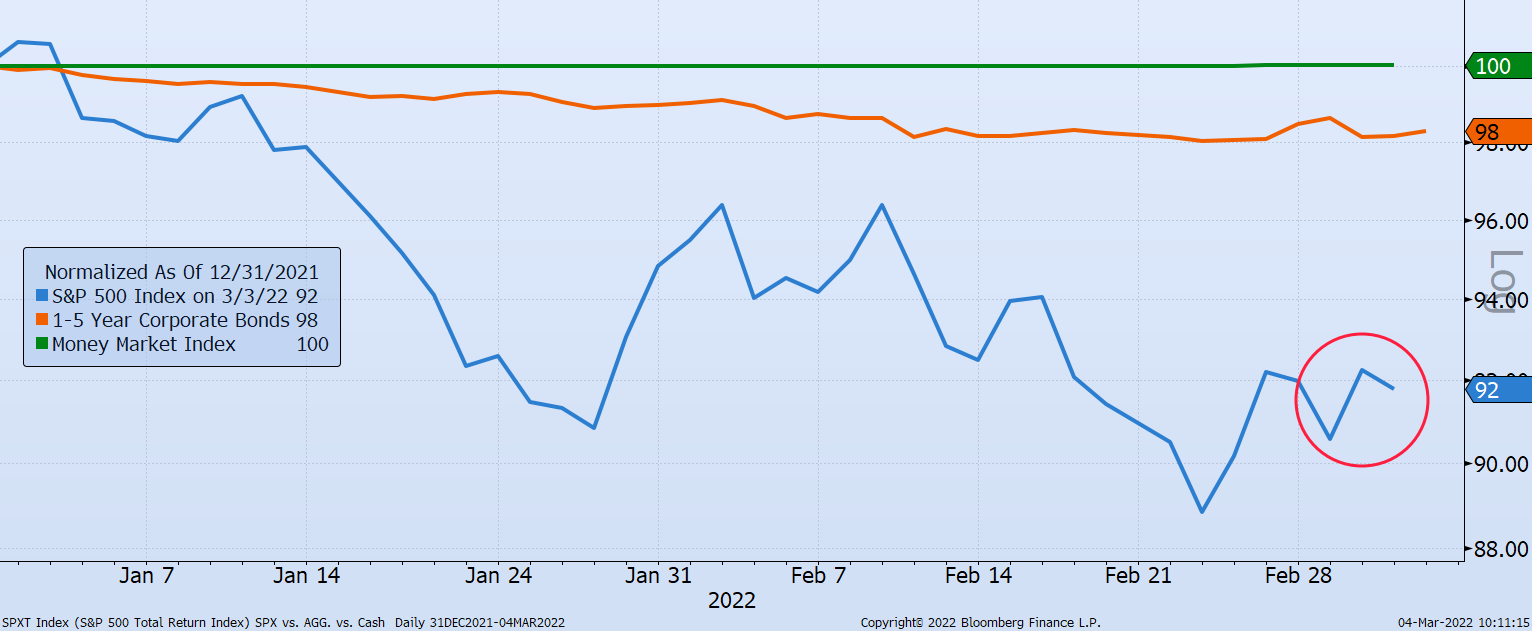

The Market Response after Eight Days of Conflict

It’s hard to do commentary when in the morning, the markets are down, and by lunch they are level, and by the close they might be up, and vice versa.

Learn about our Refer-a-Friend Program. Terms and conditions apply.

It’s hard to do commentary when in the morning, the markets are down, and by lunch they are level, and by the close they might be up, and vice versa.

The better-than-expected third-quarter corporate earnings reports were evidence of a broad-based economic recovery causing investor psychology to..

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The..

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The..

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The..

Economic indicators are proving that consumers and businesses are fueling the economy with pent-up demand on spending. Consumers are reacting to the..

The S&P 500 Index gained 8.1% for the second quarter and 14.4% year-to-date despite concerns over Federal Reserve policy, fiscal spending and the..

The S&P 500 index was up slightly in the month of May due to growing investor confidence in higher 2021 corporate revenues and earnings. With the..

Most first-quarter corporate earnings reports have been meeting or beating expectations and this has raised the confidence that equity valuations are..

The creation of cryptocurrencies or digital currencies such as Bitcoin has bankers, financiers and governments pondering the long-term potential..

The S&P 500 Index grew 5.8% in the first quarter in response to the massive fiscal stimulus and the anticipation of a significant economic rebound...

With the completion of the fourth quarter of 2020 corporate earnings releases, investors are monitoring daily COVID headlines, rising interest rates,..

