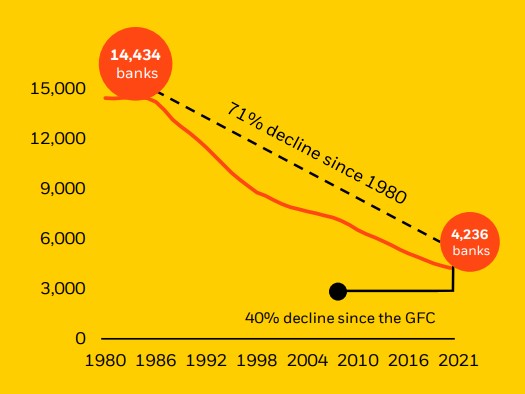

Chart of the Day: Vanishing Banks

There used to be a bank on every corner; however, today’s Chart of the Day from BlackRock shows a 71% decline in US banks since 1980. Why?

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

There used to be a bank on every corner; however, today’s Chart of the Day from BlackRock shows a 71% decline in US banks since 1980. Why?

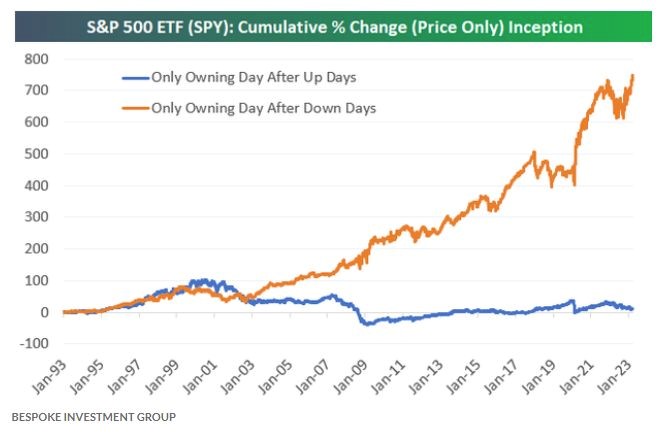

Today’s Chart of the Day from Bespoke shows the difference in price, excluding dividends, if you owned the S&P 500 only during the day after it went..

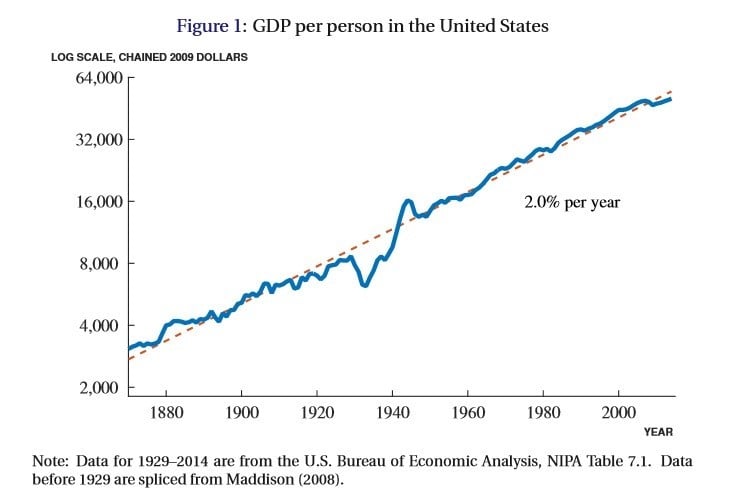

Today’s Chart of the Day shows the Gross Domestic Product (GDP) per person growing 2% per year since 1870.

Today’s Chart of the Day shows 11 of the largest companies and which brands/products they own and distribute.

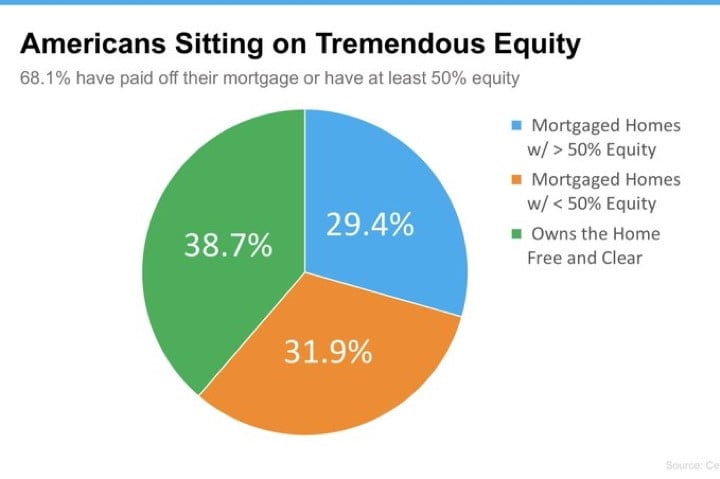

Today’s Chart of the Day shows that a combined 68% of Americans have paid off their mortgage or have at least 50% in equity. If there is a “downturn”..

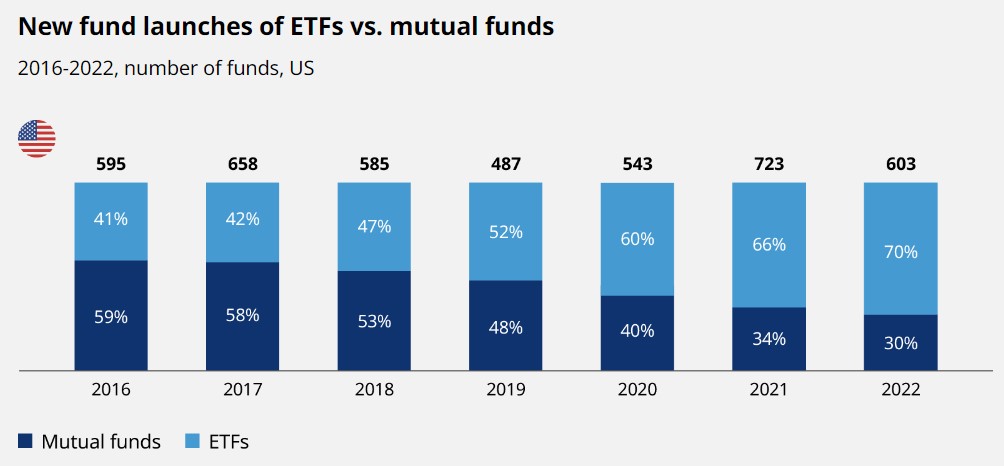

Today’s Chart of the Day from OliverWyman shows the number of new funds being created each year in the U.S. since 2016.

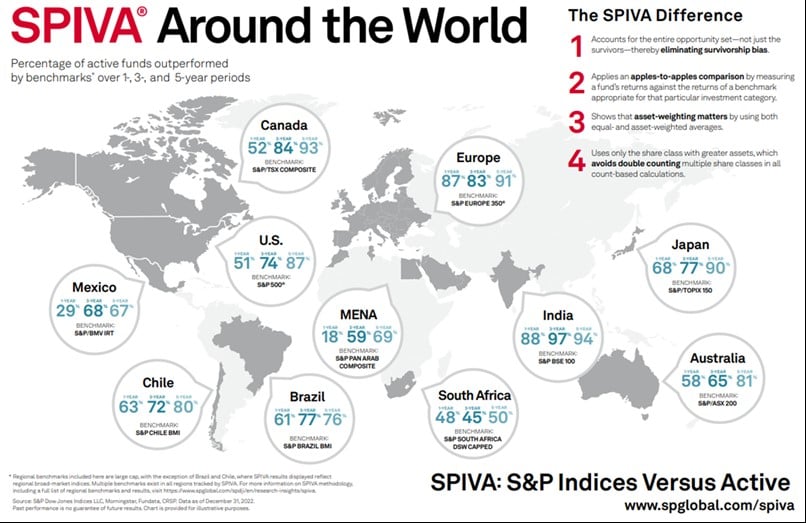

Over the last five years, 87% of actively managed funds in the U.S. underperformed their index. Today’s Chart of the Day from S&P Global shows this..