The S&P 500 Index was down 1% in January based on investors’ revised expectations of corporate revenue growth and earnings. First, the COVID-19..

2020 was an unusual and volatile one with the S&P 500 Index’s 34% decline in 30 days in March followed by a retracement and rise of over 16% by..

The S&P 500 and Nasdaq index had wonderful performance during the third quarter, with returns of 8.5% and 11%, respectively. However, pre-election..

It’s hard to do commentary when in the morning, the markets are down, and by lunch they are level, and by the close they might be up, and vice versa.

The better-than-expected third-quarter corporate earnings reports were evidence of a broad-based economic recovery causing investor psychology to improve and funds to flow from bonds into stocks. This has since reversed as the uncertainty of the spread and severity of COVID mutation Omicron remains unknown. The concern is that the supply chain of parts and goods produced in emerging markets may slow and deter global economic growth.

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The S&P 500 Index has grown this year as earnings and growth have supported valuations, but now, as fiscal and monetary policies change, we are seeing investor concerns. With fiscal policy, there are many supportive benefits of spending $500 billion on actual bridge and road infrastructure. However, the massive $3.5-trillion “human” infrastructure package is concerning due to higher taxes and escalating inflation. This plan is likely to be debated and downsized before passage – if at all.

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The S&P 500 Index has grown this year as earnings and growth have supported valuations, but now, as fiscal and monetary policies change, we are seeing investor concerns.

The S&P 500 Index is consolidating as Washington policymakers postpone important decisions on the budget ceiling and the infrastructure bills. The S&P 500 Index has grown this year as earnings and growth have supported valuations, but now, as fiscal and monetary policies change, we are seeing investor concerns. With fiscal policy, there are many supportive benefits of spending $500 billion on actual bridge and road infrastructure. However, the massive $3.5-trillion “human” infrastructure package is concerning due to higher taxes and escalating inflation. This plan is likely to be debated and downsized before passage – if at all.

Economic indicators are proving that consumers and businesses are fueling the economy with pent-up demand on spending. Consumers are reacting to the vaccinations with robust spending on vacations, furniture, automobiles and homes, while businesses are trying to ramp up production and services to meet the need.

The S&P 500 Index gained 8.1% for the second quarter and 14.4% year-to-date despite concerns over Federal Reserve policy, fiscal spending and the spreading delta variant of COVID. Most investors see an improving economy with continued low interest rates being positive for corporate earnings.

The S&P 500 index was up slightly in the month of May due to growing investor confidence in higher 2021 corporate revenues and earnings. With the receding COVID pandemic, consumers and businesses are emerging from social-distancing protocols and accelerating their spending. This strong growth in demand for goods has led to inventory shortages in many cases. Temporary delivery delays for raw materials and components are constraining global growth. Employment is expanding, however, which means goods manufacturing should improve and service industries should gain momentum.

The creation of cryptocurrencies or digital currencies such as Bitcoin has bankers, financiers and governments pondering the long-term potential economic and political ramifications for the future. While the increasing use of digital currencies demonstrates the power of a secure, secretive payment transfer system, it also has created a loophole from government control.

The S&P 500 Index grew 5.8% in the first quarter in response to the massive fiscal stimulus and the anticipation of a significant economic rebound. The recent passage of the $1.9 trillion federal stimulus package added to the previous five major stimulus bills totaling over $5.2 trillion. Lawmakers as well as the Federal Reserve have responded dramatically to the COVID pandemic flooding the market with liquidity and the markets responded positively. The COVID-relief money flooding into depository institutions is being used for consumption and investment and helping corporate earnings rebound quickly.

With the completion of the fourth quarter of 2020 corporate earnings releases, investors are monitoring daily COVID headlines, rising interest rates, and the potential for a new stimulus program. Corporate earnings were mostly better than expected and guidance for the year ahead was surprisingly strong.

The S&P 500 Index was down 1% in January based on investors’ revised expectations of corporate revenue growth and earnings. First, the COVID-19 vaccine distribution and inoculation process is proceeding slowly while the virus is mutating. The new strains appear to be slightly more virulent and the vaccination timeline will take longer and delay economic normalization.

2020 was an unusual and volatile one with the S&P 500 Index’s 34% decline in 30 days in March followed by a retracement and rise of over 16% by year-end. This proved once again that a longer-term outlook is required in successful equity investing.

The S&P 500 and Nasdaq index had wonderful performance during the third quarter, with returns of 8.5% and 11%, respectively. However, pre-election politics obstructing a new federal stimulus package and an escalation in COVID cases caused both indexes to decline in September.

current_page_num+2: 3 - disabled