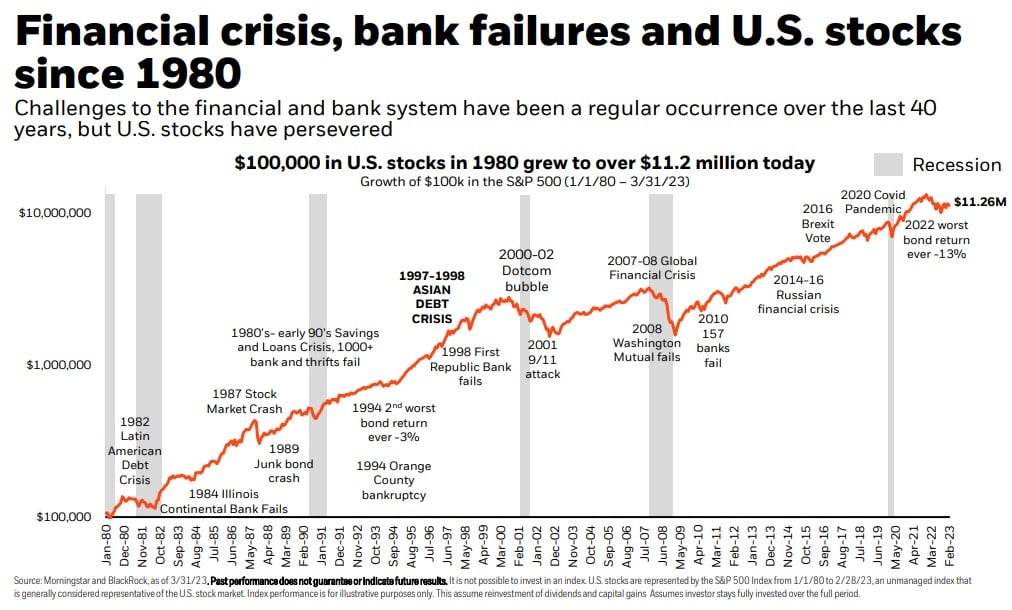

Today’s Chart of the Day from iShares by BlackRock shows that, even though we've experienced numerous financial problems along the way, $100,000..

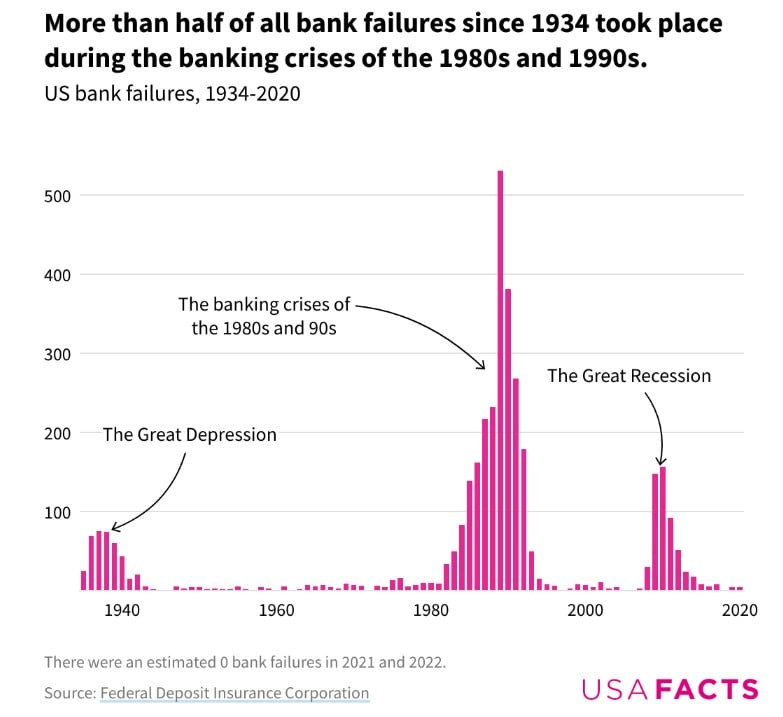

Today's Chart of the Day is the history of bank failures from USAFacts. The year 1989 was the height with 531 banks failing from a savings and loan..

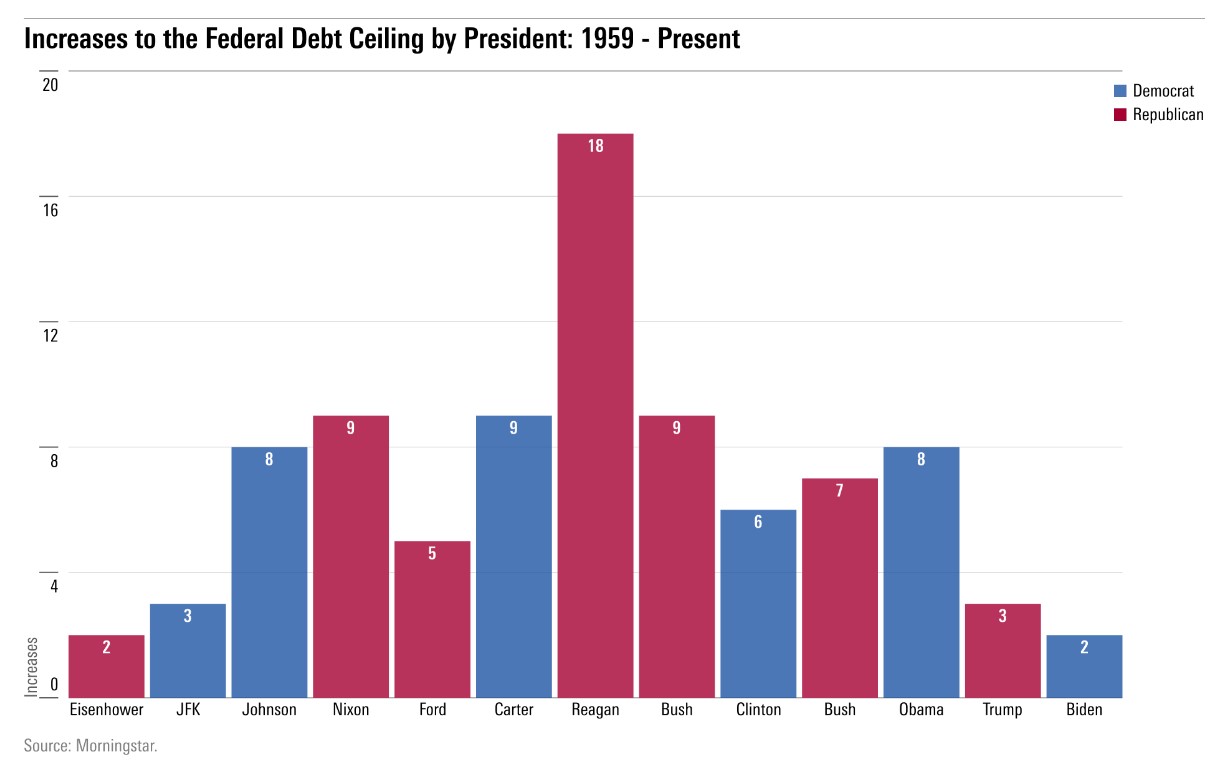

Today’s Chart of the Day comes from Morningstar.com. In the last 40 years, the debt ceiling has gone up 53 times.

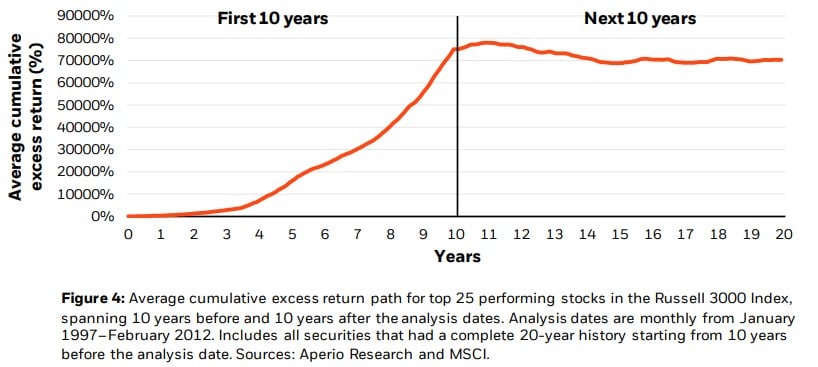

Today’s Chart of the Day is from a BlackRock research paper on concentrated portfolio risks. In it, they graph the top 25 performing stocks over the..

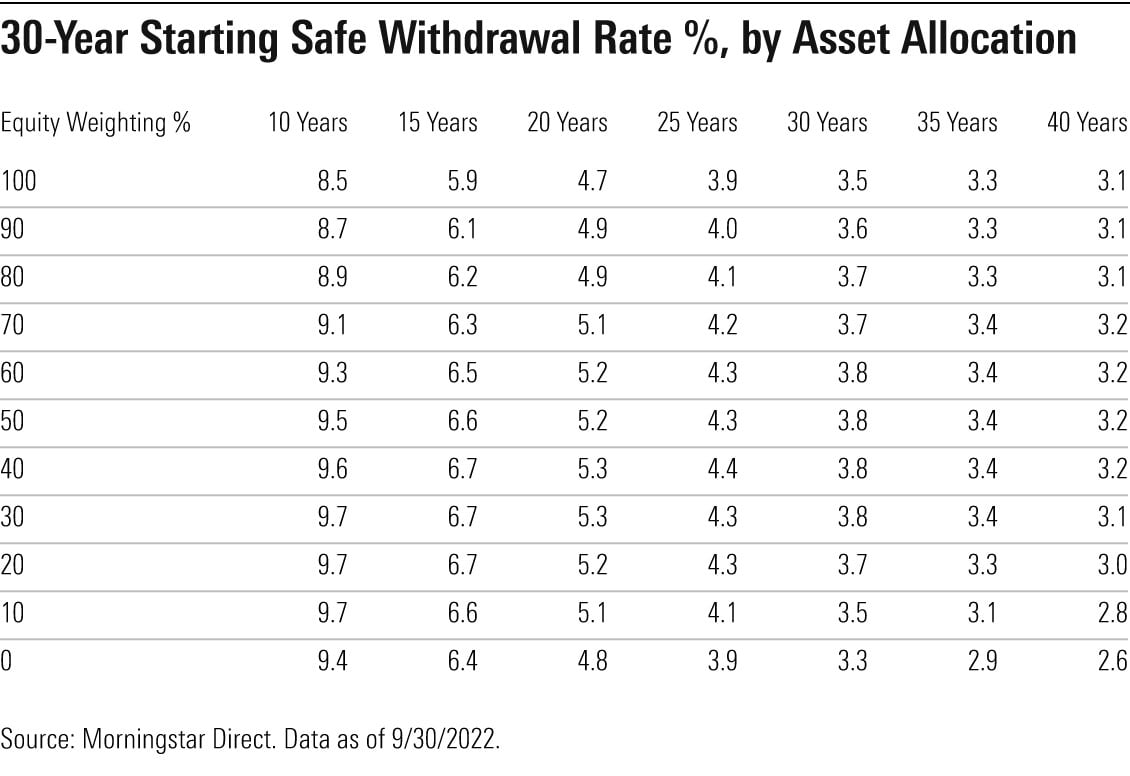

Today's chart from Morningstar shows there is a 90% chance you would not run out of money during your life following these projected safe withdrawal..

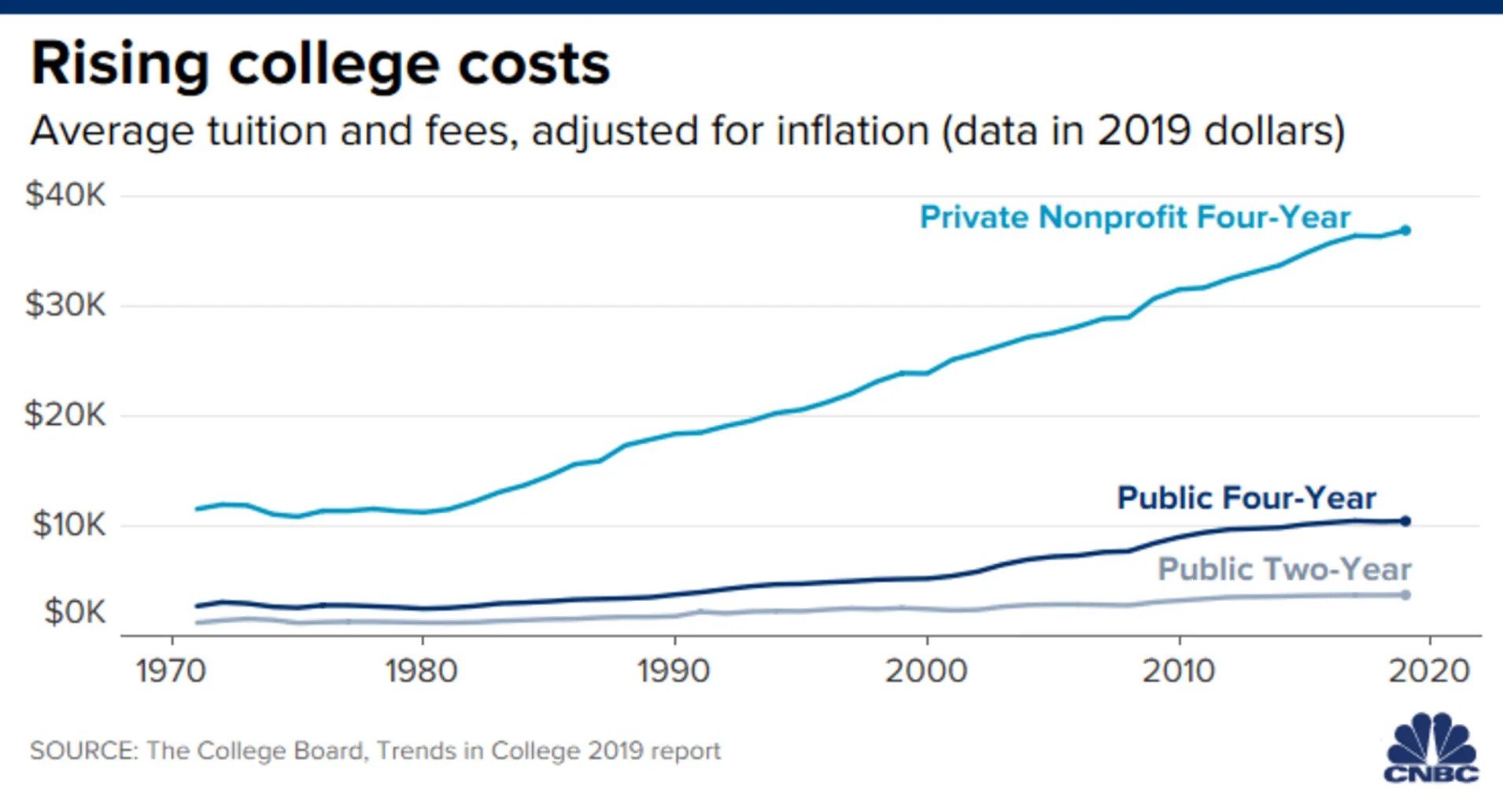

Today’s Chart of the Day provided from CNBC with data from The College Board shows the average cost of college adjusted for inflation since 1970.

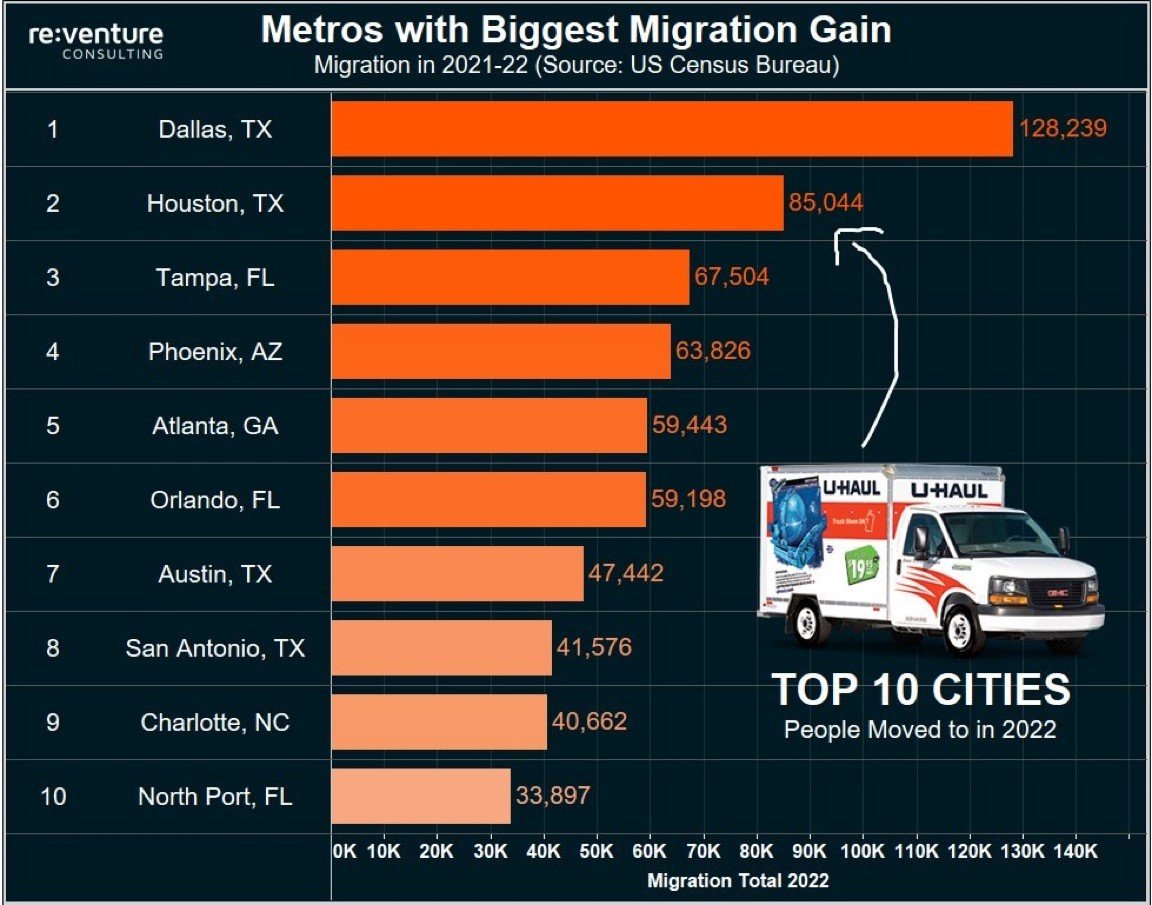

Today's Chart of the Day includes the top 10 cities people moved to in 2022 according to Re:Venture Consulting, with data from the US Census Bureau...

There used to be a bank on every corner; however, today’s Chart of the Day from BlackRock shows a 71% decline in US banks since 1980. Why?

Today’s Chart of the Day from Bespoke shows the difference in price, excluding dividends, if you owned the S&P 500 only during the day after it went up the previous day (blue) vs. owning it after it went down the previous day (orange).

Today’s Chart of the Day shows the Gross Domestic Product (GDP) per person growing 2% per year since 1870.

Today’s Chart of the Day shows 11 of the largest companies and which brands/products they own and distribute.

Today’s Chart of the Day shows that a combined 68% of Americans have paid off their mortgage or have at least 50% in equity. If there is a “downturn” in the real estate market, it will not look like ones in the past.

Today’s Chart of the Day from OliverWyman shows the number of new funds being created each year in the U.S. since 2016.

Over the last five years, 87% of actively managed funds in the U.S. underperformed their index. Today’s Chart of the Day from S&P Global shows this trend also holds true around the world. Why?

Today’s Chart of the Day from iShares by BlackRock shows that, even though we've experienced numerous financial problems along the way, $100,000 invested in the stock market in 1980 grew to $11.2 million today.

Today's Chart of the Day is the history of bank failures from USAFacts. The year 1989 was the height with 531 banks failing from a savings and loan crisis. For perspective, there have only been three in 2023.

Today’s Chart of the Day comes from Morningstar.com. In the last 40 years, the debt ceiling has gone up 53 times.

Today’s Chart of the Day is from a BlackRock research paper on concentrated portfolio risks. In it, they graph the top 25 performing stocks over the past 10 years, starting from 10 years ago, and their subsequent underperformance over the next 10. (Resulting in their total performance over the last 20 years.)

Today's chart from Morningstar shows there is a 90% chance you would not run out of money during your life following these projected safe withdrawal rates based on equity weightings.

Today’s Chart of the Day provided from CNBC with data from The College Board shows the average cost of college adjusted for inflation since 1970.

Today's Chart of the Day includes the top 10 cities people moved to in 2022 according to Re:Venture Consulting, with data from the US Census Bureau. Tampa was third, Orlando was sixth, and our beloved North Port came in at number 10. The bonus second chart, below, shows where they moved from.

current_page_num+2: 21 -